Diwali Fundamental Muhurat Picks 2025 by Kotak Securities

Wishing you a Happy Samvat 2082

How Samvat 2081 went

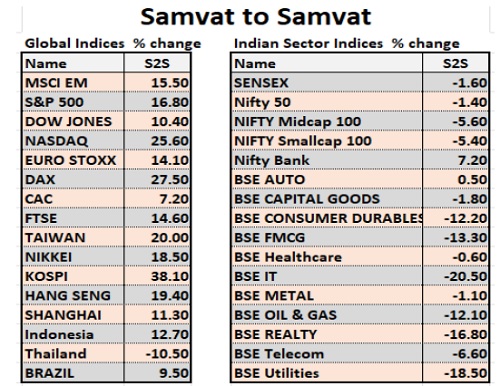

Indian markets have been lackluster in Samvat 2081 and underperformed several global peers. This is primarily attributed to earnings weakness and tariff uncertainty, compounded further by a series of geopolitical and macro headwinds. The Nifty touched a low of 21750 in March 2025, while BSE Sensex touched a low of 71500, with both benchmark Indexes losing around 1.5 % each during Samvat 2081. The Nifty Midcap and Smallcap Index underperformed and lost ~5.6% and ~5.4% respectively. The downward movement and underperformance of Indian markets was surprising considering efforts by global community to solve geopolitical tensions, easing global and domestic inflation, easing crude prices, interest rate cuts by RBI and Fed, GST rationalization, increase in income tax slabs and progress on various tariff agreements by Indian Government. The downward movement was driven by heavy FII selling to the tune of $27.3 bn (or Rs 2.4 lakh crores). While the DIIs set forth their conviction in Indian capital market by infusing Rs 4.5 lakh cr in the last one year, the retail category (via SIPs) wasn’t behind and invested Rs 28000 cr each in August and September 2024 and Rs 137000 cr in H1FY26. Samvat 2081 belonged to Bank Nifty (+7.2%) and Autos (0.5), while worst performers were BSE IT (- 20.5%), BSE FMCG (-13.3%), BSE Real Estate (-16.8%), BSE Utilities (-18.5%) and BSE Consumer Durable (-12.2%).

Situation of developed economies

US rate cuts have resumed, although we still expect the Fed to adopt a cautious approach. For US trade tensions are expected to deliver sub-trend growth in the second half of CY25, but the uplift in consumer income may help the U.S. economy avoid a recession. Inflation is expected to increase in Q4CY25, as the effects of tariffs begin reflecting in consumer prices. For Europe, while trade policy uncertainty will likely remain a drag on the economy, GDP growth is expected to slow only modestly in the near term and then pick up at the end of 2025 and early 2026, driven by rate cuts and fiscal easing. However, larger geopolitical and competitiveness challenges remain, with productivity growth a key hurdle for the region. Key themes affecting China’s outlook include ongoing trade uncertainty, the implementation of counter-cyclical economic policy to stabilize growth and a wave of innovation, as seen in the recent success of DeepSeek. On the domestic front, expectations for additional policy stimulus have been lowered and housing market weakness has reemerged

Domestic factors

Both the RBI and GOI have adopted several growth-stimulating measures over the past few quarters, which should now begin to yield results, with risks evenly balanced depending on the magnitude of slowdown in global growth. The GOI, on its part, had earlier provided a budgetary stimulus of Rs 1 lakh crores through personal income tax foregone, which, coupled with GST benefits, is expected to encourage consumption. A well-distributed and normal monsoon rainfall, multi-period high real rural wage growth, the advent of the festive season, and a lower base effect are additional growth drivers for H2FY26 and can help boost market sentiments going forward. Brent crude oil prices at around US$65/barrel are healthy for the economy. Even August CPI inflation of 2.1% is benign. S&P’s upgrade of India’s sovereign credit rating to investment grade (from BBB- to BBB)—the first upgrade in 18 years and the highest S&P rating received in the past 35 years rekindles sentiments in Indian Market. We expect real GDP to growth at 6.5% each for FY26, FY27 and FY28

We are cautiously bullish on India for Samvat 2082

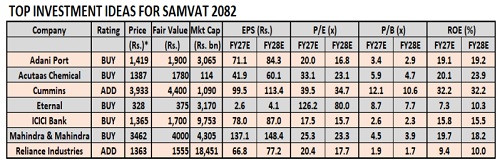

We expect (1) some stability in earnings after large downgrades over the past 12-15 months and (2) strong growth in earnings in FY27 (18% for the Nifty- 50 Index). We note a moderation in the pace of EPS downgrades over the past few months, although Q2FY26 may see some more downgrades, given the prevailing weak demand environment. We expect earnings growth to be fairly broad-based for FY27, which gives us confidence about our earnings estimates. Of course, global events can still derail the earnings recovery story. We expect (1) stabilizing earnings, (2) strong growth in earnings of 17.6% in FY27 to Rs 1297 and of 14.3% in FY28 to Rs 1487 and (3) a steady macro to provide a ‘high’ floor to the market but (1) rich valuations across sectors and stocks and (2) global headwinds to act as a ‘low’ ceiling to the market. The market may offer modest returns over the next 12-15 months with growth in earnings being partly offset by lower multiples. Based on our assessment of markets, sectors and stocks, we have identified 7 potential stock ideas which are expected to do well in Samvat 2082. Happy Investing!

Adani Port and SEZ (ADSEZ) TP – Rs 1900 Rating - BUY

* We take note of the strong pace of the value addition by ADSEZ

* We anticipate strong volume growth in two-thirds of ADSEZ’s port portfolio.

* East Coast ports poised for strong growth and capex boost.

* Dominant share of volume comes from containers & strong growth trajectory.

* We estimate a Rs11400 cr topline and Rs2800 cr EBITDA in FY29.

* We value ADSEZ using DCF and SoTP based methodology.

Acutaas Chemical (ACUTAAS) TP – Rs 1780 Rating - BUY

* Fast-growing producer of pharma intermediates & specialty chemicals.

* Sharp margin expansion owing to process improvements & favorable mix.

* Reiterated guidance for 25% revenue growth with improved margins.

* Three CDMO project in discussion, to contribute from Q4FY26.

* Well-placed to deliver strong expansion in margins for 2nd successive year.

* Growth outlook strong, good visibility in pharma, electrolyte, semiconductor.

Cummins India (KKC) TP – Rs 4400 Rating - ADD

* KKC has penetrated new markets and raised its new offerings in FY25.

* KKC has meaningful scope for growing its distribution business over time.

* Majority of end-user segments in powergen are on a strong growth trajectory.

* Expect KKC to be well-placed to sustain/grow its current 20%+ margin profile.

* We assume 14-15% CAGR in revenue/EBITDA/PAT over FY26-28.

* We value 40X Sept’ 26E EPS & modest 1X additional multiple for BESS.

Eternal TP – Rs 375 Rating - BUY

* In Food, Gross merchandise value share (~57%) vs. Swiggy (~43%) in FY25.

* Has a wide geographical presence in 750 cities vs 660 cities (Swiggy).

* We believe Blinkit’s take rate has room for expansion.

* Higher proportion of older stores should drive operating leverage.

* We expect Blinkit to achieve EBITDA breakeven in H2FY26.

* Expect to deliver a CAGR consolidated revenue of 83% over FY25-28E.

ICICI Bank (ICICIBC) TP – Rs 1700 Rating - BUY

* Return on Equity (RoE) at 18% is among the best in the industry.

* Strong PBT performance across each business segment .

* Asset quality metrics showed no stress visible in the unsecured loan portfolio.

* Loan growth is broad-based and granular.

* Capital market-related subsidiaries had another strong year.

Mahindra & Mahindra TP – Rs 4000 Rating - BUY

* M&M executes well by maintaining a leadership position in all 3 segments.

* We expect the tractor segment’s volume growth momentum to continue.

* Co. expects SUV segment volumes to grow by mid-high teens yoy in FY26E.

* We expect LCV segment demand momentum to pick up.

• We expect profitability to improve in LCV and tractor segments.

Reliance Industries (RELIANCE) TP – Rs 1555 Rating - ADD

* RIL’s telecom business IPO by H1CY26.

* Target to double EBITDA between FY22 and FY27E (Rs.2,11,100 cr).

* Organized retail: 20%+ revenue CAGR over the next three years.

* FMCG business: 5-year ambition of Rs1 lakh cr revenue (Rs11,500 cr in FY25) & a long-term ambition of being India’s largest FMCG company with a global presence.

* With an aim to transform into a deep-tech enterprise, it has announced a new JV with Meta and has expanded its partnership with Google Cloud.

* Sum-of-the-parts-based fair value of Rs1,555.

RATING SCALE (PRIVATE CLIENT GROUP)

Definitions of ratings

BUY – We expect the stock to deliver more than 15% returns over the next 12 months

ADD – We expect the stock to deliver 5% - 15% returns over the next 12 months

REDUCE – We expect the stock to deliver -5% - +5% returns over the next 12 months

SELL – We expect the stock to deliver < -5% returns over the next 12 months

The report has been prepared for information purposes only.

SUBSCRIBE – We advise investor to subscribe to the IPO.

RS – Rating Suspended. Kotak Securities has suspended the investment rating and price target for this stock, either because there is not a sufficient fundamental basis for determining, or there are legal, regulatory or policy constraints around publishing, an investment rating or target. The previous investment rating and price target, if any, are no longer in effect for this stock and should not be relied upon.

NA – Not Available or Not Applicable. The information is not available for display or is not applicable

NM – Not Meaningful. The information is not meaningful and is therefore excluded.

NOTE – Our target prices are with a 12-month perspective. Returns stated in the rating scale are our internal benchmark.

Please refer disclaimer at https://www.kotaksecurities.com/disclaimer

SEBI Registration No. INZ000200137