Commodities Weekly Insights By Axis Securities Ltd

The Week That Was

* COMEX Gold’s remarkable eight-week winning streak came to an abrupt halt, retreating sharply after hitting a record high of $2,956. The metal fell over 2.6% in the last session, pressured by a rebound in the U.S. dollar, which snapped its three-week losing streak with a nearly 1% gain. Investors adjusted positions following the latest Core PCE Price Index report, which showed a 0.3% MoM increase in January, in line with expectations. The annualised inflation rate eased slightly to 2.5% from 2.6% in December. However, consumer spending contracted by 0.2%, marking its first decline in nearly two years,even as personal income surged 0.9%—the strongest gain in a year.

* COMEX Silver also lost momentum, snapping a five-week winning streak and posting its steepest weekly decline since July 2024, down over 4%. The pullback in gold and renewed dollar strength intensified selling pressure on silver. On the supply side, Hecla Mining Company—America’s largest silver producer—reported a 13% YoY increase in silver production for 2024, reaching 16.2 Mn ounces, its second-highest output in 134 years. Meanwhile, demand softened, as U.S. silver coin purchases fell 27% YoY in January to 3.5 Mn ounces, marking the weakest January demand since 2018.

* NYMEX Crude Oil extended its losing streak to six weeks, navigating heightened volatility as the dollar’s rebound and trade policy concerns weighed on sentiment. Investors remain cautious amid speculation that potential U.S. tariffs on key trading partners could disrupt economic growth and weaken energy demand. Further pressure on prices stemmed from a thaw in U.S.-Russia relations, with discussions of potential peace talks in the Russia-Ukraine conflict raising the prospect of reduced sanctions and a full resumption of Russian oil exports.

* COMEX Copper edged higher in the last session, gaining 0.6% following reports that the U.S. administration is considering tariffs on copper imports. The news prompted traders to accelerate inventory purchases ahead of potential policy changes. While tariffs are structurally bearish for copper and other base metals due to their impact on global trade and economic growth, the current lack of clarity is fueling market volatility. Until further details emerge, price action is expected to remain choppy.

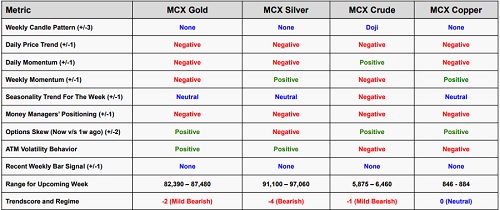

Summary View For The Week

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633