Fed Holds Rates, Projects Weaker Growth and Higher Inflation : CareEdge Ratings

The US Fed kept the federal funds rate unchanged in the 4.25-4.5% range in June, marking its fourth consecutive pause, in line with market expectations. However, the Fed’s latest projections pointed towards a more cautious outlook, with weaker growth, slightly higher unemployment, and stickier inflation relative to the March projections. The Fed acknowledged that uncertainty around the economic outlook has diminished but remains elevated. The dot plot continues to signal two rate cuts in 2025.

Fed Projects Weaker Growth and Higher Inflation

Economic projections have been trimmed. The Fed now sees GDP growth slowing to 1.4% in 2025, down from its earlier projection of 1.7% in March. Growth for 2026 has also been revised lower, to 1.6% from 1.8%. The labour market is expected to be softer than previously projected, with the unemployment rate now seen at 4.5% in both 2025 and 2026 (up from 4.4% and 4.3%, respectively).

Inflation projections have been revised upwards. Core PCE inflation, the Fed’s preferred measure, is now projected at 3.1% in 2025 (vs 2.8% projected previously) and 2.4% in 2026 (vs 2.2% previously). Notably, inflation is no longer seen returning to the Fed’s 2% target by 2027.

Stickier inflation likely reflects higher tariffs. Even though the US and China recently agreed to a 90-day truce that included deeper-than-expected tariff cuts, overall US tariff levels remain elevated. These are expected to feed into inflation and dampen domestic demand. At the same time, legal uncertainty surrounding US trade policy continues to create policy ambiguity and could weigh on growth.

Recent US Data Presents a Mixed Picture

According to the second estimate, the US economy contracted at an annualised rate of 0.2% in Q1 2025, its first quarterly decline in three years. Notably, this contraction came even before the reciprocal tariffs were announced in April and was largely driven by a surge in imports, as businesses front-loaded shipments in anticipation of rising trade barriers.

Q2 high frequency data shows retail sales fell 0.9% month-over-month in May, the biggest drop in four months. ISM PMIs for manufacturing (48.5) and services (49.9) were in the contractionary zone in May, reflecting subdued activity. Nonfarm payrolls rose by 139K in May, slightly above expectations, but were lower than 147K in April. The unemployment rate held steady at 4.2% in May but remains below the pre-Covid average of around 6%. The University of Michigan consumer sentiment index rose to 60.5 in June from 52.2 in May but was still below December levels.

On the inflation front, headline CPI inflation rose for the first time in four months to 2.4% in May from 2.3% in April. Core inflation stood at 2.8%.

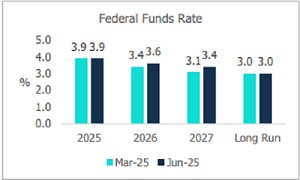

Rate Path: Two Cuts Still Expected in 2025

The median projection in the Fed’s dot plot still signals two rate cuts in 2025; however, it remains a close call. Eight FOMC members project two cuts, while seven expect none. Two members project just one cut, while another two

members expect three cuts. For 2026, the median dot now indicates only one rate cut, down from two in March. The 2027 projection also shows one cut, unchanged from before. The longer-run rate projection remains steady at 3%. The CME FedWatch tool shows markets are still pricing in two rate cuts in 2025 (a total of 50 bps), likely beginning in September.

Market Reaction and Outlook

The 10-year US Treasury yield was largely flat around 4.39% following the Fed meeting, though it has risen by about 40 bps since early April. The DXY index showed some strengthening amidst rising tensions in the Middle East but remains below 100 and is down 8.8% year-to-date. We expect the dollar to stay soft amidst a weaker US growth outlook, rising fiscal concerns, and expected Fed rate cuts. Geopolitical tensions in the Middle East will remain a key monitorable, given their potential impact on global oil prices and the broader inflation trajectory.

Exhibit: FOMC Summary of Economic Projections (Median Projections)

Above views are of the author and not of the website kindly read disclaimer