Doji in uptrend hints fatigue, but week starts strong for market - Tradebulls Securities Pvt Ltd

Nifty

A Doji appearing within a sustained uptrend signals early signs of fatigue, but the market’s strong weekly start—anchored above the gap support at 23900 and maintaining a higher top–higher bottom structure—keeps bullish momentum intact. This sets the stage for a potential move towards the 24440–24500 zone, with the recent sharp rally exhibiting impulse wave traits, hinting at the beginning of a broader bullish phase that could eventually extend to 26400. Key support has now shifted to 22900, marked by a crucial moving average crossover, reinforcing the trend's strength. Momentum traders should stay long with a revised stop-loss at 23830. On the daily chart, RSI remains below its prior peak of 71.65, indicating further upside potential, while the ADX, though above 25, suggests the trend is still maturing. Options data highlights strong support between 24000–23500 and resistance around 25000, where the highest Call OI is stacked. However, caution is warranted if the index dips below 23830 or accelerates too quickly toward 244

Please refer disclaimer at https://www.tradebulls.in/disclaimer

SEBI Registration number is INZ000171838

Tag News

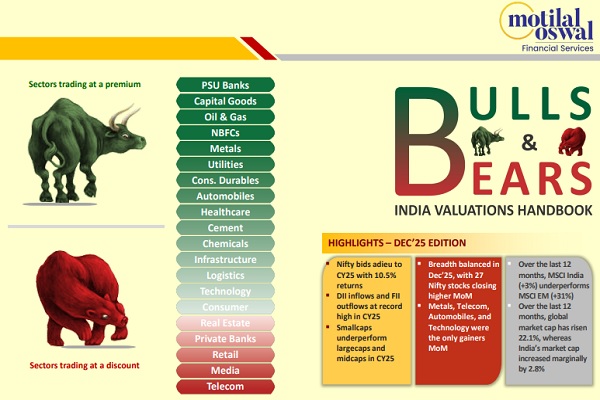

India Strategy : Indian market manages double-digit gain in volatile CY25 by Motilal Oswal F...

.jpg)