Buy Wipro Ltd For Target Rs.555 By Choice Broking Ltd

.jpg)

BFSI growth to sustain; Q3 to remain frail with resilient margins

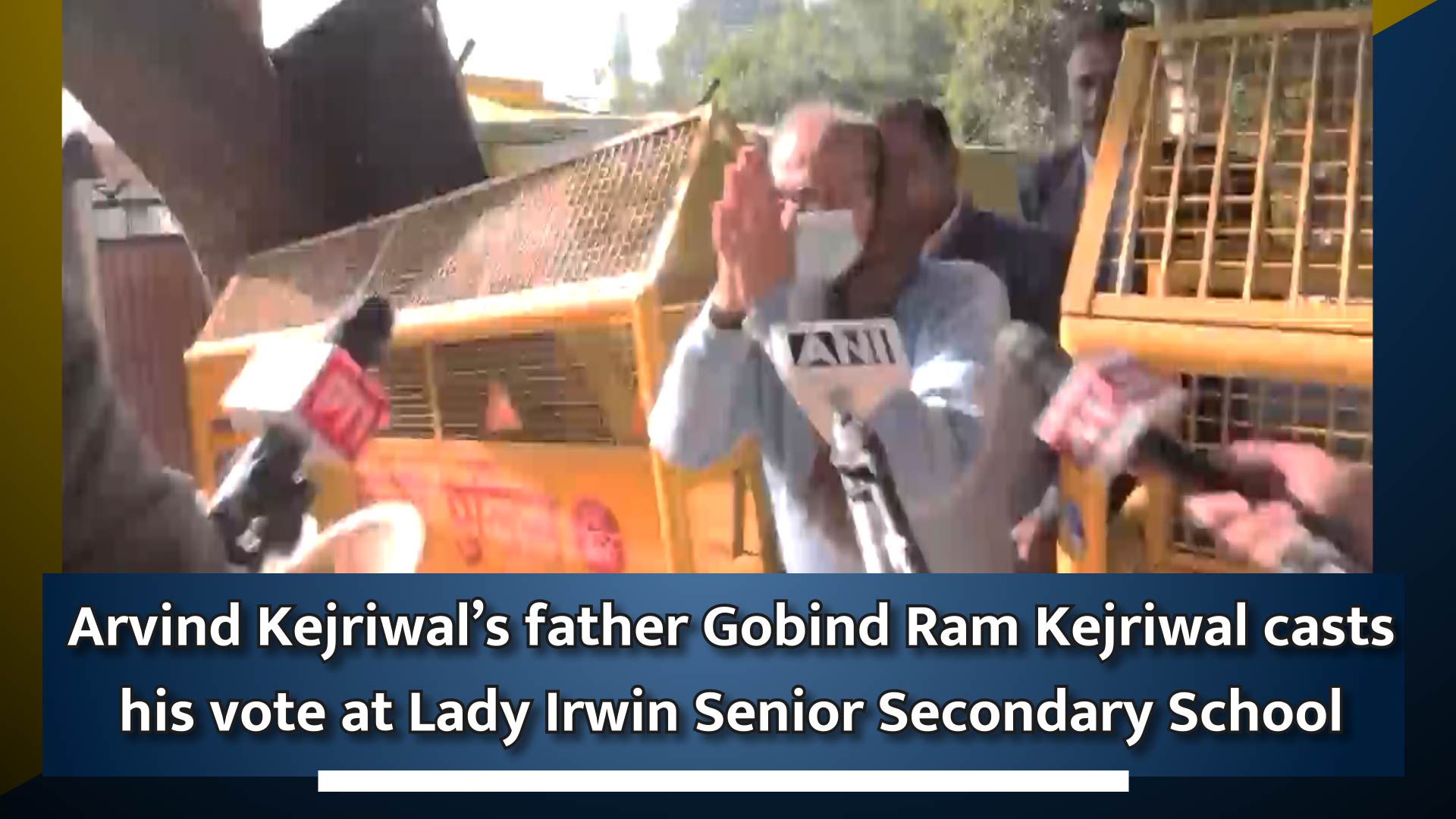

Wipro Ltd. reported Q2FY25 revenues at $2,660mn, up 0.6% QoQ but down 2.3% YoY in cc terms. In USD terms, reported revenue was up1.3% QoQ but down 1.9% YoY. INR revenue stood at INR223bn, up 1.5% QoQ but down 1.0% YoY. During Q2, Order Book TCV stood at $3.6bn, down 5.6% YoY cc of which $1.5bn were large deal TCV. PAT for the quarter was INR32.3bn, up 21.0% YoY, driven by high other income. EPS for the quarter stood at INR6.1. Operating cash flows stood robust at 132.3% of net income at INR42.7bn.

* Management’s top priority is to accelerate growth, having identified five strategic areas to achieve this in recent quarters. First, they aim to enhance large deal momentum through close collaboration with clients and partners. Second, they plan to strengthen relationships with existing large clients while identifying new accounts with potential for significant growth. Third, the focus will be on industry-specific offerings and business solutions driven by consulting and enhanced by AI. Fourth, they are committed to developing a skilled workforce that is AI-ready and capable of delivering tailored business solutions. Lastly, management seeks to simplify the operating model and emphasize execution rigor and speed. Confident in their ability to implement these strategies, they are prepared to adapt to technological shifts and market conditions while sharing their progress.

* The demand environment remains cautious and hence, short term challenges exist. Discretionary spends are similar to previous quarters as there is no improvement. Clients are still making conservative investments focusing on returns and better optimization. Company is seeing good progress with its consulting-led industry solutions in the automotive manufacturing segment. In addition, there are also signs of uptick in demand in the industrial segment. Management identifies opportunities for vendor consolidation and cost takeout, especially within the energy sector. Management anticipates a seasonally weak Q3FY25E, with revenue expected to be in the range -2.0% to 0.0% cc and margins to be in narrow band. Management identifies margin improvement levers as rotation, off-shoring, lowered SG&A expenses etc. and aspires margin to be in 17-17.5% range over long term.

* In Q2, Americas 1 reported sequential growth of 1.2%, fueled by strong performance in the healthcare, technology, and communication sectors. Similarly, Americas 2 achieved sequential growth of 0.8%, bolstered by robust demand and effective execution in the BFSI sector. APMEA saw a growth of 0.3%, driven by positive developments in Capco, indicating early signs of business stabilization in the region. In contrast, Europe experienced a sequential decline of 0.1% due to overall weak demand and specific issues with certain clients. The energy and utilities sector continues to be weak, experiencing a sequential decline of 3.7%. In Q3FY25E management expects, IT service business segment to be in range between $2,607- 2,660mn.

Valuation: Wipro continues to invest in its clients, its strategic priorities, and building a strong AI powered company. We have introduced FY27E and expect Revenue/EBIT/PAT to grow at a CAGR of 4.9%/9.7%/10.6% respectively over FY24-FY27E. We maintain our REDUCE rating to arrive at a revised target price of INR555, implying a 22x PE on SepFY27E EPS of INR27.1.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)

.jpg)

.jpg)