Our Top 5 Diwali Recommendations by Religare Broking Ltd

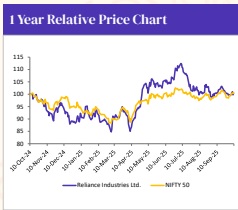

Reliance Industries Ltd

Consumer engines firing; new energy to drive the next leg

Reliance Industries (RIL), India’s largest private sector enterprise, holds a leading position across energy, telecom, and retail sectors. Its integrated oil-to-chemicals operations, expanding digital ecosystem through Jio, and strong retail footprint drive diversified and resilient earnings. The company’s ongoing investments in new energy and technology innovation position it well to capture emerging opportunities across the next growth cycle.

Investment Rationale

1. Dominant Consumer Platforms Set for Sustained Growth: Reliance’s consumer businesses are positioned to be the primary drivers of future growth and profitability. Jio’s consistent ability to add millions of new subscribers each quarter, combined with a steady increase in ARPU driven by the ongoing 5G rollout and premiumization, points to a long runway of high-margin growth. Simultaneously, Reliance Retail is set to further solidify its leadership by continuing its dual strategy of aggressive physical store expansion and scaling its digital commerce capabilities through JioMart, ensuring it captures an everlarger share of India’s rising consumption.

2. New Energy Poised to Emerge as the Next Value-Creation Engine: The company’s massive investment in its New Energy ecosystem is nearing a major inflection point. With the fully integrated giga-factories in Jamnagar expected to become operational within the next 4-6 quarters, the narrative will shift from capital expenditure to revenue generation and monetization. This business is strategically designed to be a self-funding growth engine, poised to not only capture the multi-decade opportunity in India’s energy transition but also to provide low-cost captive power, enhancing the profitability of all other business verticals

3. Resilient O2C Cash Flows to Fund a New Media Powerhouse: The legacy Oil-toChemicals (O2C) business is expected to remain a resilient and powerful cash generator, with a constructive outlook supported by robust domestic demand and limited global capacity additions. This financial strength provides a solid foundation to fund the company’s high-growth ambitions. Foremost among these is the newly consolidated Media business (JioStar), which has already proven its ability to monetize premium content like the IPL at a massive scale and is now structured to dominate India’s entertainment and sports landscape for years to come.

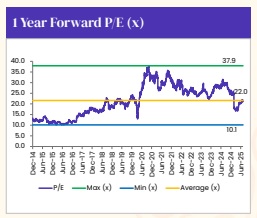

Valuation & Outlook

The outlook remains robust, driven by sustained momentum in the high-growth consumer businesses (Jio and Retail) and the impending monetization of the New Energy gigacomplex. We expect this to translate into a strong consolidated Revenue/EBITDA to grow at a CAGR of 10%/15.1% over FY25–27E, as resilient O2C cash flows continue to fund new growth engines. The current valuation does not fully capture the immense value-unlocking potential from the New Energy and consolidated Media businesses. We therefore maintain a BUY rating, as these catalysts are expected to drive a re-rating and support a target price of Rs.1,600.

HDFC Life Insurance Company Ltd

Sustained compounding through quality growth and digital scale

HDFC Life Insurance, a subsidiary of HDFC Bank (holding 50.3%), is among India’s top private life insurers offering a wide range of protection, savings, investment, annuity, and health products. In FY25, it recorded 18% growth in individual APE and a 13% rise in VNB to ?3,962 crore, with a strong 11.1% market share in individual WRP. Supported by persistency ratios of 87% (13th month) and 63% (61st month), along with 600 branches and 2.4 lakh agents, the company maintains leadership in profitability and efficiency. Its continued focus on digital initiatives and diversified distribution drives consistent long-term growth.

Investment Rationale

1. Diversified Growth Engine Delivering Robust Performance: HDFC Life continues its strong growth trajectory with a 12.6% YoY increase in Individual APE and a 13.6% rise in New Business Premium in Q1FY26. This performance is anchored by a well-balanced product portfolio across ULIPs, participating products, and protection, coupled with a formidable multi-channel distribution network led by its dominant bancassurance channel and an expanding agency force, ensuring sustained, broad-based growth.

2. Resilient Profitability Underpinned by High-Quality Business: The Company demonstrates strong operational discipline by maintaining stable Value of New Business (VNB) margins at 25.1%, effectively navigating regulatory changes. This profitability is reinforced by industry-leading 13th-month persistency of 87%, which reflects superior customer retention and ensures a predictable, high-quality stream of renewal premiums, forming a solid foundation for long-term value creation.

3. Strategic Expansion Unlocking Future Value: HDFC Life is securing its next phase of growth by strategically deepening its penetration into Tier 2/3 markets, which now contribute to three-fourths of new business operating profit. This geographic expansion is amplified by significant investments in digital transformation (‘Project Inspire’) to enhance agent productivity and operational efficiency, building a scalable and technologically advanced model to capture India’s vast underinsured market.

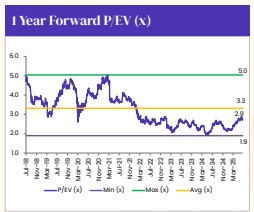

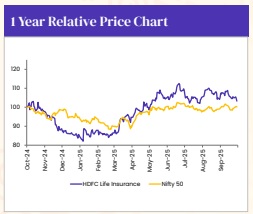

Valuation & Outlook

HDFC Life’s consistent execution, strong brand franchise, and industry-leading profitability metrics justify its premium valuation. The long-term outlook remains robust, driven by its strategic expansion into underpenetrated Tier 2/3 markets, a growing protection business, and a relentless focus on digital innovation. We expect an Embedded Value (EV) CAGR of over 17% through FY27, reflecting sustained value creation. While near-term margin pressures are largely priced in, the company’s resilient business model and clear growth drivers support continued upside. We value the stock at 2.6x its FY27E EV, maintaining a positive outlook with a target price of Rs. 870.

Power Finance Corporation Ltd

Powering growth, financing India’s energy evolution

Power Finance Corporation, a Maharatna public sector enterprise, stands as India’s largest Non-Banking Financial Company (NBFC) and a pivotal financier for the nation’s power sector. With the Government of India holding a majority stake of ~56%, PFC plays a strategic role in implementing national energy policy by providing financial assistance across the entire power value chain, including generation, transmission, and distribution projects. Having consolidated its leadership by acquiring Rural Electrification Corporation (REC), PFC has progressively aligned its portfolio with India’s energy transition goals, increasing its focus on financing green initiatives like renewable energy, battery storage, and EV infrastructure

Investment Rationale

1. Diversified Growth Engine Delivering Robust Performance: PFC’s loan book is on a strong growth trajectory, driven by a renewed thrust from the private sector, particularly in renewable energy and power distribution. This segment expanded at a 48% CAGR between FY20-FY25, fueling an overall loan growth of 12.2% CAGR in the same period. With a revived capital expenditure cycle and stable asset quality, this momentum is expected to continue, with projections indicating a 12.4% CAGR in the loan book and a 13.5% CAGR in disbursements through FY27.

2. Resilient Profitability Underpinned by Stable Asset Quality: The company demonstrates strong financial discipline, with Net Interest Margins (NIMs) expected to remain stable around 3.8%. This stability, combined with resilient asset quality, is set to drive robust earnings growth. While a rising share of private sector lending may slightly increase credit costs from cyclical lows, overall provisions are expected to remain modest. This foundation supports a projected Profit After Tax (PAT) growth of 12.3% CAGR over FY25-FY27E.

3. Structurally Positioned for Sustained Value Creation: PFC is a crucial lender in India’s power sector, with its growth firmly anchored to structural tailwinds like the national push for renewable energy, grid modernization, and increasing private sector involvement. Supported by a stronger balance sheet and disciplined credit underwriting, the company’s valuation is well-supported, limiting downside risk. Its strategic importance ensures a healthy disbursement pipeline and sustained earnings momentum for the long term.

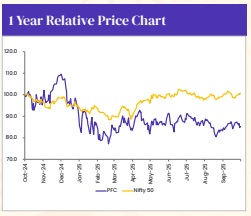

Valuation & Outlook

PFC’s outlook remains strong, driven by its strategic role in financing India’s energy transition and infrastructure growth. The company is set to capitalize on a healthy disbursement pipeline, stable profitability, and resilient asset quality, which are projected to deliver a PAT CAGR of 12.3% over FY25-27E. We value PFC on a standalone basis at 0.9x its FY27E Adjusted Book Value and add the value of its stake in REC (with a 30% holding company discount). This methodology supports continued upside, and we maintain a positive outlook with a target price of ?502.

Mahindra & Mahindra Financial Services Ltd

Rural recovery and digital leverage to lift profitability

Mahindra & Mahindra Financial Services (MMFS) is a leading non-banking financial company (NBFC) with a strong rural and semi-urban focus. As a key part of the Mahindra Group, it leverages a vast network of over 1,375 branches to provide a comprehensive suite of services, including vehicle and tractor financing, SME lending, and leasing. With a robust AUM and strong capitalization, the company is a vital player in driving financial inclusion across India.

Investment Rationale

1. Synergistic Growth Driven by Parent Company: MMFS’s growth is intrinsically linked to the strong market position of its parent, Mahindra & Mahindra. A significant portion of its AUM is driven by financing M&M’s expanding portfolio of utility vehicles and tractors, creating a reliable and sustained pipeline for loan growth. This powerful synergy provides a strong foundation for consistent AUM expansion, further supported by favorable government policies and a positive rural economy.

2. Profitability Boosted by Margin Expansion and Efficiency: The company is poised for improved profitability, driven by an expected expansion in Net Interest Margins (NIMs) as borrowing costs ease. This is complemented by significant gains in operational efficiency, with AUM per branch and AUM per employee showing strong growth. Ongoing investments in digital infrastructure are expected to further streamline operations and moderate the cost-to-income ratio, leading to better return metrics.

3. Strategic Diversification and Resilient Asset Quality: MMFS is actively diversifying its portfolio to reduce historical dependence on the cyclical vehicle financing segment. A strategic push into SME lending, leasing, and digital financial products is gaining traction, building a more balanced and resilient business model. This growth is supported by stable asset quality, achieved through strengthened collection processes and enhanced digital risk management, ensuring credit costs remain under control.

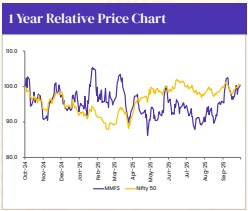

Valuation & Outlook

The long-term outlook for MMFS is positive, supported by its deep rural presence, strong promoter backing, and a clear strategy for portfolio diversification. With steady AUM growth, improving cost efficiencies, and stable asset quality, the company is well-positioned for healthy earnings momentum. We maintain a positive outlook with a Buy rating and a target price of Rs. 327, valuing the company at 1.4x its FY27E adjusted book value.

Nuvoco Vistas Corporation Ltd

Operational efficiency and capacity expansion to cement growth

Nuvoco Vistas is a leading cement player in India, with a strong presence in the Eastern and a growing footprint in the Western regions. The company boasts a significant manufacturing capacity, which is set to expand to approximately 31 million tons per annum (MTPA) by Q3 FY27 following the strategic acquisition of Vadraj Cement. Nuvoco focuses on a high-margin product mix, with a significant share of premium products in its trade sales, and is committed to strengthening its balance sheet through a consistent deleveraging strategy for its core business operations.

Investment Rationale

1. Robust Operational Performance Driving Growth: Nuvoco has demonstrated strong operational performance, characterized by healthy revenue growth driven by a balanced increase in sales volumes and improved pricing realizations. With management guiding for steady volume growth in line with a favorable industry demand outlook, the company is well-positioned for sustained top-line expansion.

2. Margin Expansion Through Efficiency and Pricing: The company’s profitability has shown significant improvement, with EBITDA per ton reaching multi-quarter highs. This has been achieved through a combination of sustained pricing power and rigorous cost-control measures, including savings in power and fuel. Management’s continued focus on operational excellence is expected to protect and enhance margins going forward

3. Strategic Acquisition Unlocking Future Capacity: The successful acquisition and fast-tracked integration of Vadraj Cement is a key strategic initiative that strengthens Nuvoco’s presence in the high-growth Western India market. This expansion is being funded through a prudent mix of debt and equity, minimizing balance sheet strain. This move not only adds significant capacity but also positions the company to capitalize on regional demand spurred by government infrastructure and housing projects.

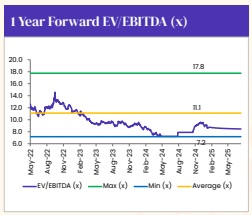

Valuation & Outlook

Nuvoco Vistas’ outlook is positive, underpinned by strong industry tailwinds and projected demand growth in the cement sector. The company’s strong operational performance, coupled with the strategic expansion through the Vadraj acquisition, provides clear visibility for future earnings. Management’s dual focus on deleveraging the core business while efficiently managing capex for growth inspires confidence. Therefore, we maintain a Buy rating with a target price of Rs. 478.

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ000174330