Gasoline stocks increased by 816,000 barrels, both figures well above estimates - HDFC Securities Ltd

GLOBAL MARKET ROUND UP

Gold strengthened for a fourth day, as investors pushed back against US President Donald Trump’s tax-cut plan and growing fiscal deficit by driving long-range US Treasury yields to near a two-decade high.

Concerns over US fiscal health remain after Moody’s downgrade on Friday. The US faces a precarious fiscal situation, with a growing debt pile and rising interest payments, which could lead to higher borrowing costs and make it harder to reduce the deficit unless the government takes action to address its finances. This situation is providing strong support for bullion as investors seek safety amidst economic and financial uncertainty.

Crude oil retreated from the day’s high and settled lower on Wednesday, pressured by higher US stockpiles, which reinforced worries about an oversupplied market. US crude oil inventories rose by 1.33 million barrels last week, according to EIA data.

Gasoline stocks increased by 816,000 barrels, both figures well above estimates. A higher inventory report overshadows geopolitical concerns, including the potential Israeli strike and Iran-US nuclear talks, which are affecting oil prices. Changes in Iranian oil exports and OPEC production levels could also impact these prices.

Natural gas gives back some of the significant gains made the previous day, as the market shifts its focus to today's storage report, which is anticipated to reveal the largest weekly injection so far this year.

Copper prices are remaining within a range due to mixed factors, and traders are awaiting fresh cues for further direction.

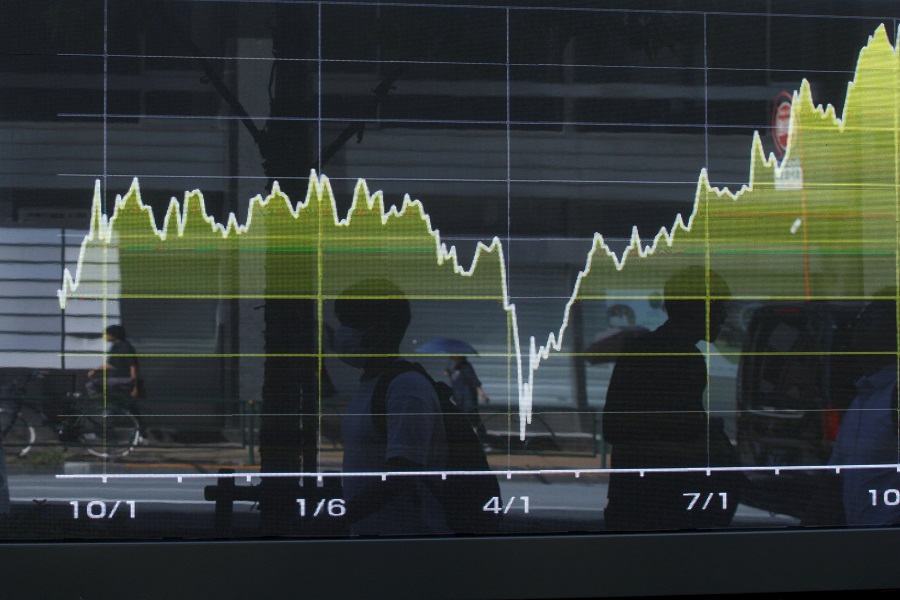

Asian markets are struggling with falling US stocks, and the dollar as a result of fears about Washington's increasing deficit and waning investor interest in US assets.

Gold

Trading Range: 95750 to 97300

Intraday Trading Strategy: Buy Gold Mini Jun Fut at 95650-95675 SL 95180 Target 96480/96700

Silver

Trading Range: 97500 to 100300

Intraday Trading Strategy: Buy Silver Mini Jun Fut at 98400-98425 SL 97680 Target 99300

Crude Oil

Trading Range: 5150 to 5350

Intraday Trading Strategy: Sell Crude Oil Jun Fut at 5345-5350 SL 5445 Target 5210/5180

Natural Gas

Trading Range: 270 to 304

Intraday Trading Strategy: Sell Natural Gas May Fut at 295 SL 304 Target 284/280

Copper

Trading Range: 850 to 870

Intraday Trading Strategy: Buy Copper May Fut at 856-857 SL 853 Target 865

Zinc

Trading Range: 254 to 265

Intraday Trading Strategy: Buy Zinc May Fut at 258.50 SL 255.0 Target 262.80.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133