Hold Siemens Energy India Ltd for the Target Rs. 3,360 by Prabhudas Lilladher Pvt Ltd

Powering India’s energy transition journey

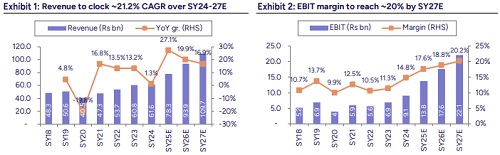

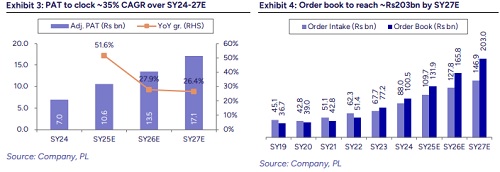

We initiate coverage on ENRIN with ‘HOLD’ rating at TP of Rs3,360, valuing the stock at PE of 70x Sep’27E. We believe ENRIN is well-placed to capitalize on the robust multi-year energy transition and energy efficiency opportunity given 1) it being among the only 3 players in India having HVDC capabilities, 2) its market leading position in product sale and upgradation of industrial steam turbines (up to 250 MW), 3) robust opportunities in energy and utility-scale gas services in India, 4)its comprehensive portfolio catering to the decarbonization space, and 5) ongoing doubling of its power transformer manufacturing capacity along with capacity and capability expansion across key transmission equipment manufacturing. We estimate revenue/adj PAT CAGR of ~21.2%/34.8% over SY24-27E. The stock is trading at PE of 92.4x/73.1x on SY26/27E earnings. Initiate with ‘HOLD’.

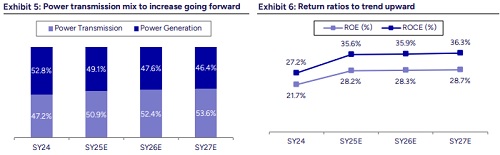

Gearing up to capitalize on strong T&D upcycle in India: ENRIN is well-positioned to benefit from India’s rapidly expanding transmission sector, with its planned ~Rs8.0bn investment to double power transformer capacity, expand vacuum interrupters, large reactors, and HV switchgear manufacturing. It is expected to meet rising demand, particularly in the 765 kV EHV segment where India’s 765 kV substation capacity is expected to register ~16.5% CAGR over FY25-32. Additionally, ENRIN’s strong presence in the growing STATCOM market—with a projected annual opportunity of ~Rs20bn for the next 5 years due to increasing renewable integration and grid stability needs—further supports robust growth prospects and market leadership in India’s power transmission value chain.

ENRIN’s tech prowess positions it to capture India’s strong VSC HVDC pipeline: ENRIN is poised to capitalize on India’s growing VSC HVDC transmission market, with an addressable opportunity of ~Rs380bn till FY31 (assuming ~50% scope of electrical equipment supply in HVDC projects) driven by multiple approved and potential projects totaling ~Rs769bn. ENRIN’s exclusive focus on VSC technology—favored for integrating renewables and providing superior control and reactive power support—coupled with its proven track record, including India’s first ±320 kV, 2,000 MW VSC HVDC project commissioned in 2021, strengthens its position. ENRIN is a key contender to win Leh-Kaithal and Khavda-South Olpad VSC HVDC orders in FY26-27. If awarded, we believe that these orders will potentially add cumulative HVDC revenue of ~Rs120bn by SY30 (assuming ~50% scope of business), reinforcing its leadership in India’s energy transition.

Leadership position in industrial steam turbines (up to 250 MW): ENRIN is wellplaced to benefit from India’s energy transition through its leadership in industrial steam turbines (up to 250 MW). Rising data center capacity (21% CAGR over 2024–27) along with energy transition and efficiency in key industries provide a strong growth runway for industrial steam turbines. The company also taps into a sizable gas turbine R&M/LE services market (~Rs12.7bn annually till FY29). It offers a comprehensive decarbonization portfolio spanning CCUS, WHR, green hydrogen, electrification and automation, positioned to capture multi-decade opportunities in industrial sustainability.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271