Daily Derivatives Report 14th October 2025 by Axis Securities Ltd

The Day That Was:

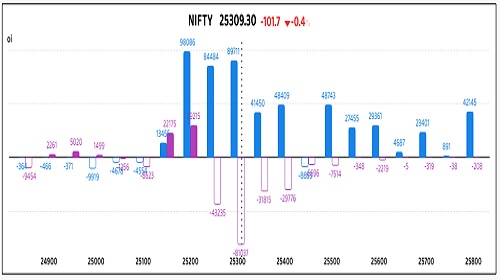

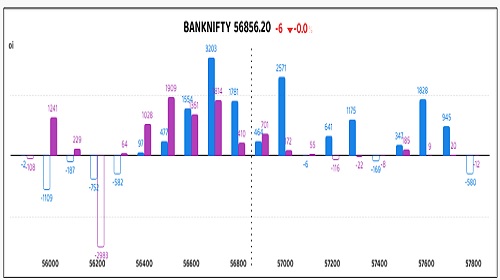

Nifty Futures: 25,309.3 (-0.4%), Bank Nifty Futures: 56,856.2 (0.0%).

Nifty Futures and Bank Nifty Futures closed lower on Monday, 13th October, 2025, primarily driven by heightened global risk aversion following renewed US-China trade tariff tensions, which led to a broad sell-off in risk assets globally and boosted safe-haven demand. Domestic equity benchmarks broke a two-day winning streak, exhibiting intraday weakness from the open before a slight recovery near the close, tracking negative global cues. Nifty Futures fell by 101.7 points, signalling a Short Build Up with an open interest increase of 0.4% to 189 Lc, an absolute increase of 79,200 shares. Simultaneously, Bank Nifty Futures also declined by 6.0 points, registering a Short Build Up as open interest rose by 1.0% to 19.9 Lc (19,90,590 shares), an increase of 20,440 shares. This defensive stance was further reflected in the futures segment as the Nifty futures premium decreased significantly from 126 to 82 points, and the Bank Nifty premium dropped from 252 to 231 points. Sectorally, global economic outlook-sensitive sectors like IT were among the day's laggards relative to the Nifty 50 decline, while certain heavyweights in the financial and public sector space, particularly in the Banking and Financial Services segments, displayed relative strength, providing some cushion to the Nifty Bank index. Furthermore, the market's expectation of near-term volatility, gauged by the India VIX, rallied sharply by 8.95% to close at 11.01, and the Rupee (USD-INR) traded with a weakening bias, closing near its previous session's level around Rs 88.66 per USD, narrowly avoiding an all-time low.

Global Movers:

US stocks rebounded yesterday, as US-China trade tensions eased. The S&P 500 finished closed 1.6% higher at 6655 in what was its best advance since May 27, while the Nasdaq 100 rallied 2.2%, its best day since late May. Sentiment was also boosted by Broadcom and OpenAI announcing an agreement, signalling that AI continues to be a dominant theme driving investor interest. In related markets, the VIX fell 12% and dropped under the 20 mark, while the dollar index rose. Spot gold surged 2.3% - its best such jump since June - to settle at $4110. This was another record high for the yellow metal, and came as ETFs continued to see inflows, with SocGen raising its 2026-end target price to $5000/ounce. Elsewhere, brent prices nearly a percent to end above $63 as the trade spat appeared to have been contained.

Stock Futures:

Kfin Technologies Ltd. (KFINTECH) surged 6.6% following its strategic $35 Mn infusion into its Singapore arm and the acquisition of a 51% stake in Ascent Fund Services, signalling aggressive expansion in fund administration. The rally was underpinned by Short Covering, as open interest contracted 1% with a shedding of 55 futures contracts, bringing total futures OI to 5,606. In the options arena, call positions rose sharply by 1,791 contracts to 4,108, while puts added 1,145 contracts to reach 2,875, driving the Put-Call Ratio (PCR) down to 0.70 from 0.75. The skewed build-up in calls relative to puts suggests bullish undertones, with option buyers positioning for continued upside amid declining PCR and reduced futures exposure.

L&T Finance Ltd. (LTF) advanced 4% after successfully raising Rs 1,050 Cr via Non-Convertible Debentures through private placement, reinforcing investor confidence in its capital access. The stock exhibited Long Addition, with futures open interest climbing 1.7% through an addition of 187 contracts, totalling 11,415. Options positioning reflected a balanced sentiment, with call OI rising by 322 contracts to 6,461 and put OI increasing by 588 contracts to 5,993, nudging the PCR up to 0.93 from 0.88. The proportional rise in both call and put interest, coupled with a higher PCR, indicates a cautiously optimistic stance among option participants, with writers likely hedging against further upside.

Kaynes Technology India Ltd. (KAYNES) tumbled 3.7% as regulatory headwinds emerged following a SEBI show-cause notice to its MD, triggering Short Addition and heightened selling pressure. Futures open interest jumped 5.4% with 737 new contracts, totalling 14,434, while the futures premium flipped to a steep discount of 196.5 points from a prior 63.5-point premium, marking a 260-point reversal. On the options front, call OI surged by 6,070 contracts to 21,901, far outpacing the 1,692-contract rise in puts to 9,480. The disproportionate buildup in calls amid price decline and rising futures OI signals aggressive bearish positioning by writers, with elevated call exposure reflecting expectations of sustained weakness.

Voltas Ltd. (VOLTAS) declined 3.1% as lingering concerns over Q1FY26 performance, high inventory levels, and margin compression in its cooling segment weighed on sentiment, prompting Short Addition. Futures open interest rose 2.6% with 880 new contracts, reaching 35,370, while the futures discount widened to 55.6 points from 8.4, a 47.2-point deterioration. In options, call OI expanded by 1,913 contracts to 8,862, whereas put OI contracted by 157 to 6,720. The sharp increase in call positions alongside falling prices and reduced put interest suggests bearish dominance by option writers, with the positioning reflecting expectations of continued downside pressure.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 1.05 from 1.32 points, while the Bank Nifty PCR fell from 1.14 to 1.13 points.

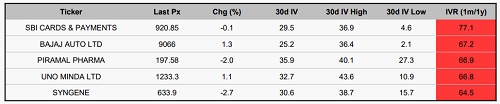

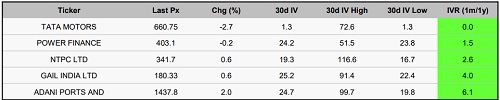

Implied Volatility:

Bajaj Auto (BAJAJ-AUTO) and SBI Cards & Payments (SBICARD) are exhibiting heightened volatility in the derivatives segment. This is evidenced by their elevated Implied Volatility (IV) Ranks of 77% and 67%, respectively. These high IV percentiles align with substantial Expected Volatility (EV) metrics 25% for Bajaj Auto and 30% for SBI Cards signalling significant market anticipation of price dispersion. The surge in volatility has resulted in a material expansion of option premiums, consequently increasing margin and capital requirements for executing both risk-hedging and directional strategies. Currently, options on these counters are capital-intensive, rendering them less viable for setups aiming for low-cost exposure. Conversely, PFC and NTPC are situated in a low-volatility regime relative to the broader F&O universe. Their subdued Expected IVs of 24% and 19% have led to significant premium compression. This offers a more advantageous cost structure for directional plays. Specifically, Long Call or Long Put positions on these underlying assets benefit from a reduced upfront premium outlay, thereby enhancing the risk-reward profile for speculative positioning. Furthermore, the subdued volatility environment observed in IDFC First Bank and NTPC supports the deployment of income-generating strategies, such as short options. This is predicated on the lower probability of adverse price swings and the relative stability in the underlying price action.

Options volume and Open Interest highlights:

Crompton Ltd (CROMPTON) and Hindustan Zinc (HINDZINC) are exhibiting decisively bullish sentiment in the derivatives segment. Their respective Call-to-Put Volume Ratios of 7:1 and 4:1 signify aggressive long positioning and a strong market expectation of upside potential in the underlying equities. This surge in Call demand has, however, inflated option premiums, raising the cost of establishing directional exposure for new participants. Importantly, such extreme ratios may also warrant a contrarian interpretation, potentially indicating overbought conditions. Dixon Technologies (India) (DIXON) and IndusInd Bank (INDUSINDBK) are seeing a rise in Put option interest, with Put-to-Call Volume Ratios at 1:1. This balanced yet elevated Put activity reflects increasing caution and downside risk hedging among traders. A substantial build-up in Put Open Interest (Put OI) is typically associated with bearish sentiment or protective strategies. Nevertheless, concentrated bearish positioning could also imply that these stocks are nearing oversold territory, potentially presenting attractive contrarian buying opportunities. Kaynes Technology (KAYNES) displays a mixed directional outlook with a subtle negative tilt. A simultaneous increase in Open Interest (OI) for both Call and Put options suggests that market participants are actively pricing in heightened short-term volatility. Tata Elxsi (TATAELXSI) has registered increased Call-side activity, which typically denotes a bullish bias and expectations of price appreciation. However, this trend requires a nuanced interpretation as it could also be driven by Call writing strategies, including short-covering or hedging activities, rather than pure speculative buying. Max Healthcare Institute (MAXHEALTH) continues to show accumulation in Put OI, reinforcing a defensive stance among market participants. While directional conviction remains subdued, this persistent build-up in protective Puts underscores prevailing concerns regarding short-term volatility and downside risk exposure. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures saw a total volume change of 12,098 contracts, predominantly driven by an aggressive build-up of 8,960 long contracts by Clients, a move that starkly contrasts with the concurrent, substantial deleveraging a decrease of 4,370 contracts by Foreign Institutional Investors (FIIs) and an even more pronounced reduction of 7,728 contracts by Proprietary desks, suggesting a divergent outlook where retail sentiment exhibits a robustly bullish bias against the cautious and defensive positioning of institutional and desk traders. In the stock futures segment, the market witnessed a massive turnover of 54,047 contracts, characterized by a marginal 821 contract decrease in Client positions and a nominal increase of 2,227 contracts by Proprietary traders, which were overshadowed by the overwhelming 53,226 contracts shed by FIIs, indicating an unprecedented, unanimous, and highly bearish exodus by institutional players from individual stock exposure.

Nifty

Bank Nifty

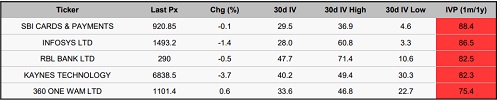

Stocks with High IVR:

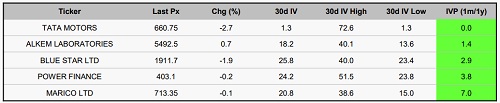

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Quote on Market 20th October 2025 by Vinod Nair, Head of Research, Geojit Investments Limited