Hold State Bank of India Ltd For Target Rs. 970 By InCred Equities

Limited room for outperformance

* 2Q PBT beat was led by strong core performance. Margin/core fee surprised positively while loan spread moderated QoQ. Asset quality was steady.

* We expect modest core profitability progression and see risk to sustainability of non-core income. We expect RoA/RoE at 0.9%/13% in FY27F/28F.

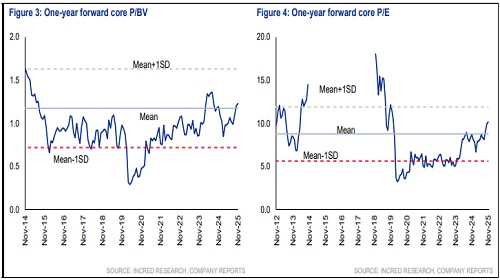

* We raise TP to Rs970 (up 2%) as we roll forward & increase our earnings. Current valuation at 1.1x Sep 2027 P/BV has limited room for outperformance.

SBI clocks RoA of 1% ex-stake sale gains; loan spread moderates

State Bank of India (SBI) posted 2QFY26 PAT of Rs202bn, including gains from Yes Bank stake sale of Rs45.9bn. Adjusted for that, SBI clocked annualized RoA of 1%. Core performance was strong, aided by a positive surprise on margin, up 7bp QoQ, at 2.97% (we had built in a decline of 5bp QoQ) and strong fee income (25% YoY; 14% above our estimate). NII grew by 5% QoQ (3% YoY; 5% above our estimate), helped by uptick in margin as well as healthy average balance sheet growth (2% QoQ). Cost growth was wellcontained at 12% YoY (11% QoQ partly owing to seasonality). Asset quality was steady, with moderation in net slippage QoQ (0.3% annualized vs. 0.55% last quarter) driving lower NPA credit costs (39bp vs. 47bp). Domestic deposit growth was subdued at 7% YoY (flat QoQ; partly owing to a reduction in bulk deposits). CASA growth was healthy at 8% YoY (3% QoQ) driven by strong current account flows (18% YoY; helped by revamped cash management solutions). Average LCR ratio increased QoQ (143% vs. 137%). Average retail deposit (per LCR) growth was healthy at 3% QoQ. The CET-1 ratio improved QoQ (12.5% vs. 11.6%), aided by raising Rs250bn capital (70bp).

Margins surprise positively - helped by balance sheet optimization

Headline margin increased by 7bp QoQ to 2.97% while loan spread declined by ~5bp QoQ. Domestic yields declined by 20bp QoQ and were partly offset by lower domestic funding costs, down 16bp QoQ. We note that loan spreads have bottomed out and will gradually inch up over the next few quarters. That said, the pace of margin progression hinges on incremental disbursement margin/MCLR cuts, given that SBI lags large private peers. Moreover, 3QFY26F margin could be impacted by the drag from lumpy borrowing towards end-Sep 2025. Management gave margin guidance of 3% over the next few quarters while we expect FY26F margin at 2.95% and build in broadly steady margin for FY27F.

We expect RoA to moderate; RoE to dip to ~13% over FY27F-28F

RoA of 1% in 2QFY26 (ex-stake sale gains) includes 17bp (pre-tax) via recovery from written-off loans & 15bp from treasury gains. We see a risk to sustainability of non-core income and any moderation will impact RoE materially (given the elevated leverage at 15x). We expect RoA to moderate to 0.9% over FY27F-28F, from ~1.1% in FY25, and RoE to moderate to ~13% (during FY27F-28F vs. the guidance of 15%). We build in a lower margin (2.95% vs. 3.1% in FY25), normalized credit costs (~50bp vs. 40bp) and lower treasury gains (10bp vs. 20bp). We increase our target price to Rs970 (2% upside) from Rs875 earlier. Maintain HOLD rating on SBI. At core valuation of 1.1x Sep 2027F core BV, we see limited room for outperformance vs. large private/SOE peers. Upside risks: Benign credit costs for a longer span and better margin progression. Downside risks: Higher cost ratios and weaker-than-expected growth.

Above views are of the author and not of the website kindly read disclaimer