Diwali Muhurat Picks Samvat 2082 by Ashika Institutional Equities

Punjab National Bank Ltd

RECO: Rs. 115 | TARGET: Rs. 140

* Punjab National Bank (PNB), India’s second-largest public sector bank, offers a diversified portfolio across retail, agriculture, MSME, corporate, and international segments. With a robust branch network, established customer base, and strong focus on digital transformation, the bank continues to drive financial inclusion and strengthen customer engagement across individual and institutional clients.

* PNB is strategically rebalancing its portfolio toward the Retail, Agriculture, and MSME (RAM) segments, targeting a mix of 57–59%. The bank is emphasizing higher-yield, cash-flow–based MSME lending and digital onboarding while phasing out low-yield IBPCs. Concurrently, it is reducing high-cost CDs and enhancing granular retail deposits to boost yield and ensure sustainable growth.

* PNB demonstrated robust operational performance in Q2FY26, reflecting growth across both domestic and international operations. On a YoY basis, global business expanded 10.6% to Rs 27.88 lakh crore, driven by a 10.9% rise in deposits (Rs 16.17 lakh crore) and a 10.3% increase in advances (Rs 11.71 lakh crore). Domestic business mirrored this trend, with total business up 10.5% YoY, supported by double-digit growth in both deposits and lending. Sequentially, global business grew 2.5% QoQ, led by a 3.6% increase in advances versus a 1.7% rise in deposits, while domestic credit-deposit ratios strengthened moderately, highlighting improved credit deployment and fund utilization.

* Core MSME growth remains strong at ~19% YoY, with digital platforms supporting faster processing, better risk management, and improved customer experience, keeping NPAs at ~1%. PNB has implemented a bank-wide outreach program, with top management including MD and EDs actively engaging with regional centers to generate quality leads. These leads are centralized, processed efficiently, and sanctioned promptly, enhancing turnaround times and deepening market penetration. Similar initiatives in retail and agriculture lending are expected to further strengthen PNB’s competitive positioning in RAM and enhance its long-term growth potential.

* The bank has also improved asset quality, reducing GNPA to 3.78% as of June 2025 from 4.98% in June 2024 and 3.95% in March 2025. Net NPA has declined from 0.60% in June 2024 to 0.38% in June 2025. Management remains confident of achieving GNPA and net NPA targets for FY26 of below 3% and 0.35%, respectively. The provision coverage ratio stands at 96.88% as of June 2025, above the FY26 guidance of 96%, reflecting robust risk management and proactive provisioning.

* Additionally, PNB holds a 23% stake in Canara HSBC Life and plans to divest around 10% of this holding, expected to generate gains of Rs. 9–10 billion. Liquidity will also benefit from an additional Rs. 150 billion resulting from recent CRR cuts, providing additional flexibility for lending growth and strategic investments. •At the CMP, the scrip is valued at P/BV multiple of 0.9x on FY27E BVPS.

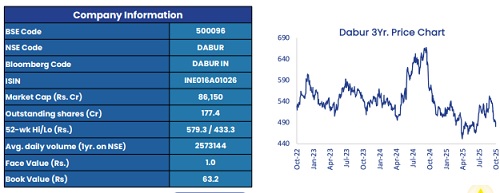

Dabur India Ltd.

RECO: Rs. 483 | TARGET: Rs. 580

* Dabur India Ltd., one of India’s leading FMCG companies, has built a legacy of trust and quality over 141 years. Reaching 8.5 million retail outlets, Dabur stands as the third most distributed FMCG brand in the country, with eight out of ten Indian households using at least one Dabur product. Its diverse portfolio includes three Rs. 1,000-crore brands—Dabur Amla, Dabur Red Toothpaste, and Real—alongside three Rs. 500-crore brands and sixteen brands in the Rs. 100–500 crore range. This wide product mix across personal care, healthcare, and beverages underscores Dabur’s deep consumer connect and strong brand equity across urban and rural India.

* The recent GST rate rationalisation, reducing most FMCG products from 12–18% to 5%, has given a significant boost to Dabur India. Nearly 85% of its portfolio, including hair oils, oral care, health supplements, and beverages, now falls under the lower 5% slab. This reduction has improved affordability, spurring higher demand, especially in pricesensitive rural and semi-urban markets. As a result, Dabur is witnessing stronger sales volumes and deeper market penetration, enhancing its competitive strength in the FMCG sector.

* Although the company experienced temporary disruptions during the transition, including inventory adjustments and short-term sales impact, the long-term benefits of GST remain highly positive. The lower tax structure has enhanced Dabur’s pricing flexibility and supported sustained growth through greater affordability, volume expansion, and wider reach across key product categories.

* In its Q2FY26 business update, Dabur expects consolidated revenue growth in the mid-single digits, with operating profit rising nearly in line. Category-wise, the oral care segment (Red Toothpaste, Meswak) is projected to deliver double-digit growth, while skincare (Gulabari, Oxy) and shampoos are expected to post high single-digit growth. Hair oils are likely to see mid-single-digit growth. The beverages portfolio, especially the premium “Activ” range, is anticipated to grow over 30%, offsetting weather-related pressures on overall beverage sales caused by heavy rains and flooding in July–August. E-commerce, including quick commerce, continues to expand in double digits, while modern trade remains steady.

* Internationally, Dabur expects robust performance from MENA, Turkey, and Bangladesh, though operations in Nepal remain subdued due to political unrest. The company’s inventory is now optimised, with correction largely complete, positioning it for sustained growth ahead. Looking forward, softening food inflation, a favourable monsoon, and improving urban and rural demand are expected to drive recovery. With its balanced portfolio, deep rural presence, and GST-led consumption boost, Dabur is well-placed to enhance profitability, strengthen return ratios, and maintain leadership in the Indian FMCG landscape.

* At the CMP, the scrip is valued at P/E multiple of 39.7x on FY27E EPS.

Aditya Birla Lifestyle Brands Ltd.

RECO: Rs. 140 | TARGET: Rs. 175

* Aditya Birla Lifestyle Brands ltd. (ABLBL), demerged from Aditya Birla Fashion and Retail in May 2025, carries forward the strong cash-generating legacy businesses of Louis Philippe, Van Heusen, Allen Solly, and Peter England, along with emerging brands like Van Heusen Innerwear, Reebok, and American Eagle.

* Over time, ABLBL has strengthened its presence in the casualwear segment, which now contributes over 50% to individual brand revenues—marking a shift from its earlier focus on formal and wedding wear. Additionally, Van Heusen and Allen Solly are expanding their offerings across women’s, kids’, winter, and innerwear categories to enhance store productivity. Despite a subdued demand environment, the overall brand portfolio continues to record encouraging double-digit like-to-like (LTL) growth.

* Store expansion remains a key lever, with plans to add 250 net stores annually to reach 4,500 stores and 7.3 mn sq. ft. by FY30.

* Company’s 40% of stores are now omni-enabled, thus ensuring a relatively better consumer experience. Going forward, ABLBL plans to invest around Rs 250 crore annually in new store openings, refurbishments, and selective capacity enhancements. Of the total planned expansion, 30–40% is expected to come from smaller towns, as the company aims to strengthen its presence and introduce more brands to Tier 2 and Tier 3 markets

* Company has also invested in new age portfolios like innerwear, sports (Reebok), and youth jeans wear in order to capture a higher share of consumer wallet.

* Despite sluggish consumption environment during 1QFY26, ABLBL has delivered double digit LTL retail growth across its Lifestyle brands portfolio, aided by strong brand recall, widespread network, and improved retail execution. Further, company aims to deliver early double-digit growth in Lifestyle brands through retail network expansion and robust LTL growth, while Emerging brands are likely to see higher ~18-20% growth on a relatively lower base. The 2HFY26 is expected to be better for the company due to festive demand and reduction in GST rate.

* The management targets doubling the company’s scale by FY30 while achieving EBITDA margins above 11%, supported by stronger full-price sales in the core portfolio, mid-single-digit SSSG, an increasing retail channel mix, and emerging brands reaching positive unit economics.

* The company also aims to become debt-free within 2–3 years, ensuring a robust balance sheet. The demerger provides sharper operational focus and more disciplined capital allocation, enabling free cash flow to be directed toward high-growth initiatives for accelerated expansion and margin improvement.

* At the CMP, the scrip is valued at EV/EBITDA multiple of 11.7x on FY27E EBITDA

Standard Glass Lining Technology Ltd.

RECO: Rs. 177 | TARGET: Rs. 220

* Incorporated in 2012, Standard Glass Lining Technology Ltd. (SGLTL) has evolved into one of India’s top five specialized engineering equipment manufacturers for pharmaceutical and chemical sectors. Its comprehensive capabilities across design, manufacturing, installation, and commissioning, coupled with over 65 proprietary designs and more than 11,000 units delivered, underscore its engineering depth and execution strength.

* The company’s domestic launch of Shell & Tube Glass Lined Heat Exchangers a proprietary technology licensed from AG Japan marks a key inflection. SGLTL is the only Indian company with this technology, which addresses corrosion, particle contamination, and compliance challenges in high-purity pharma and specialty chemical environments. By replacing outdated graphite exchangers, this innovation positions SGLTL as a frontrunner in next-generation process solutions. Full-scale assembly in India will begin by January 2026 with a target of ~300 units per month by June 2026. The company has already secured 250 orders and installed the first unit at SRF’s Dahej plant. With a domestic replacement market of ~Rs. 2,000 crore annually and low royalty outgo (4% domestic / 7% international), management expects this segment to be margin-accretive as localization progresses.

* SGLTL’s international strategy is gaining traction through two initiatives. Its partnership with BioCon Solutions Pte Ltd, Singapore, provides market access across Indonesia, Malaysia, Thailand, and Singapore, while the incorporation of Standard Engineering Inc. in South Carolina supports U.S. and European markets through distributor IPP.

* Export revenue, at 4% of sales in Q1FY26, is projected to rise to 12–15% by FY26-end, with a 10year aspiration of a 40:60 export-domestic mix. Export EBITDA margins (~25%) exceed domestic levels, supporting blended margin expansion.

* SGLTL is executing a Rs. 130 crore greenfield expansion over the next 18–24 months to enhance scale and technical capabilities. The upcoming 550,000 sq. ft. facility on 36 acres will feature 100-ton crane capacity and 100mm fabrication thickness, enabling entry into higher-value petrochemical and heavy engineering verticals. Alongside, the company is intensifying automation across existing plants, increasing welding robots from seven to over forty to achieve threefold capacity expansion. The newly commissioned 100,000 sq. ft. Unit 5, currently at 60% utilization will also see further automation to improve efficiency.

* SGLTL maintains long-standing relationships with nearly 90% of India’s leading Contract Development and Manufacturing Organizations (CDMOs) and top 25 pharma clients. With ongoing capex across pharma and biotech, the company’s broad equipment portfolio positions it as a one-stop solution provider for end-to-end process requirements. This strong positioning ensures recurring business, with the growing CDMO sector driving future growth.

* At the CMP, the scrip is valued at a P/E multiple of 31.4x on FY27E EPS.

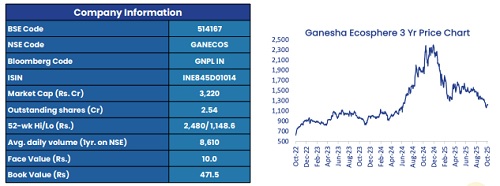

Ganesha Ecosphere Ltd.

RECO: Rs. 1213 | TARGET: Rs. 1490

* Ganesha Ecosphere Ltd (GESL) is among India’s leading PET bottle recyclers, holding the largest FSSAI-approved rPET (recycled polyethylene terephthalate) granule capacity as of FY25. The company specializes in converting used PET bottles into high value-added products such as Recycled Polyester Staple Fibre (rPSF), Recycled Polyester Spun Yarn (rPSY), Dyed Textured Yarn (DTY), and premium offerings including Recycled Filament Yarn and rPET B2B granules/chips.

* Company operates through 6 manufacturing units with a combined capacity of around 196,440 TPA (tonne per annum), which includes 12,280 TPA of Recycled Filament Yarn and 42,000 TPA of rPET B2B chips/granules.

* Company recycle around 8.5 billion scrap bottles annually as of FY25.

* With over three decades of industry experience, GESL has built a diverse portfolio of 500+ product variants, catering to more than 400 customers across 20 countries. As part of its growth strategy, the company aims to triple its rPET granule capacity from 42,000 TPA to 132,000 TPA by H1FY27, while increasing the share of value-added products from 40% in FY25 to 60–65% by FY27.

* Ganesha is undertaking an Rs 600 crore greenfield expansion in Odisha to establish a 67.5 KTPA rPET granule (B2B chips) facility, which targeted to complete by H1FY27. In addition, a 22.5 KTPA brownfield expansion at Warangal, with a capital outlay of Rs 130 crore, is expected to be commissioned by December 2025. Upon completion of these projects, the company’s total B2B chip capacity will reach 132,000 tonne. Over the long term, Ganesha aims to capture around 30% of the ~1 million tonne market.

* The recent EPR (Extended Producer Responsibility) norms which mandate company brand owners to compulsorily use recycled material for producing PET bottles will benefit Ganesha as it should enhance the demand of rPET B2B chips because it will mandate bottle manufacturers to use rPET scrap to produce bottles. •Furthermore, early signs of demand recovery are evident in B2B granules segment, with a notable pickup in orders for September and October 2025. Supportive regulations, easing raw material prices, emerging demand momentum, and the successful ramp-up of the South India plant are all expected to strengthen Ganesha’s growth trajectory.

* The B2B chip industry is currently facing a capacity shortfall, hence the pricing is expected to be stable in coming time. Further, Ganesha has targeted to gain 30% market share in food grade B2B chips by FY30.

* At the CMP, the scrip is valued at P/E multiple of 20.5x on FY27E EPS.

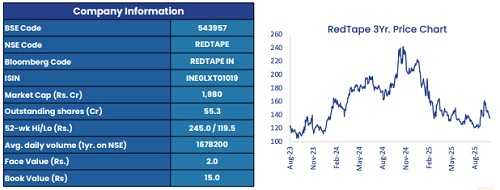

RedTape Ltd.

RECO: Rs. 133 | TARGET: Rs. 165

* RedTape Ltd. is a leading Indian fashion and lifestyle brand known for its strong presence in footwear, garments, and accessories. With over 26 years of expertise in footwear and 15 years in garments, the company operates through two major verticals supported by a network of nearly 600 retail stores, of which ~70% are Exclusive Brand Outlets.

* RedTape’s Unnao manufacturing unit contributes around 25% of total production, while the remaining 75% is sourced through contract manufacturing, primarily from Bangladesh. The brand also enjoys a global footprint, with operations in 17 countries, reinforcing its international recognition and credibility. Positioned as an affordable, high-quality fashion brand, RedTape continues to strengthen its market presence through digital expansion, omnichannel strategies, and effective brand differentiation in India’s competitive fashion sector.

* The implementation of GST has had a favorable structural impact on RedTape’s operations. Footwear priced above Rs. 1,000 now attracts 18% GST compared to the pre-GST rate of 26–28%, while products below Rs. 1,000 are taxed at 12% instead of 20–22%. Apparel, too, benefits from a lower 5–12% rate. Consequently, RedTape’s operating margins have expanded by roughly 150–200 basis points, while logistics costs have declined by 10–12% due to warehouse consolidation and more efficient inter-state movement of goods. These reforms have significantly boosted the company’s profitability and operational efficiency

* The brand’s value proposition—combining quality, affordability, and style—has deeply resonated with India’s growing middle-class and youth demographics. RedTape’s commitment to innovation, trend-focused design, and consistent quality has helped it stay ahead in a dynamic retail landscape. Strategic marketing efforts, including celebrity endorsements, influencer collaborations, and digital campaigns, have enhanced brand recall and customer loyalty.

* RedTape’s rapid digital transformation has been another key growth pillar. By leveraging its own website and partnering with e-commerce giants like Amazon, Flipkart, Myntra, and Ajio, the brand has achieved wider reach and improved accessibility. Focused investments in digital platforms, exclusive online collections, and advanced logistics have fueled strong e-commerce revenue growth. The company has also implemented SAP HANA and integrated Easycom software to optimize order management, inventory synchronization, and real-time analytics.

* Supported by strong fundamentals, efficient sourcing, and a balanced domestic-international presence, RedTape is well-positioned for sustained growth. Its asset-light model, innovation-driven strategy, and digital integration are expected to drive continued margin expansion amid India’s rapidly evolving retail landscape.

* At the CMP, the scrip is valued at P/E multiple of 37.1x on FY27E EPS

Above views are of the author and not of the website kindly read disclaimer