India Strategy : Macro Strength, Market Depth, and Earnings Resilience - April 2025 by Motilal Oswal Financial Services Ltd

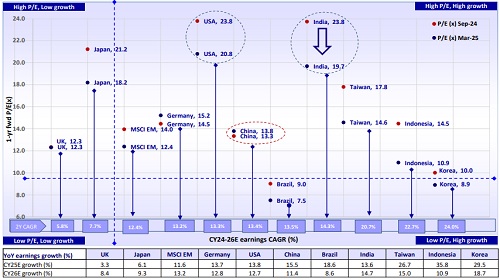

India to witness better earnings growth than global peers

* Most of the global markets experienced a moderation in their valuations in the past six months. India and Indonesia saw the sharpest valuation corrections of 24% and 17%, while China and Germany were the only markets with moderate gains of 3% and 5% in the past six months, respectively.

* While valuations have moderated, India’s earnings growth is likely to surpass key global markets, with an estimated CAGR of ~14% over the next two years

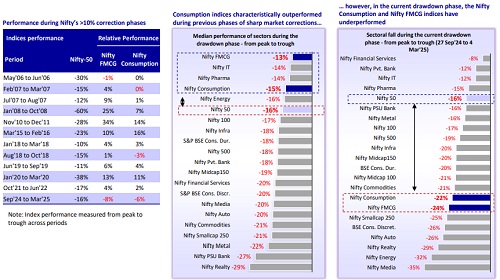

Tailwinds emerging for consumption stocks

* Nifty FMCG/Nifty Consumption indices have fallen ~20%/17% from their peaks in Sep’24, underperforming Nifty-100 by ~900-600bp. This has been an aberration from historical trends, as consumption indices typically outperform the benchmark during phases of sharp market downturns.

* Nifty FMCG/Nifty Consumption indices have delivered an average alpha of 10%/5% during the past 11 phases of a 10%+ correction in the Nifty-50 over the last two decades. Current underperformance can be explained by weak FY25 earnings (MOFSL-covered consumption basket to post weak 2% YoY PAT growth). However, fiscal and monetary policies, such as income tax relief, transfer schemes announced by some key states, and OMO actions announced by the RBI to infuse liquidity into the banking system, along with easing inflation, can drive incremental positivity in select consumption names.

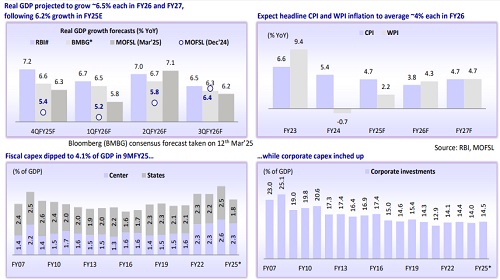

India’s macro likely to strengthen for FY26

Real GDP is expected to grow 6.0-6.5% in 4QFY25 and ~6.5% in FY26

* GDP growth: After 9.2% growth in FY24, real GDP growth of 6.2% in the first three quarters of FY25 was not particularly weak. We upgrade our real GDP growth forecast to 6.2% for FY25, aided by 6.0-6.5% growth in 4QFY25. We also upgrade our forecasts for FY26/FY27 to ~6.5% each from 6.3% each earlier.

* CPI inflation: The headline retail inflation forecast for FY25 is revised to 4.7% YoY from 5.1%, while the FY26 forecast remains nearly unchanged at 3.8%.

* India’s real investment growth was at an eight-quarter low of 5% YoY, and (nominal) investment growth hit a 12-quarter low of 30.5% of GDP in 3QFY25

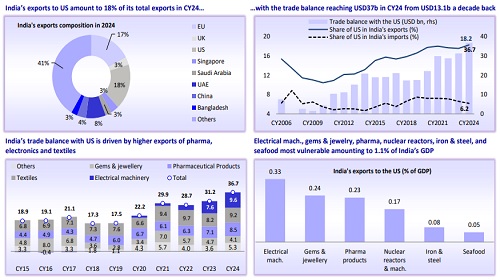

Reciprocal tariffs on India likely to have a moderate overall impact

India’s US exports of 1.1% of GDP to be the most vulnerable

* The US is one of the largest trading partners of India, with bilateral trade of USD124b in CY24. Exports from India to the US reached USD81b, and imports to India from the US amounted to USD44b. This resulted in a trade surplus of USD37b for India in CY24. The US is India’s largest export destination, with its share reaching 18% in CY24 from 13% in CY14 and 6% in CY06.

* The Trump administration unveiled the Reciprocal Tariff Plan—a strategy aimed at levelling tariffs, taxes, and non-tariff barriers with trading partners—and imposed a 26% tariff on India to engineer trade parity.

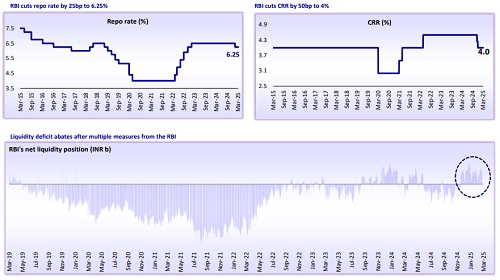

The RBI remains on the path of accommodation

* Following a period of tight liquidity, the RBI has deployed various monetary tools to boost demand and liquidity, including a 50bp CRR cut, a 25bp repo rate cut, and liquidity injections through OMOs and FX swaps.

* Low inflation will certainly allow the RBI to be more relaxed in its monetary policy, although strong growth and an uncertain global economic environment will limit its ability to cut interest rates sharply.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

The Economy Observer : Real GDP growth improves in 3QFY25 by Motilal Oswal Financial Service...