Weekly Derivatives Insights - Axis Securities

NIFTY HIGHLIGHTS

* Nifty futures closed at 22917.65 on Friday, down 5.7% in open interest and 0.2% (40.5 points), signaling long unwinding.

* India Vix, has increased to 20.11% from 13.76% up by 46.1%.

* Bank Nifty futures closed at 51002.35, with a 4.9% drop in open interest and a 0.8% price decline (431.5 points), indicating long unwinding.

* Total open interest in Nifty futures is 1,56,96,000, up from 1,56,94,275 last week, while Bank Nifty is at 28,15,590, increased from 27,25,170.

* The Long-Short Ratio for FIIs in index futures fell from 0.41 to 0.34 due to a reduction in long positions and an uptick in short positions. This increase in shorts indicates a more cautious stance with heightened bearish expectations.

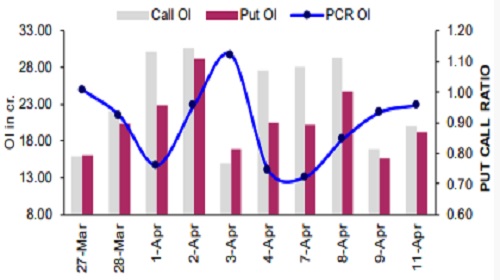

Nifty PCR OI

* During the week, the PCR OI reached a high of 0.96 and a low of 0.72, closing at 0.96, UP from last week's 0.74.

* The Put-Call Ratio (PCR) stands at 0.96, below the neutral level of 1. This indicates that call option holders slightly outnumber put option holders, which may suggest a cautiously optimistic outlook for the Nifty in the upcoming week.

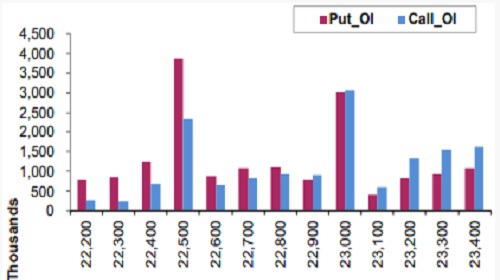

Open Interest Analysis

* According to the current expiry, Options built up indicate that Nifty has strong support at 22,000 and 22,500 and resistance at 23,000 and 23,500.

* The monthly options data reveals significant open interest in Call options at the 23,000 and 23,500 strike prices. In contrast, put options display the most open interest at the 22,500 strike, followed by the 23,500 level. Nifty's projected weekly range is expected to be between 22,500 and 23,500.

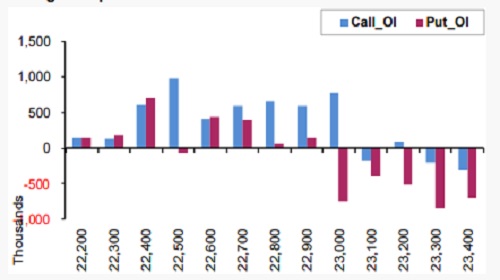

Change in Open Interest

* This week's major monthly expiry addition was seen on the Call front in 22,000, 23,000, and 22,500 strikes, adding 16.9 Lc, 7.8 Lc, and 9.9 Lc shares in OI, respectively, while there was significant unwinding seen at 23,800 and 23,700 any strike.

* This week's significant monthly expiry addition was seen on the Put front in the 23,500, 22,500, and 23,000 strikes, adding 38.9 Lc, 38.6 Lc, and 37.5 Lc shares in OI, respectively, while there was unwinding witnessed at 22,400 & 21,800 strike.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Market Strategy Note 2026 by Geojit Investments Ltd

.jpg)