Indian Capital Market : Negative market sentiments hurt activities across segments by Motilal Oswal Financial Services Ltd

Negative market sentiments hurt activities across segments

ADTO continues to decline; SIP flows maintain a strong momentum

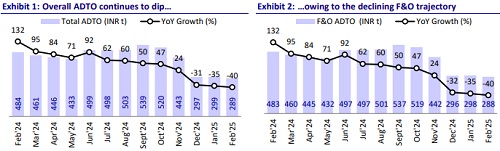

* In Feb’25, daily volumes on exchanges continued to dip with overall ADTO declining 4% MoM to INR289t. Post-implementation of new F&O regulations in Nov’24, total ADTO has declined 44% (F&O ADTO down 45%). Other factors such as weak market performance, unfavorable macro environment, and negative investor sentiments have also contributed to the decline.

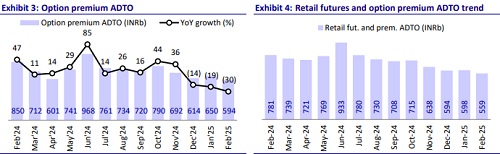

* Retail participation declined amid F&O regulations and weak market trends. Retail cash ADTO declined 12% MoM to INR342b while retail future and option premium ADTO declined 6% MoM to INR559b.

* Commodity notional ADTO achieved a new peak in Feb’25, growing 3% MoM to ~INR2.6t, driven by 8% MoM growth in futures to INR278b and 3% MoM growth in options to INR2.3t.

* Demat additions were the lowest since May’23 at 2.3m in Feb’25 (2.8m in Jan’25). Historically, the slowdown in demat additions has occurred during the phase of weak market performance.

* Mutual Fund AUM declined ~1% MoM in Feb’25 to INR67.6t (up 24% YoY) with equity AUM affected by weak market trends. It dipped 3% MoM to INR28.8t. SIP maintained its momentum with INR260b of inflows in Feb’25 vs. INR264b in Jan’25.

* We expect the growth trajectory of capital market players to recover once the market stabilizes and participation across asset classes improves. F&O volumes have now achieved a new base with all regulations kicking in and we expect brokers and exchanges to benefit from the rise in participation in the long term. Mutual fund activity is expected to remain stable, backed by efforts of the industry to spread awareness, enhance financial literacy, and promote a long-term investment perspective. Our Top picks in the sector are: ANGELONE, HDFCAMC, and Nuvama.

Equity: ADTO on a downward trajectory; BSE’s F&O market share inching up

* Total ADTO declined 4% MoM in Feb’25 to INR289t on account of a 4%/5% decline in F&O/cash ADTO to INR288t/INR1t. The option premium ADTO declined 9% MoM to INR594b.

* In the cash segment, NSE retains its dominant position with a 95% market share in Feb’25. However, BSE continues to attract incremental market share every month in the F&O segment. It had a notional turnover market share of 36% in Feb’25 (36% in Jan’25) and an option premium turnover of 19% (18% in Jan’25).

Commodities: Volumes maintain ~2x YoY growth trajectory

* Total volumes on MCX declined 6% MoM to INR53.9t in Feb’25 (up 111% YoY) on account of lower trading days, while ADTO was the highest ever. Option volumes declined 6% MoM to INR48.1t, while futures volumes declined 1% MoM to INR5.8t.

* Crude oil volumes dipped 22% MoM, which was offset by a 92.2%/225.1% MoM surge in gold/silver volumes and an 8.9% MoM rise in natural gas volumes.

* In commodity futures, 25%/21% MoM de-growth in crude oil/index volumes was offset by 38%/16% MoM growth in gold/silver volumes.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

India Strategy : Earnings review ? A modest 3QFY25; Earnings downgrade ratio worst since 1QF...