Cement Sector Update : Demand remains tepid; complete GST benefit pass-through by Motilal Oswal Financial Services Ltd

Demand remains tepid; complete GST benefit pass-through

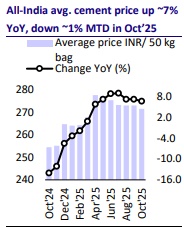

All-India average cement price inched lower by 1% MTD in Oct’25

Cement prices (WSP) declined by INR26-29/bag as of Sep’25 end following the pass-through of the GST rate cuts. Cement demand (so far) has been subdued due to slow construction activity amid the festive season and due to the labor shortage. Our recent channel checks suggest that in Oct’25 so far, the all-India average cement price (WSP) has corrected marginally by ~1% vs. the Sep’25-end level, mainly due to a price decline in south and east regions. Meanwhile, prices remain steady in other regions. Cost pressure continues to be benign given favorable fuel prices, barring a recent surge in petcoke prices.

All-India average cement price dips marginally in Oct’25 vs. Sep’25-end level

* The all-India average cement price (WSP-net of GST) declined 1.3% QoQ in 2QFY26 due to price corrections in south, east and west regions, while prices in north and central regions remained stable. The average cement price (WSP-net of GST) in Oct’25 so far has declined by 0.6% vs. the Sep’25-end level, mainly due to a price decline in South and East regions, while prices remain steady in other regions. Most dealers suggested that there would be no price hikes in the near term and that cement players may look for price changes, if any, from Jan’26 onward considering the demand trend.

* Cement demand in 2QFY26 was subdued and is estimated to grow in mid-single digits on a YoY basis, despite on a low base. Demand has been slow so far in Oct’25 due to slow construction work amid the festive season and due to the labor shortage and state/local municipal elections in a few markets. Dealers expect a meaningful pickup in demand from mid-Nov’25, with the return of labor workforce and the beginning of a peak construction period.

South – Prices down ~2% in Oct’25 (MTD) vs. Sep’25-end level

* After the pass-through of GST rate cuts by Sep’25 end, the average cement price (WSP net of GST) in the south region has further declined by INR5/bag (~2%). Notably, cement prices jumped ~14% QoQ in 1QFY26. However, in 2QFY26, prices corrected (as partial hike reversed) and the average price declined ~4% QoQ. However, the current average cement price in the south region is up ~7% YoY. Dealers suggested that a price hike is unlikely in the near term and that companies may look for a price revision, if any, from Jan’26 onward.

* Cement demand was weak in 2QFY26 due to extended monsoon and flood in some parts of the region (Hyderabad and nearby areas). Andhra Pradesh has seen some demand improvement, led by government-infra projects (road, highways), while in other markets demand momentum was relatively weak. Dealers expect a recovery in demand after the festive season, backed by IHB and an expected increase in government spending and private capex.

East – Prices edge lower by ~1% in Oct’25 (MTD) vs. Sep’25-exit level

* Following the pass-through of GST rate cuts by Sep’25 exit, the average cement price (WSP net of GST) in the east region has further declined by INR3/bag (~1%), mainly due to the price correction in the Odisha and Chhattisgarh markets. Notably, cement prices in the region increased ~4% QoQ in 1QFY26 but dipped by ~2% QoQ in 2QFY26. However, the current average price in the region is up ~7% YoY. Dealers suggest that the Odisha market is seeing increased competition and hence pricing is under pressure.

* Cement demand was weak in 2QFY26 due to intense monsoon and weak government spending in a few markets (West Bengal and Jharkhand). In Bihar, demand was relatively better, backed by rural housing and infrastructure works, while demand is expected to moderate given the upcoming elections.

West – Trade price flat in Oct’25; non-trade price corrects

* With the pass-through of GST rate cuts by Sep’25 end, the average cement price (WSP net of GST) in the west region remained flat. However, non-trade price declined by up to INR20-30/bag due to weak demand. Dealers suggested that price hikes are unlikely in the near term given the need to pass on GST benefits, although the average cement price in the region is up ~6% YoY currently.

* Cement demand was mixed in 2Q, as Jul’25 volume offtake was robust, which moderated in Aug’25 and declined sharply in Sep’25 due to strong rains across the region. Initially in Oct’25, demand had improved, though it has slowed recently due to the labor shortage and festivals. Dealers suggested a pickup in demand from mid-Nov’25 as the labor workforce returns. Further, they also suggested that across the west region, demand from Bulker, batching and RMC plants is higher compared to per-bag demand.

North and Central – Cement prices hold firm; highest among regions

* After the pass-through of GST rate cuts by Sep’25, cement prices remained stable. Average WSP (net of GST) was steady in both regions in the past six months, showing limited volatility. The average WSP net of GST is the highest in the north region, followed by central India. Dealers expect prices to remain stable in the near term.

* Cement demand was weak in 2QFY26 due to an extended monsoon. Dealers expect demand to recover going forward, with the pick-up in construction activity, IHB segment and government-led infra projects. In UP, a meaningful recovery is expected after mid-Nov’25 due to the festive holidays (Diwali and Chhath Puja).

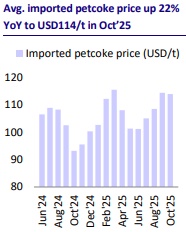

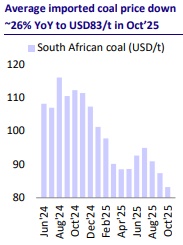

Fuel prices mixed, with petcoke prices rising and coal prices declined

* The average South African coal price, after declining by ~4% MoM in Sep’25, has further corrected by ~5% (MTD) in Oct’25 to USD83/t. The average petcoke price, which increased ~5% MoM in Sep’25, remainsstable (MTD) in Oct’25 at USD114/t. Domestic petcoke prices have also increased ~4% MoM to INR14,518 in Oct’25.

* A change in the duty structure in coal — from 5% GST plus green energy cess of INR400/t to 18% GST, with full input tax credit eligibility along with lower coal prices, has made the consumption cost of imported coal more economical than petcoke. Spot imported coal/petcoke price stood at USD82/USD115 per ton. At spot prices, the imported coal consumption cost stood at INR1.22/Kcal, while the imported petcoke consumption cost stood at USD1.44-1.46/Kcal.

* We estimate the all-India average cement spread for trade sales (cement price net of GST after subtracting variable cost) to be largely stable (so far) given the resilient pricing and favorable fuel mix. However, profitability in the near term is estimated to decline sequentially due to negative operating leverage.

Outlook and recommendation

* In the cement sector, near-term weakness persists due to subdued demand, muted pricing trends and high petcoke prices. We maintain a positive outlook on the sector, given: a) strong earnings growth in FY26E (estimate our cement coverage aggregate EBITDA to surge ~34% YoY, albeit on a low base) and FY27E by ~23% YoY; b) increased consolidation, and c) benign cost pressure amid favorable coal prices and industry players’ focus on optimizing costs through an increase in green power and AFR usage and investing in efficiency improvement and logistics cost reduction.

* UTCEM remains our preferred pick in the large-cap space, while we maintain a positive view on JKCE and DALBHARA in the mid-cap space.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Auto Sector Update : Domestic demand fails to revive in most segments, even in July By Motil...