Daily Derivatives Report By Axis Securities Ltd

The Day That Was:

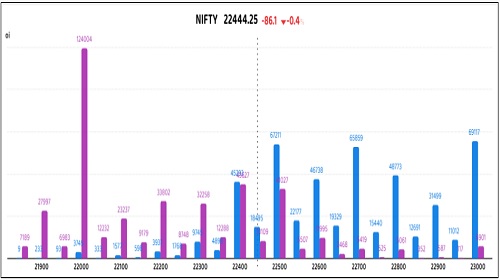

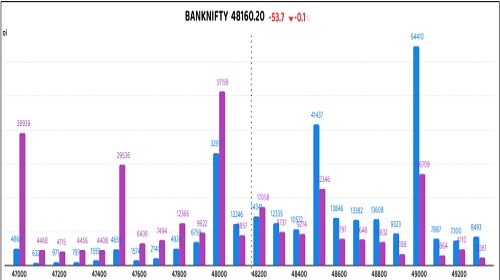

Nifty Futures: 22,444.25 (-0.4%), Bank Nifty Futures: 48,160.2 (-0.1%).

Nifty futures fell 86 points on Thursday, despite strong industrial production and easing retail inflation, concluding a volatile, holiday-shortened week with a nearly 1% loss. Initially buoyed by positive global sentiment, the session succumbed to broad-based selling pressure, erasing intraday gains and settling near session lows. Weekly index option expiry amplified volatility, triggering significant sell-offs across most sectors, notably realty, auto, and metals. Global trade war anxieties, impacting the US economic outlook, weighed heavily on IT heavyweights, contributing to the benchmark's sustained downward trajectory. Bank Nifty futures demonstrated relative resilience, registering a comparatively modest 54-point drop. Nifty futures premium contracted from 60 to 47 points, while Bank Nifty premium narrowed from 157 to 100 points.

Global Movers:

US stocks recovered on Friday after dropping into an official correction as the risk of a government shutdown faded. The S&P 500 rose 2.1%, its best-such day since November, while the Nasdaq 100 and the Dow rose 2.5% and 1.7% respectively. Meanwhile, incoming data showed that consumer spending fell to a two-year low while inflation expectations jumped, as tariff-related uncertainty made the economic outlook increasingly unclear. Even with Friday's jump though, the S&P finished down for the fourth week, the longest such streak of declines in seven months. In markets, the VIX finished below 22, the dollar fell a little while the 10-year yield rose, bitcoin rallied nearly 5%, Gold climbed past $3K for the first time in history and oil continued its sideways churn above $65.

Stock Futures:

A noticeable surge in trading volumes on Thursday reflected heightened market participation in DMART, CAMS, PB Fintech Ltd., and Bharat Forge. This increase in volume suggests amplified investor interest and substantial momentum in these stocks.

Avenue Supermarts (DMART) witnessed a robust 3.2% price appreciation, culminating in a monthly peak close and exhibiting the month's highest single-day volume, marking two consecutive weeks of upward price movement. This surge was catalysed by the release of February's retail inflation data, which registered a seven-month low of 3.61%, falling below the RBI's 4% target for the first time since August 2024, driven by decelerating food price inflation. However, the rally's foundation was primarily rooted in a significant short covering, evidenced by a negligible 0.4% reduction in open interest (19,800 shares) despite the substantial price gain. This divergence signals a limited conviction in sustained bullish momentum and a potential for a swift reversal in the sentiment.

Computer Age Management Services (CAMS) experienced a significant 2.3% price appreciation, achieving the month's peak single-day trading volume and surpassing the previous session's high. This upward trajectory occurred despite a prior decline in CAMS and other capital market firms following a 26% contraction in February's equity mutual fund inflows. Notably, the rally was reinforced by a substantial 35.5% increase in open interest, marking a series high for single-day open interest gains. This surge in open interest indicates the establishment of new long positions, driving total futures open interest to a series high and reflecting a strong, short-term bullish sentiment towards the stock.

PB Fintech Ltd. faced a steep 5.5% decline, hitting a nine-month low and closing at a series low, extending losses for the second consecutive session. This downturn was primarily precipitated by the company's announcement of a substantial Rs 696 crore investment in its subsidiary, PB Healthcare Services Private Limited, aimed at operational expansion. Notably, this bearish trend was reinforced by firm conviction among traders, as evidenced by futures open interest reaching a two-series high. Coupled with a 10% price drop from the series peak, the elevated open interest strongly signals a prevailing bearish sentiment and suggests the potential for further price depreciation.

Bharat Forge experienced a sharp 5% price decline, its most significant single-day loss since early August 2024, triggered by the US EPA's announcement of a potential rollback of vehicle emission standards. Bharat Forge's expectation of a pre-buy surge in US commercial vehicle emissions in the latter half of the year may not occur if the announced rollback is enacted. Concurrently, a 3.6% increase in open interest, representing 5.2 lakh shares, signaled a substantial short build-up. This confluence of a series-high single-day price fall and a significant rise in short positions underscores a strong bearish sentiment, forecasting potential further downward price trajectory.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR)fell to 1.02 from 1.09 points, while the Bank Nifty PCR fell from 0.98 to 0.94 points.

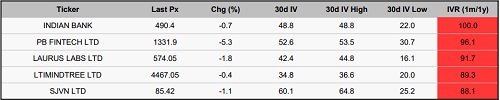

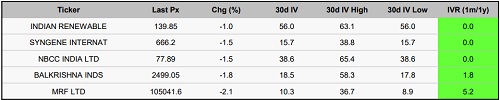

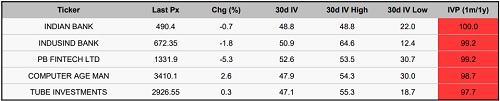

Implied Volatility:

Indian Bank and PB Fintech Ltd have witnessed considerable price fluctuations, illustrated by their peak implied volatility rankings of 100 and 96 respectively. Indian Bank's implied volatility is at 49% and PB Fintech's at 53%, indicating that the increase in implied volatility makes options for these stocks costly, which could lead traders to adopt hedging strategies to mitigate risks associated with price movements. On the other hand, IREDA and Syngene International have registered the lowest implied volatility rankings, with IVs of 56% and 16%, respectively. This suggests that their options are more attractive, presenting a favorable opportunity for traders aiming to establish long positions.

Options volume and Open Interest highlights:

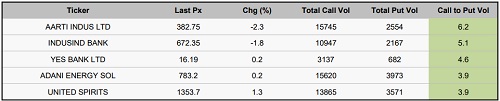

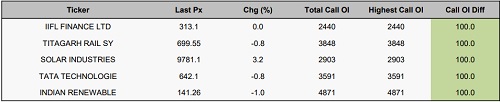

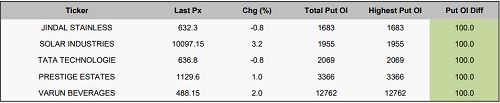

IndusInd Bank and Aarti Industries are attracting significant attention from traders, as indicated by their call-to-put volume ratios of 6:1 and 5:1, respectively, which suggest bullish sentiment. However, these ratios may also reflect differing perspectives among investors. In contrast, Mahanagar Gas and Balkrishna Industries are experiencing an increase in put option volumes compared to calls, each showing a 2:1 ratio, which signals heightened caution regarding possible declines. In terms of positioning, IIFL Finance and Titagarh Rail Systems are experiencing the highest open interest in call options, while Jindal Stainless and Solar Industries India are at the forefront on the put side, indicating a greater probability of price fluctuations. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

A notable decline of 4,601 contracts was recorded in index futures, primarily attributed to a decrease of 4,048 contracts by clients, indicating a bearish outlook among retail investors. In parallel, Foreign Institutional Investors (FIIs) experienced a slight reduction of 553 contracts, underscoring a shrinking risk appetite. On the other hand, proprietary traders, taking a contrarian approach, increased their holdings by 993 contracts, suggesting a selective bullish perspective within this group. Turning to stock futures, a significant change of 39,408 contracts was noted, driven by clients' marked expansion of 12,820 contracts, reflecting optimism in specific stocks. However, this was offset by a substantial unwinding of 36,634 contracts by FIIs, highlighting a strong bearish sentiment on individual equities. Additionally, proprietary traders further contributed to this negative trend by decreasing their positions by 2,774 contracts.

Securities in Ban for Trade Date 17-March-2025:

1) BSE

2) HINDCOPPER

3) INDUSINDBK

4) MANAPPURAM

5) SAIL

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

Stocks With High Call Volume To Put Volume

Stocks With High Put Volume To Call Volume

Call Open Interest Relative to Record High

Put Open Interest Relative to Record High

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

India VIX increased by 0.40% to close at 14.96 touching an intraday high of 15.47 - Nirmal...