Commodity Morning Insights 14th October 2025 by Axis Securities Ltd

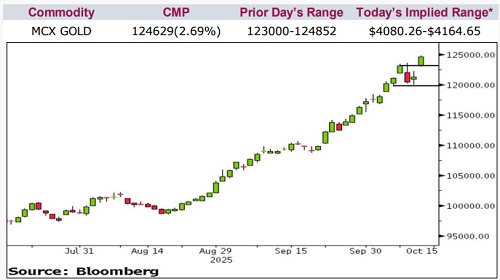

* Comex Gold extended its rally, rising over 2% in the previous session as investors sought safety amid the ongoing U.S. government shutdown and escalating geopolitical strains. Expectations of an imminent rate cut further buoyed sentiment, lifting spot prices beyond the historic $4,100 mark for the first time on record. The broader trend remains firm as long as the $3,900 support zone holds intact.

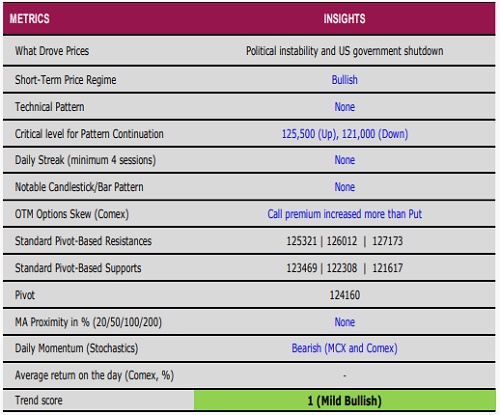

* Comex Silver soared above $52, marking its sharpest single-day gain since Jun’25, as tightening supplies in the physical market triggered a strong upside momentum. The consistent squeeze in deliverable inventories continues to underpin prices at elevated levels

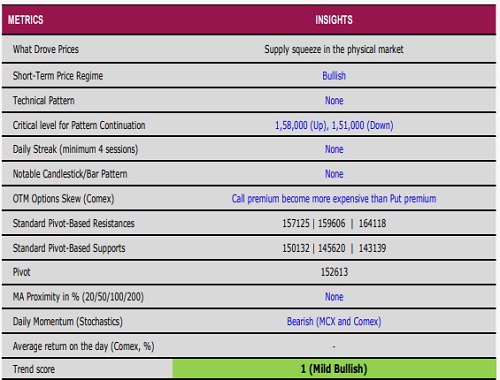

* Nymex Crude Oil rebounded by over 2% after a softer stance from Trump on China helped restore market confidence. However, the short-term tone stays weak as long as prices remain capped below the $60 threshold

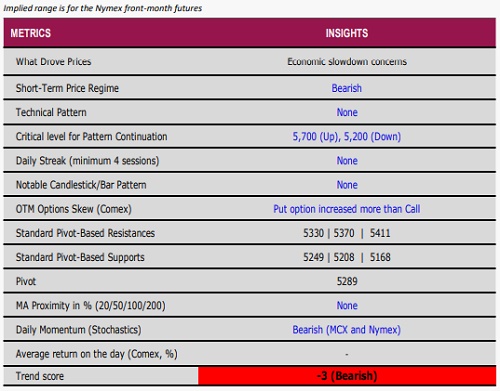

* Comex Copper posted a solid recovery of more than 5% following last Friday’s sharp decline, sparked by tariff threats. The easing rhetoric from both sides over the weekend, combined with ongoing supply disruptions, lent strong support to prices at lower levels

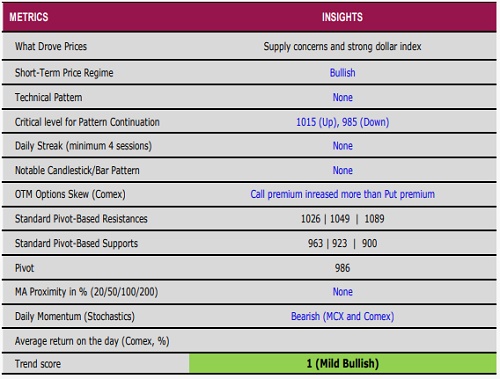

Gold

Silver

Curd Oil

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633