Diwali Muhurat stock picks 2025 by Geojit Investments Ltd

SAMVAT 2082 Vision

The Indian government has rolled out a substantial fiscal stimulus aimed at empowering middle- and upper-middle-class households. The initiative commenced with the 2025 Budget, introducing tax incentives worth Rs.1 lakh crore. In September, this was further extended by a drastic cut in GST rates, offering an additional annual relief of Rs.50,000 crore. Alongside, the government’s plan to raise infrastructure spending to 3.1% of GDP (Rs.11.21 lakh crore) is expected to uplift living standards across both urban and rural regions. The tangible impact of these measures is anticipated to unfold from the second half of FY2026 (H2FY26).

This consumption-driven momentum is expected to accelerate with a projected drop in national inflation, a good monsoon season, and reforms initiated by the Reserve Bank of India (RBI). Beyond rate cuts, the RBI’s measures to enhance credit flow and streamline operations for banks and NBFCs are likely to support financial growth. Together, these developments are expected to lift disposable incomes and generate a broad-based multiplier effect across the domestic economy

A key contrarian theme explores the large-cap IT space, which is available at historically discounted valuations. This presents a potential multi-bagger opportunity, as future Federal Reserve rate cuts are likely to drive increased upside in U.S. IT spending. At the same time, this SAMVAT portfolio is designed to capitalize on strengthening domestic demand, with a focus on sustainable domestic growth while avoiding risks from external demand and overvalued stocks & sectors.

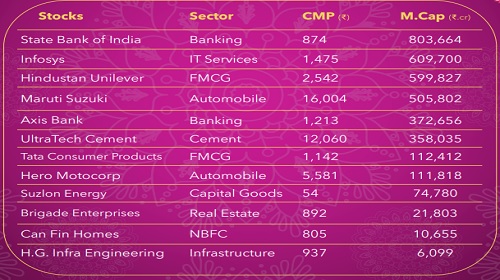

Muhurat Diwali Stock Portfolio

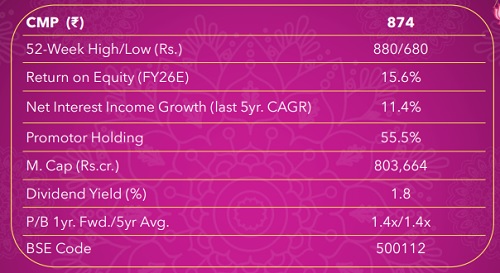

State Bank of India Ltd.

Rationale:-

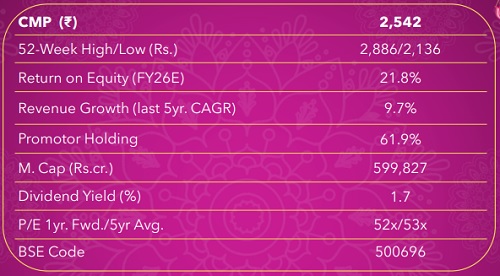

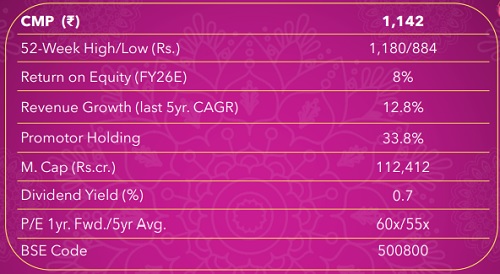

State Bank of India Ltd

* SBI aims to enhance branch efficiency through initiatives such as ‘Grahak Mitra’ and increased automation. It also plans to boost profitability by leveraging all avenues to grow fee income, rationalizing operating expenses, and improving employee productivity.

* SBI aims to strengthen the bank’s leadership position and book quality advances in retail, agriculture and MSME (RAM) as well as corporate segments while also catering to the GYAN (Garib, Yuva, Annadata and Naari) segment, which can contribute significantly towards ‘Viksit Bharat’

* With the government’s divestment program continuing, reduced bureaucracy and the introduction of professional management bode well for the company. SBI remains wellpositioned to sustain its growth momentum, supported by a comfortable LDR, which provides the leverage to accelerate credit growth.

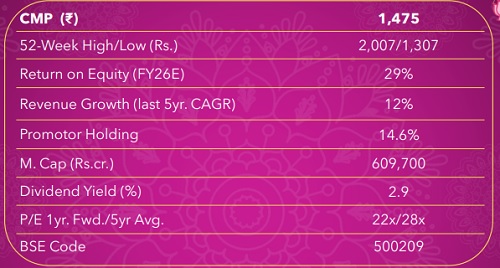

Infosys Ltd.

Rationale:-

* The order pipeline remains robust at $3.8 billion in Q1FY26, with 55% comprising net new orders, driven by strong demand for AI agents across business operations and IT functions.

* Investments in automation, productivity tools, and AI have improved delivery and client outcomes, with continued focus on enhancing platforms such as Finacle and insurance solutions, particularly in Europe.

* Infosys maintains its FY26 margin outlook, backed by Project Maximus, cost cuts, and disciplined spending. At a 1-year fwd. P/E of ~22x, the stock is trading below its long-term averages, and the recent buyback signals management confidence and adds to shareholder value.

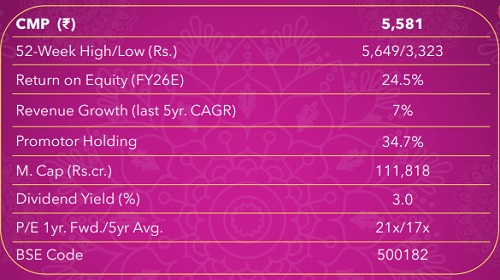

Hindustan Unilever Ltd..

Rationale:-

* HUL’s strategic focus on premiumization and innovation is expected to drive performance. Moreover, the company's recent leadership transition presents a promising opportunity for sustainable value creation.

* With the expected benefits of direct & indirect tax relief, lower inflation, a favourable monsoon, and the upcoming 8th Pay Commission, HUL is wellpositioned to capitalise on the improving macro environment.

* We expect the revival in demand, especially from rural areas, will aid healthy earnings growth over the next year. At a 1-year fwd. P/E of ~52x, the stock is trading below its long-term average and also its peers.

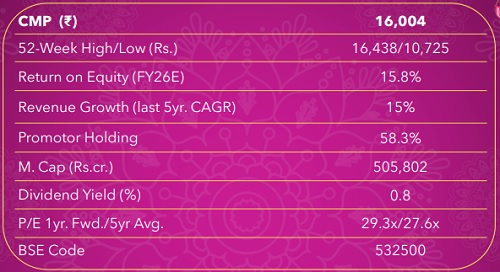

Maruti Suzuki Ltd.

Rationale:-

* GST rationalization enhances affordability, while expected pickup in rural income, new launches and Maruti’s vast distribution network support strong growth.

* Maruti offers one of the most comprehensive and diverse portfolios in the sub-1,200 cc segment, securing a dominant market share of the demand surge triggered by lower prices.

* 1 year fwd. P/E is ~29x (5yr avg is ~28x). Strong earnings growth expectation of ~31% over FY25-27E justifies improvement in future valuation.

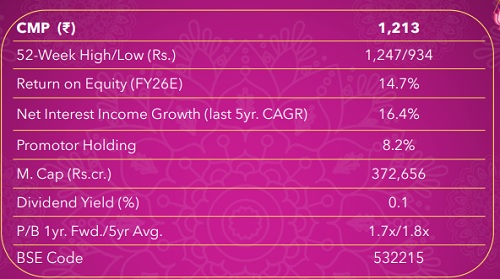

Axis Bank Ltd.

Rationale:-

* Axis Bank is expanding their footprint in India’s thriving startup ecosystem, offering entrepreneurs seamless access to banking, advisory, and capital through our hub-and-spoke model. Their efforts include contributing to the evolving fund ecosystem in collaboration with VCs, incubators, and policy platforms to support early- and growth-stage ventures.

* The ‘One Axis’ Ecosystem integrates Axis Bank’s entire suite of financial services—including asset management, retail broking, insurance, consumer lending, fintech, and investment banking—into a seamless, unified platform.

* Among the universal banks, Axis Bank is preferred due to its attractive valuation relative to peers, offering a favourable risk-reward setup.

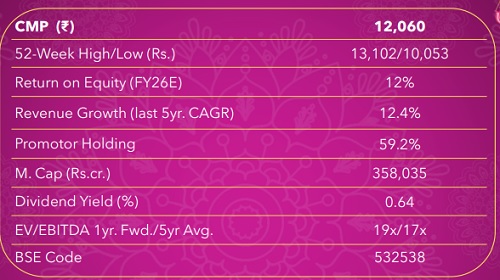

UltraTech Cement Ltd.

Rationale:-

* As the largest cement player in India, UltraTech Cement's strategic investments in new capacities, cost optimization and commitment to green technologies are expected to drive growth.

* Further, the integration of acquired assets, including India Cements and Kesoram, is progressing well, with a focus on enhancing efficiency and productivity, which will add to earnings growth.

* As a pan-India player, Ultratech is poised to benefit from the positive cement demand outlook given GOI’s strong focus on housing & infra along with the recent improvement in realization and reduction in costs. Ultratech is currently trading at 1yr fwd. EV/EBITDA of ~19x, above its long-term average of ~17x, factoring in strong earnings growth over FY25-27E.

Tata Consumer Products Ltd.

Rationale:-

* The diversified portfolio, including leading brands such as Tata Tea, Tata Salt, and Tata Sampann, along with a focus on innovation and expansion into new channels, positions the company well for long-term growth.

* The company has expanded into high-growth, high-margin categories, including health and wellness, through acquisitions like Organic India and Capital Foods, which will support margin expansion.

* At a 1year fwd. P/E of ~60x, the stock is trading moderately above its long-term average, factoring in strong earnings growth of ~27% CAGR over FY25-27E.

Hero Motocorp Ltd.

Rationale:-

* Hero Motocorp is set for a robust performance, driven by new products across segments, improving product mix, better cost management and increasing financing penetration.

* We expect strong earnings growth over the next year, with volume growth exceeding the industry’s growth. Q2FY26 has already showcased impressive volume growth of ~11%, which is the highest in the last 5 quarters.

* With a strong market share in the entry-level segment and a valuation below industry peers, we expect a re-rating in the stock going forward.

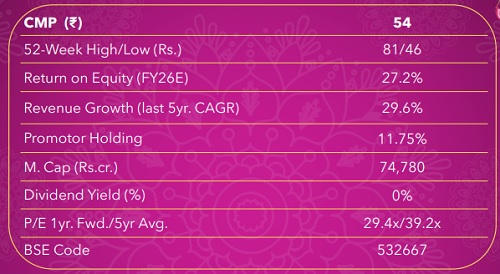

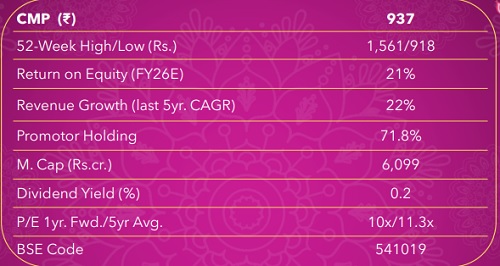

Suzlon Energy Ltd.

Rationale:-

* With a robust Q1FY26 exit order book of 5.7 GW, the current execution pace provides clear revenue visibility for the next three years, underpinning a projected 42% CAGR in revenue over FY25–27E.

* As utilization rises in the wind turbine generator (WTG) segment and the forging & foundry businesses, Suzlon is positioned to realize volume-driven efficiencies, supporting an expected 117bps margin expansion (FY25-27E).

* Earnings are projected to grow at a strong 43% CAGR, driven by improved asset turnover and rising profitability. ROE is expected to reach 27.1% by FY27E, setting the stage for a potential valuation re-rating. At 29x, the stock remains attractively priced, leaving significant upside potential

Brigade Enterprises Ltd.

Rationale:-

* The total revenue for Q1 grew by 19% year-on-year, driven by a 15% rise in leasing and a 19% increase in hospitality, supported by high occupancy and better realizations.

* The company has a robust pipeline of ~12.3msf of launches for FY26 across key cities, which is expected to support a 15% growth in pre-sales.

* The successful listing of Brigade Hotel Ventures Ltd (74.1% owned by Brigade Enterprises) reflects strategic diversification and enhances visibility, potentially unlocking value for shareholders.

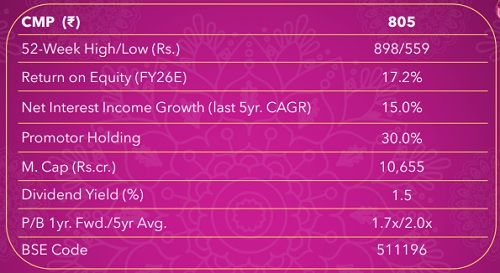

Can Fin Homes Ltd.

Rationale:-

* Canara Bank’s strong parentage offers the company both a trusted brand identity and comprehensive support for funding.

* The key strategy involves expanding into semi-urban and developing cities to enhance access to affordable credit for underserved communities. The company will strategically extend credit to salaried individuals and selectively to self-employed and nonprofessional borrowers within safe geographic regions, with a particular emphasis on affordable and mid-segment housing.

* With rising disposable incomes supported by tax reductions and lower interest rates stimulating housing demand, coupled with the stock’s attractive valuation, we believe these factors collectively strengthen the company’s growth outlook.

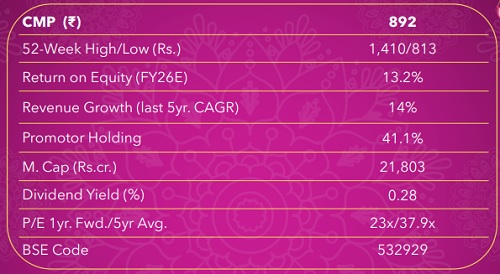

H.G. Infra Engineering Ltd.

Rationale:-

* H.G. Infra has a strong order book of Rs.14,656 cr in Q1FY26 (2.4x TTM revenue) and is targeting an order inflow of Rs.11,000 cr in FY26 due to a solid tender pipeline from NHAI.

* The company signed a binding agreement to monetize 5 HAM projects with an attractive valuation of ~1.8x P/B, which will strengthen its balance sheet and reinvest in high-return projects.

* With ongoing execution progress, revenue is expected to grow at a CAGR of 15% over FY25–FY27. The company aims to diversify its order book—targeting 30–40% from non-road projects over the next two to three years—while maintaining a healthy margin profile to support sustained future growth.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345