Daily Derivatives Report By Axis Securities Ltd

The Day That Was:

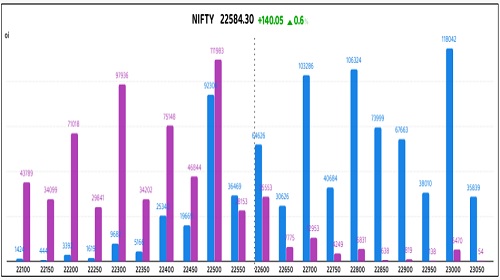

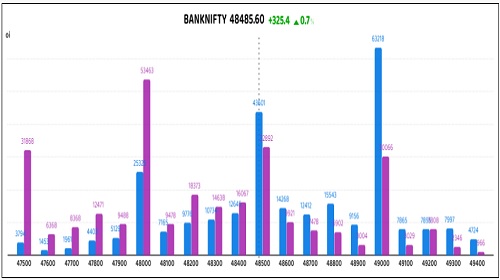

Nifty Futures: 22,584.3 (0.6%), Bank Nifty Futures: 48,485.6 (0.7%).

Nifty futures rebounded, adding 140 points, fueled by a global equity rally and robust accumulation seen in the banking sector. Domestic indices followed suit, registering marginal gains as US government shutdown concerns subsided and markets braced for the Federal Reserve's policy decision. The Nifty closed positively, with pharmaceutical and healthcare sectors exhibiting notable strength, though profit-taking limited further upside. Concurrently, India's wholesale price index (WPI) inflation escalated to 2.38% in February 2025, driven by increased manufactured food and textile prices; the reading was up from 2.31% in January, signalling persistent inflationary pressures. Bank Nifty futures surged by 325 points. Nifty futures premium expanded to 76 from 47 points, and that on the Bank Nifty increased from 100 to 131 points.

Global Movers:

US equities rallied for a second day, with the S&P 500 rising 0.6%, while the Nasdaq 100 and the Dow gained 0.5% and 0.9%, respectively. 90% of the S&P members rose, even as most big tech names fell. The advance was fueled by retail sales data which rose less than expected, but wasn't as bad as the January 1.2% decline - that reassured investors that consumers continue to spend although the pace may have reduced somewhat. In markets, the VIX finished ended below 21, the dollar and the US 10-year trsy yield fell a little, bitcoin held above $80K for the fourth day in a row, Gold closed above $3000/ounce for the first time in its history and oil prices held their gains around $67 with the outlook for China's economy in focus.

Stock Futures:

Yesterday's sharp increase in trading volumes indicates heightened market engagement with Muthoot Finance, PB Fintech Ltd, Bajaj Finserv, and the Indian Energy Exchange. This surge in volume reflects significant investor interest and considerable momentum for these stocks.

Muthoot Finance experienced a notable 4.8% price jump, attaining a monthly high close and recording the month's peak single-day volume. This rally was triggered by the company's announcement of its gold loan AUM surpassing ?1 trillion on March 13, 2025, driven by heightened gold loan demand amid constrained credit availability. The 5.5% increase in open interest, representing 1.83 lakh additional shares, supported yesterday's price surge, indicating strong market confidence in the stock's sustained upward trajectory and potential for further appreciation from a short-term perspective.

Bajaj Finserv's stock surged by 3.9%, accompanied by record single-day trading volume in the last two months and closed above the prior three-session highs. This rally appears to be driven by the company's post-market announcement of acquiring Allianz's 26% stake in its life and general insurance ventures, thus securing full ownership. Reinforcing this bullish momentum, open interest witnessed a significant 11.5% increase, a series high for single-day gains. This substantial rise in open interest, coupled with the surge in trading volume, signifies the creation of new long positions and pushed total futures open interest to a two-series peak, underscoring a strong, immediate bullish outlook for the stock.

PB Fintech Ltd. rebounded with a 2.7% price increase, recovering from a nine-month low and reversing a two-session decline despite its ?696 crore investment in PB Healthcare Services. This recovery was underpinned by a significant long build-up in yesterday's session, with futures open interest reaching a two-series high. Adding 9 lakh shares, representing a 14% surge in open interest, indicates traders' firm conviction and potential for further price appreciation driven by short sellers getting squeezed. This substantial increase in open interest, coupled with the price rebound, reflects a shift in market sentiment, signalling a possible reversal of the prior bearish trend.

Indian Energy Exchange (IEX) witnessed a significant 5.9% price surge, marking its largest single-day gain in two months. This rally was fueled by a brokerage report detailing a 6.6% year-on-year increase in India's power demand for February 2025, reaching 131 billion units, attributed to temperature fluctuations and heightened industrial activity. Despite the price increase, open interest fell by 0.9%, indicating the unwinding of 4 lakh shares, which suggests a dynamic of short covering rather than an accumulation of new long positions. A sharp price increase and reduced open interest strongly indicate that existing short positions were closed, driving higher prices.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 1.05 from 1.02 points (the prior day's reading does not account for expired contracts), while the Bank Nifty PCR rose from 0.94 to 1.03 points.

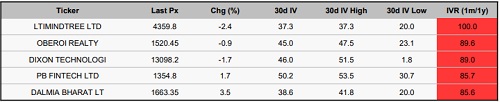

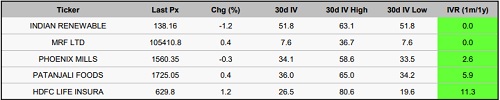

Implied Volatility:

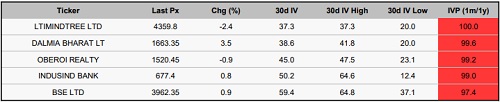

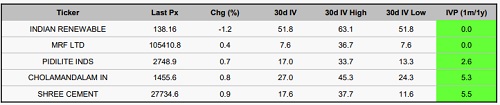

LTI Mindtree and Oberoi Realty have experienced significant price changes, evidenced by their high implied volatility rankings of 100 and 90, respectively. LTI Mindtree shows an implied volatility of 37%, while Oberoi Realty's is at 45%. This rise in implied volatility increases the cost of options for these stocks, prompting traders to consider hedging strategies to manage risks tied to price fluctuations. In contrast, IREDA and Phoenix Mills have recorded the lowest implied volatility rankings, with 52% and 34% IVs, respectively. This indicates that their options are more appealing, offering a promising opportunity for traders looking to take long positions.

Options volume and Open Interest highlights:

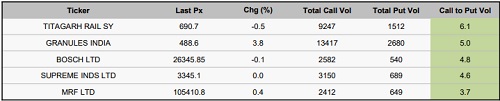

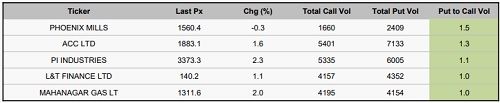

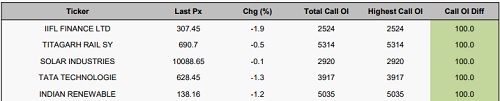

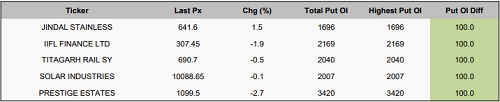

Titagarh Rail Systems and Granules India are drawing considerable interest from traders, evidenced by call-to-put volume ratios of 6:1 and 5:1, indicating bullish sentiment. Nonetheless, these ratios could also signify contra perspectives among investors. Conversely, Phoenix Mills and ACC Ltd are witnessing more put option volumes than calls, each showing a 2:1 ratio, reflecting increased caution about possible downturns. Regarding positioning, Solar Industries India, IIFL Finance, and Titagarh Rail Systems are seeing the highest open interest in both call and put options. Additionally, the Indian Renewable Energy Development Agency excels on the call side, and Prestige Estates leads on the put side, illustrating a greater likelihood of price volatility. (This data considers only those stock options that saw a minimum of 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In yesterday's session, a notable decline of 5,282 contracts suggested a potential decrease in index futures. Foreign Institutional Investors (FIIs) substantially boosted their long positions, increasing by 12,150 contracts, which indicates an optimistic outlook. In contrast, Proprietary traders decreased their holdings by 6,954 contracts, showcasing a pessimistic perspective. Regarding stock futures, an additional drop of 3,990 contracts in open interest pointed to a reduction in overall engagement. Nevertheless, FIIs displayed strong acquisition tendencies, adding 57,018 contracts, enhancing their favourable stock-specific view. On the other hand, Proprietary traders significantly reduced 27,192 contracts, emphasising their bearish outlook.

Securities in Ban for Trade Date 18-March-2025:

1) BSE

2) HINDCOPPER

3) INDUSINDBK

4) MANAPPURAM

5) SAIL

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

Stocks With High Call Volume To Put Volume

Stocks With High Put Volume To Call Volume

Call Open Interest Relative to Record High

Put Open Interest Relative to Record High

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633