Spot Silver is likely to rise further towards $32.00 level as long as it holds the support near $31.0 - ICICI Direct

Bullion Outlook

• Gold is likely to trade with positive bias amid rise in demand for safe haven as white house reiterated that US President Donald Trump will implement tariffs of 25% on Canada and Mexico and 10% on Chinese products on Saturday. His tariff plans are widely seen as inflationary and potential to trigger trade war hurting global economic growth. Meanwhile, investors will remain cautious ahead of Indian Union budget to see whether government make any changes in import duty on bars and Dore. We don’t expect any changes in import duty on gold and silver. But If government increases import duty on gold and silver then we may see sharp upside in prices.

• MCX Gold April is expected to rise back towards ?82,500 level as long as it stays above ?81,700 level. On contrary if prices break below ?81,700 level prices may slip sharply towards ?80,900 level

• MCX Silver March is expected to slip towards ?92,000 level as long as it trades below ?94,200 level. On contrary if prices break above ?94,200 level then prices may move up towards 95,500 level

Base Metal Outlook

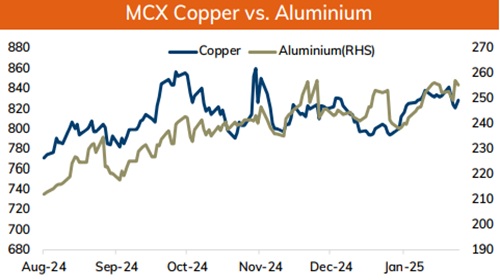

• Copper prices are expected to trade with negative bias on fears that tariffs threat from US President Donald Trump could disrupt global commodity trade and ignite trade war, hurting global economic growth and denting demand for industrial metal. Further, strong personal income spending data from US signal resilience. Investors fear that if data continues like this then US Fed will have more room to keep rates on hold for longer duration. Additionally, Chinese markets remained closed for the week long Lunar New Year holiday,

• MCX Copper February is expected to slip towards ?820 level as long as it stays below ?836 level. A break below ?820 level copper prices may slip further towards ?818 level

• MCX Aluminum Feb is expected to correct further till ?248 level as long as it trades below Rs 253 level. MCX Zinc Feb is likely to slip further till Rs 259 level as long as it stays below Rs 265 level

Energy Outlook

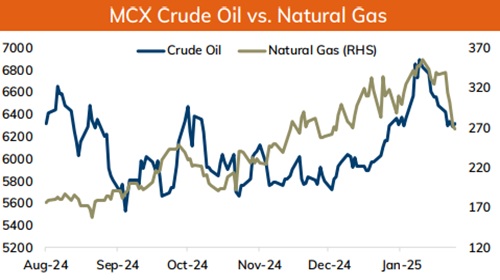

• Crude oil is expected to trade with positive bias on reports that US President administration is likely to reduce the proposed tariffs on Canadian oil from 25% to 10% and may even delay the timing of implementation. Canada and Mexico are the two largest crude oil exporters to the United States. However, investors fear that if the imports tariffs are levied by US as planned then its trading partners may even retaliate. Moreover, market will keep a close eye on OPEC+ ministerial meeting scheduled for 3 rd February.

• MCX Crude oil Feb is likely to hold the support near ?6240 level and rise further towards ?6400 level. A break above ?6400 prices may rally further towards ?6500 level. On contrary if prices dip below ?6240 level then we may witness further correction in prices till ?6150 level

• MCX Natural gas Feb is expected to hold the support near ?258 level and recover till ?275 level

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631