General Insurance Sector Update : Modest performance in Q2; industry outlook improves in H2 by Emkay Global Financial Services

Modest performance in Q2; industry outlook improves in H2

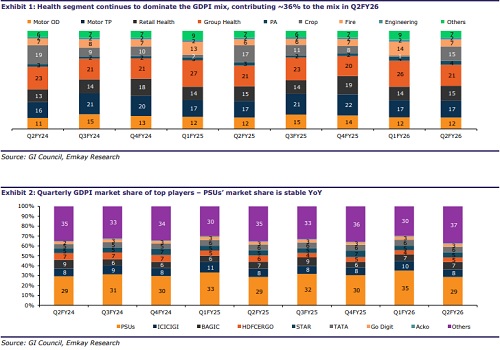

The general insurance industry posted a modest ~6% GDPI growth in Q2FY26, owing to: 1) continued slowdown in new vehicle sales till the last week of Sep25 resulting in muted growth in Motor OD (+5.6% YoY); 2) absence of a price hike causing subdued growth in Motor TP premiums (+7.4% YoY); 3) implementation of 1/n regulation, which dampened growth in the Retail Health segment (+7.4% YoY); 4) heightened pricing competition in the Group Health segment (+7.6% YoY) due to EoM guideline targets; and 5) while the 1/n regulation constrained growth in commercial lines, pricing discipline in the Fire segment (+27% YoY) supported overall ~16% rise in the commercial lines business. In Q2FY26, ICICIGI logged a marginal GDPI decline of 1.9%, whereas GODIGIT achieved a robust 16.7% YoY growth. Star Health reported a muted ~3% GDPI increase, constrained by the 1/n regulation and contraction in the Group business. Looking ahead, the general insurance industry is expected to witness growth revival, driven by multiple factors: i) recovery in new vehicle demand supporting Motor segment growth; ii) improved affordability in Health Insurance products following GST rate exemptions, thus bolstering retail Health growth; iii) normalization of the impact of 1/n regulation; iv) likely Motor TP tariff hike in Q1FY27; and v) sustained pricing discipline in the Fire segment. With the overall outlook turning favorable, the industry is poised for growth recovery in H2, backed by stronger demand following the GST rate reductions.

Growth moderation in Motor and Health segments drive modest growth in Q2

The industry saw a modest ~6% GDPI growth in Q2FY26, mainly reflecting the benign performance in the Motor/Health segments, partially offset by robust growth in Personal Accident/Fire segments. Growth in the Motor segment was constrained by a slowdown in new vehicle sales; however, it is expected to improve in H2, supported by demand recovery following GST rate reductions. The Retail Health segment recorded modest growth during the quarter, impacted by the implementation of 1/n regulation, while the Group Health segment faced heightened pricing competition, partially mitigated by strong traction in the mass government health segment. Pricing discipline in the Fire segment continued to drive a strong performance, helping deliver 27% GDPI growth in Q2FY26.

New Vehicle sales slowdown drives modest trends in Motor segment

The Motor OD segment recorded a modest 5.4% YoY growth in H1FY26, primarily due to a slowdown in new vehicle sales till the last week of Sep-25 and heightened pricing aggression. Growth in Motor OD was largely supported by ~6% expansion among private multiline players, while PSU insurers reported a muted ~3% growth. Among listed players, ICICIGI posted a subdued 2.7% YoY increase while retaining market leadership; GODIGIT achieved ~9% growth; and New India reported a modest 2.5% growth. The Motor TP segment grew ~9% YoY in H1FY26, constrained by the absence of a price hike during the year. Growth was mainly driven by PSU players, which grew ~14%, whereas private insurers saw a moderate ~7% growth. Within listed entities, GODIGIT reported a healthy 14% rise in Motor TP premium, while ICICIGI saw a subdued 1.6% growth.

Health segment continues to witness growth moderation

The Retail Health segment recorded a modest ~8% growth in H1FY26, primarily impacted by implementation of the 1/n regulation for long-term policies. SAHIs continued to be the fastest-growing category, followed by PSU multiline players. Star Health achieved ~8% growth in Retail Health while maintaining market leadership, whereas ICICIGI delivered a strong 23% growth. The Group Health segment (incl mass government health schemes), reported GDPI growth of 7.5% in H1FY26, supported by ~10% growth among private multiline insurers. However, the growth was constrained by intensified pricing competition arising from the EoM limit deadlines. ICICIGI reported a marginal decline in the Group Health segment during H1, while GODIGIT posted ~5% growth.

Fire segment drives healthy growth in Commercial Lines

The commercial lines segment recorded a healthy 14% GDPI growth in H1FY26, supported by a strong ~21% growth among PSU insurers. The Fire segment delivered a robust ~21% growth over the same period, driven by continued pricing discipline, with PSU players posting an impressive ~36% increase. ICICIGI reported ~7% growth in commercial lines, while GODIGIT registered a strong ~47% expansion. The Crop segment, however, declined ~15% in H1FY26, as the significant contraction among PSU multiline players was partially offset by growth from PSU specialized insurers.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354