Commodity Morning Insights 12th September 2025 - Axis Securities

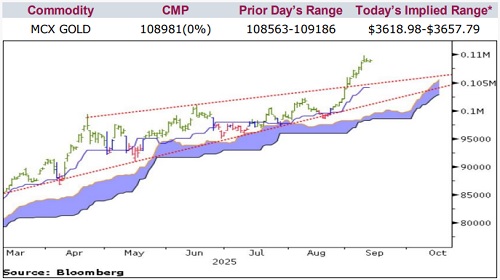

* Comex Gold ended marginally lower in the previous session amid ongoing volatility, with investors digesting a series of US economic data that continued to reinforce expectations of rate cuts. US consumer prices advanced 0.4% in August, double the 0.2% increase seen in July and slightly above the forecast of 0.3%, lifting annual inflation to a seven-month high of 2.9%, largely in line with estimates. Market participants will keep a close watch on consumer sentiment data scheduled later in the day.

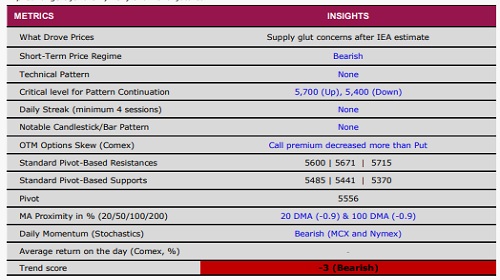

* Nymex Crude Oil snapped its winning streak and fell more than 2% on concerns of a looming supply glut, after the IEA raised its estimate for a global surplus in 2026. Sentiment was further pressured by worries over slowing US economic growth and weaker energy demand after jobless claims unexpectedly rose to their highest level in nearly four years.

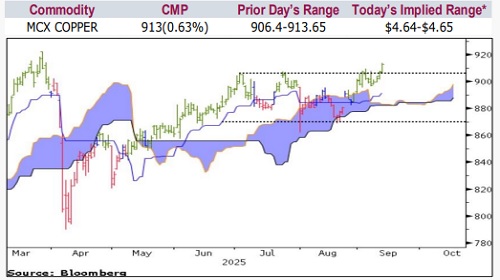

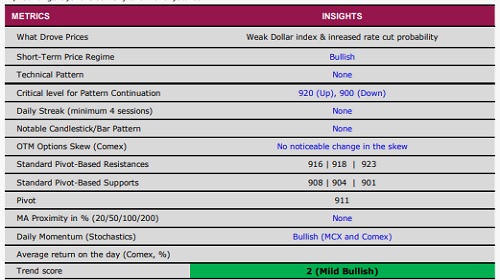

* Comex Copper extended gains for the fourth consecutive session, supported by growing expectations of rate cuts, a softer US dollar, and supply disruptions in Indonesia, which have sparked renewed concerns over availability.

* Nymex Natural Gas closed lower for a second straight session, weighed down by rising U.S. inventories and reduced demand stemming from a shift in weather forecasts.

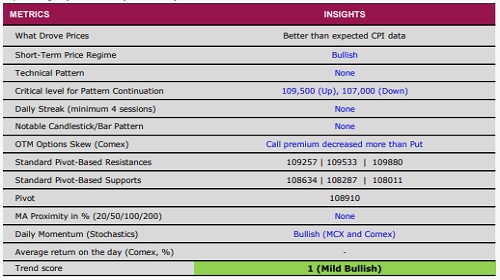

Gold

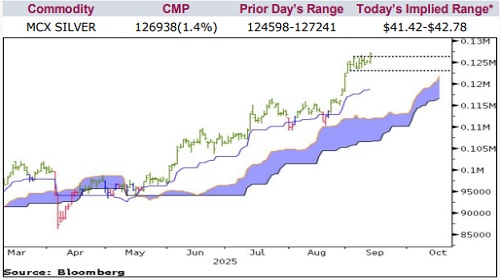

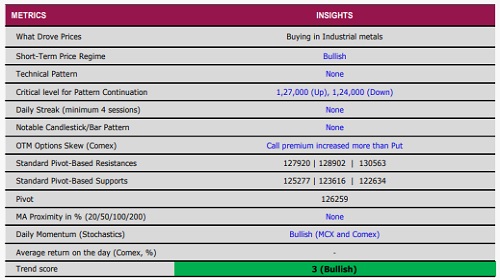

Silver

Crude Oil

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633