Evening Track : US-China trade war triggers record gold rally, Oil prices plummet on inventory Surge by Kotak Securities Ltd

Comex gold futures surged to a record peak of $2,898.9 per ounce, marking a third consecutive session of gains. Investor demand for safe-haven assets intensified amid escalating US-China trade tensions, raising concerns about global economic repercussions. While tariffs on Mexico and Canada were postponed, a 10% levy on Chinese imports proceeded, prompting retaliatory measures from Beijing on US energy products. Adding to the uncertainty, proposals regarding the Gaza Strip reconstruction further fueled market unease. Gold's appeal as a hedge against instability is likely to persist, though sustained high interest rates could moderate its gains. A weakening dollar, influenced by a recent US jobs report suggesting a labor market slowdown, has made gold more affordable for international buyers.

WTI Crude Oil edged lower to near $72 per barrel, weighed down by concerns of a US-China trade war, despite supply risks stemming from the intensified US pressure on Iran. The US administration reinstated its "maximum pressure" campaign targeting Iran's oil exports, potentially impacting 1.5 million barrels per day. This move aims to curtail Iran's oil revenue and regional influence. However, market sentiment remained cautious following China's retaliatory tariffs on US coal, LNG, and crude oil in response to prior US levies. This trade dispute has fueled anxieties about potentially weakened global oil demand. Despite the potential for disruptions from Iranian oil sanctions, the impact of a US-China trade war on US crude exports may be limited, given China's already low intake of American oil.

LME copper prices held steady this week to trade near $9161 per ton amidst escalating US-China trade tensions. China's retaliatory tariffs on US goods and an investigation into Google coincided with the US imposing a 10% levy on Chinese imports. China also implemented export controls on select niche metals, including tungsten. Base metals markets have been volatile due to trade war anxieties and concerns over Chinese demand. Although a protracted trade conflict could hinder China's economic growth, potential stimulus measures by Beijing could boost metals consumption. LME Zinc and Aluminium is trading lower by about1% today while Zine is trading positive by 0.84%. Analysts suggest Chinese demand recovery post-holiday will be gradual, with global trade friction and economic growth remaining concerns.

European natural gas trade higher as traders balanced the potential impact of a US-China trade dispute on global fuel flows against forecasts of colder-than-usual weather. China's tariffs on US liquefied natural gas could free up LNG supplies for other buyers, potentially easing concerns in Europe. However, the continent faces rapidly dwindling gas inventories and uncertainty about restocking before next winter. With some weather forecasts predicting below-average temperatures through much of February, heating demand is expected to remain high, further straining supplies.

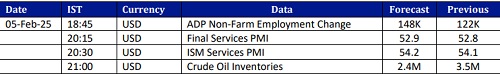

Today, Investors now turn to key US economic data, including ADP Non- Farm Employment, Final & ISM Services PMI, for further cues.

Above views are of the author and not of the website kindly read disclaimer