Nifty Weekly Expiry : Nifty opened on a positive note near 22900 zone but saw an initial dip towards 22800 - Motilal Oswal Wealth Management

NIFTY : 22907

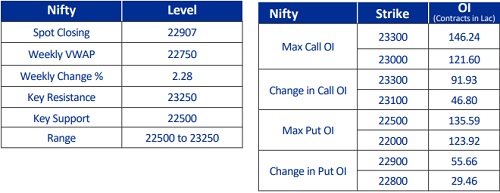

Nifty opened on a positive note near 22900 zone but saw an initial dip towards 22800. However, the index quickly reclaimed the 22900 level. Throughout the day, the index remained rangebound within 60-70 points, suggesting a lack of strong momentum. However, sustained buying at lower levels indicates strength of the bulls. It formed a small bodied bullish candle on daily chart and forming higher high - higher lows from last three trading sessions which shows supports are shifting higher. Now it has to hold above 22700 zones for an up move towards 23000 then 23250 zones while supports can be seen at 22700 then 22500 zones.

Expiry day point of view :

Overall trend is likely to be positive and Now it has to hold above 22700 zones for an up move towards 23000 then 23250 zones while supports can be seen at 22700 then 22500 zones.

Trading Range :

Expected wider trading range : 22500/22700 to 23000/23250 zones.

Option Strategy :

Option traders can initiate Nifty Bull Call Spread (Buy 22950 CE and Sell 23150 CE) to play the positive to range bound move.

Option Writing :

Option writers are suggested sell Nifty 22600 PE and 23150 CE with strict double SL.

Weekly Change:

Nifty is up by 2.28% at 22907 on a weekly basis. Nifty VWAP of the week is near 22750 levels and it is trading 160 points above the same which indicates bullish bias for the expiry day point of view.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)

More News

MOSt Market Roundup : Nifty opens gap down by 160 points but shifts base higher through day ...