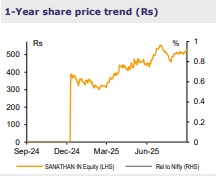

Company Update : Sanathan Textiles Ltd by Emkay Global Financial Services

Voice of the Head – Steadfast in ramping up the Punjab plant

We met Paresh Dattani, CMD, and Sammir Dattani, ED, Sanathan Textiles (STL), to discuss the industry outlook and understand the company’s roadmap following commissioning of the Punjab plant. KTAs: 1) The management is confident of ramping up the new plant (phase I: 700tpd) to near optimum utilization level by Q4FY26-end. 2) Revenue guidance stands at >Rs42bn/60bn/70bn for FY26/27/28, respectively. 3) Revenue buoyancy will be coupled with early double-digit margin guidance in FY27, on the back of variable/operating leverage benefits from ramping up the Punjab plant. 4) Reduction of GST rate (12% to 5%) on MMF yarns augurs well for industry demand; the management expects domestic demand to increase to 7-8% (vs 5- 6% currently) in the medium term. 5) A better demand outlook, coupled with a possible policy on early input refunds, shall compensate for the stretched, inverted duty structure (PTA, MEG are still taxed at 18% GST).

At the CMP, STL trades at ~30x P/E (TTM basis). The stock is ‘Not Rated’. Key risks: Change in trade and regulatory policies (anti-dumping duty/QCO); volatility in raw material prices (PTA and MEG) can temporarily impact demand, working capital, and the pricing strategy.

Robust demand outlook aligning with ramp-up/expansion

The management is confident of demand increasing to 7-8% (vs 5-6% currently) in the medium term, owing to GST rate cuts (Rs5-7/kg) on MMF products. Given the already optimal utilization of the industry (~85%), STL’s recent commissioning (phase-1 of ~700tpd) of the Punjab plant perfectly aligns with the company’s goal to cater to more demand. Further, STL plans to add ~9/11ktpa of technical textile/cotton yarn capacity, respectively, in the short to medium term; this should boost revenue over Rs42bn/60bn/70bn by FY26/27/28, respectively, based on the management’s guidance.

Sharp focus on margin expansion

STL believes savings in power and fuel, freight, and operating leverage benefits from ramp-up of the Punjab plant shall boost consolidated margins to early double digits, from high single digit currently. Further, expansion into high-margin technical textile products (~18-20%) by Mar-26 will also expand overall margins. The management aims to maintain its steady-state margin levels (post-stabilizing the Punjab plant by Q4FY26- end) in the medium term.

Other KTAs:

1) Indirect exposure to the US market is <5%. 2) Net debt to peak by FY26-end.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354