Copper prices likely to rise, trading positively amid supply concerns -ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to remain volatile amid US-China trade uncertainties. Renewed tariff threats from US on Chinese imports has rekindled trade war fears. Meanwhile, US President’s openness to negotiate with China might check the upside in bullion prices. Prices would also get support on economic uncertainty and delay in release of US economic data. Further, dovish comments from the US Fed members and weaker dollar would fuel the bullions to stay firm. This week, investors will eye on speeches from the US Fed members, as release of key economic events has been delayed due to US Government shutdown.

* Spot gold is likely to move higher towards $4075, as long as it holds above $3990. A move above $4075 it would turn bullish towards $4100. MCX Gold December is expected to hold the key support near Rs.120,000 level and move higher towards Rs.124,500 level.

* MCX Silver Dec is expected to hold support near Rs.144,500 level and rise towards Rs.151,500 level.

GOLD

Base Metal Outlook

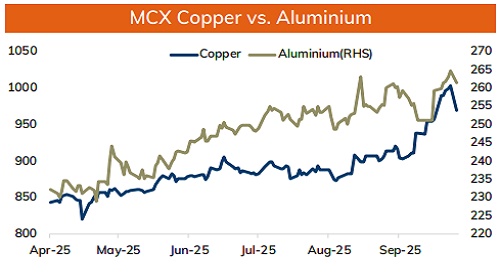

* Copper prices are expected to regain its strength and trade with a positive bias amid supply concerns. Further easing trade war concerns could support prices to hold firm. US President Donald Trump’s openness to negotiate and meet with Chinese President Xi Jinping later this month would lower trade tariff concerns and help prices to regain its momentum. Further, prices would get support amid supply tightness. The International Study group has changed its forecast for a surplus in 2026 to 150k deficit due to lower availability copper concentrate. Meanwhile, investors will eye on key economic numbers from China. New loans in China are expected to show sign of improved money supply.

* MCX Copper Oct is expected to hold support near Rs.980 and move back towards Rs.1020 level.

* MCX Aluminum Oct is expected to rise towards Rs.267 level as long as it stays above Rs.261 level.

* MCX Zinc Oct looks to rise towards Rs.297 as long as it holds key support at Rs.290.

Energy Outlook

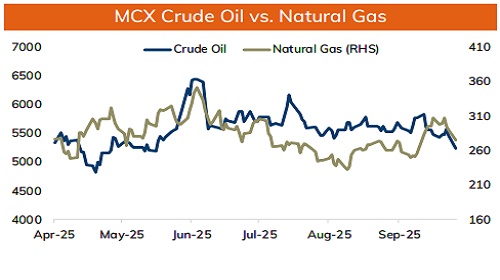

* Crude oil is likely to face hurdle near $60 per barrel and remain under pressure on easing Middle East tension and improved supply scenarios. A ceasefire between Hamas and Israel held in Gaza for third consecutive day on Sunday, ahead of the expected release of Israel hostages and Palestinian prisoners. Meanwhile, easing trade war fears between US and China could limit downside in oil prices. Additionally, fresh sanction on Iran by US could cause supply concerns.

* MCX Crude oil Oct is likely to face key hurdle at Rs.5380 level and move lower towards Rs.5200 level. NYMEX crude oil is likely to slip towards $58 per barrel as long as it trades under $60 per barrel mark.

* NYMEX Natural Gas is expected to trade lower on mild US weather forecast. Further, rising inventory levels and forecast of higher gas production would also likely to weigh on price. MCX Natural gas Oct is expected to slide towards Rs.272 level as long as it trades under Rs.300 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631