Cardamom Report 26th September 2025 by Amit Gupta, Kedia Advisory

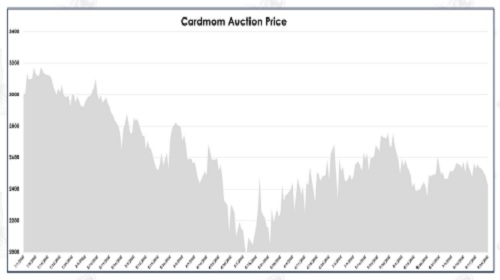

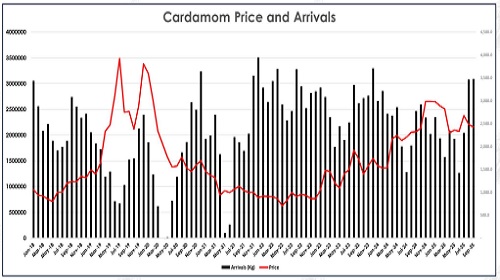

Cardamom prices are presently trading near to of Rs.2,425 per kg, reflecting a sharp correction in recent sessions. Over the past week, prices have dropped by nearly 5%, while on a one-month basis, the decline stands at around 3%. The fall has primarily been attributed to increased arrivals, cautious domestic buying, and global demand uncertainties. Despite these near-term corrections, the market structure continues to indicate strong medium- to long-term demand supported by supply tightness.

Indian cardamom has been trading at a 28–30% discount to Guatemalan cardamom, making it more attractive for international buyers. The arbitrage gap between India and Guatemala has created opportunities for exporters, especially to the Gulf and EU regions.

Swot Analysis

Strengths

* Guatemala crop down 44%, tightening global supply.

* India’s exports surged, aided by competitive pricing vs Guatemala.

* Pre-Diwali demand revival seen, indicating seasonal uplift in Gulf/SEA orders.

* India-UK trade pact cuts duties, expanding export volumes and margins.

* Strong domestic demand and premium segment traction keep baseline demand intact.

* For Apr – Jul 2025, exports of small cardamom increased 37.60% compared to April – Jul 2024.

Opportunities

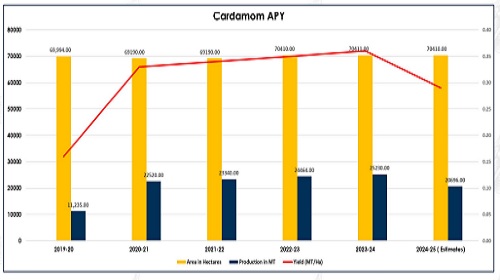

* As per Advance Estimate by Spices Board for 2024-25, small cardamom production expected to drop around 18% to 20696 MT

* Carry forward stocks are less compared to last year.

* Weather-related fungal outbreaks cut Indian output by 15%, creating quality inconsistencies.

* Risk of rhizome rot and stem infections still persists post-rainfall.

* Indian cardamom priced 30% below Guatemala offers arbitrage for bulk buyers.

* Rise in demand expected post-October ahead of peak winter consumption phase.

Weaknesses

* Cardamom dropped 5% in a week as timely rainfall in Kerala improves pod setting and late yield prospects.

* For Sep till date, arrivals increased by over 11.50% to 2759.12 tonnes compared to 2469.41 tonnes last year Sept.

* Premium grade prices stagnating, limiting upside breakout potential.

* Export demand from EU and Middle East remains flat; no surge seen post-correction.

* Auction volumes steady but lack premium buyer aggression due to tight margins.

* Domestic buying remains cautious with no visible festive demand spike yet.

Threats

* Agrochemical intervention in Idukki could boost yields and reduce fungal losses.

* Strong crop outlook in Nepal could limit Indian price rally.

* Buyers may delay orders awaiting price dip, hurting exporter cash flow.

* Increased arrivals from Nepal and India may oversupply market post-harvest.

* Regulatory compliance drives like FSSAI checks may disrupt trade flows.

* Delay in international pre-booking due to global economic uncertainty and FX risk.

* Recession threats may dampen international demand, lowering export orders and price support.

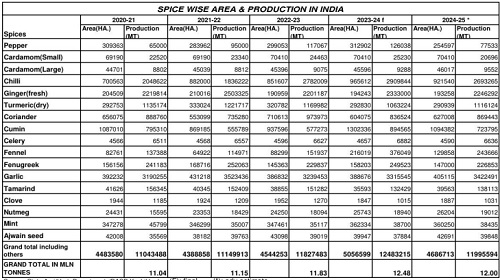

Spice Wise Area & Production

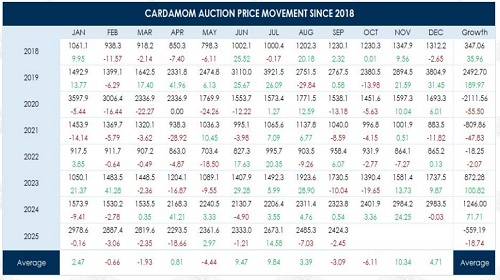

Seasonality

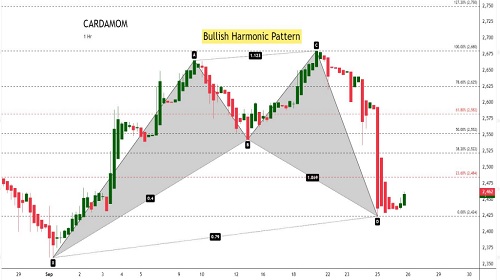

Technicals

Volatility

Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements, ranging from 0 to 100. Values above 70 indicate overbought conditions, while below 30 suggest oversold levels, helping traders identify potential trend reversals.

RSI

Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements, ranging from 0 to 100. Values above 70 indicate overbought conditions, while below 30 suggest oversold levels, helping traders identify potential trend reversals.

Moving Averages

Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements, ranging from 0 to 100. Values above 70 indicate overbought conditions, while below 30 suggest oversold levels, helping traders identify potential trend reversals.

MACD

Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements, ranging from 0 to 100. Values above 70 indicate overbought conditions, while below 30 suggest oversold levels, helping traders identify potential trend reversals.

Vortex Indicator

Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements, ranging from 0 to 100. Values above 70 indicate overbought conditions, while below 30 suggest oversold levels, helping traders identify potential trend reversals.

Cardamom

Conclusion

Price Performance: Cardamom showed resilience as Guatemala’s crop fell 44%, tightening global supply, while India’s exports rose 37.6% YoY in Apr–Jul 2025. Pre-Diwali demand revival in Gulf and SEA orders, coupled with steady domestic buying, has supported prices, even as arrivals rose 11.50% in September.

Supply–Demand Balance: Spices Board estimates 2024–25 Indian production at 20,696 MT, down 18% YoY. Carry-forward stocks remain lower, while fungal outbreaks reduced yields by 15%. With Indian cardamom priced nearly 30% below Guatemala, export arbitrage strengthens demand.

Macro & Policy Drivers: The India–UK trade pact reducing duties boosted export opportunities, while festive consumption and peak winter demand are expected to accelerate usage. Global buyers increasingly turn to India amid competitive pricing, while government support and trade diversification enhance medium-term confidence in positive trajectory.

Technical Indicators: RSI at 33.36 is recovering from oversold territory, suggesting reversal potential. MACD remains oversold but indicates possible recovery, while the Vortex shows bearish momentum exhaustion. Choppiness Index at 38.65 signals trending conditions ahead, with technicals favoring a shift towards bullish continuation in the coming months.

Price Outlook (MCX Cardamom):

Above views are of the author and not of the website kindly read disclaimer