Buy VIP Industries Ltd for Target Rs 430 by Elara Capitals

VIP upgrade – Checked-in for growth

VIP Industries (VIP IN) stands at an inflection point after a challenging period marked by COVID-19 pandemic, intensifying competition and lapses in internal execution. VIP is among India's leading luggage manufacturers with iconic brands such as VIP, Skybags, Aristocrat and Carlton London and deep distribution reach, and is now positioning itself for a multiyear turn around. The company’s renewed focus on brand premiumization, product innovation, channel transformation and process improvement along with change in ownership (providing strategy leg) presents a credible roadmap to drive growth and profitability. VIP with its strong brand portfolio continues to be a dominant player in the industry, enabling strong support to reset its challenging journey. In the longer-term, we believe VIP offers meaningful upside as operational resets take hold.

Ownership shift, key catalyst for a structural transformation: The Piramal family’s decision to divest up to 32% of its shareholding to a Multiples-led consortium signifies a decisive shift from legacy promoter-led stewardship to institutional, performance-driven governance. We believe this transition will introduce sharper accountability, tighter execution discipline, and stronger strategic direction.

Unlocking the brand moat: VIP with its well-diversified brand portfolio and strong brand recall strategically caters to the entire spectrum of consumer preferences and price segments from mass to premium. We believe a focused reset on premium identity, product innovation, increased freshness salience and technology-led product differentiation provides a credible path to restoring brand authority, improving realizations and supporting margin recovery, thus enabling VIP to reclaim leadership in the formalizing luggage market

From chaos to control – Rebuilding pricing power and channel discipline: VIP intends to build a balanced omnichannel model, with e-commerce stabilizing at ~30-35% of revenue. It is shifting towards premium products, data-led customer segmentation, performancemarketing efficiency, and strict MOP enforcement to reinstate brand authority. Channel reset, controlled online scale and profitable offline growth position VIP to restore ASPs, enhance margin, and drive durable turnaround trajectory

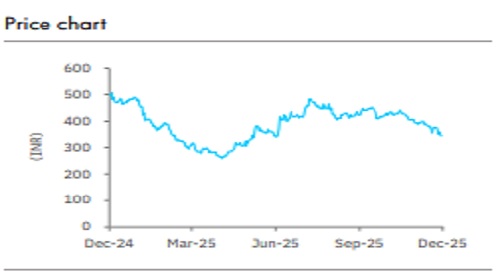

Initiate with BUY and a TP of INR 430: We assign 26x FY28E EV/EBITDA to VIP, a discount of ~30% versus Safari Industries, given near-term restructuring headwinds. At our target multiple, we arrive at a TP of INR 430, implying an upside of 25% on current market price. At our TP of INR 430, the stock would trade at an implied EV/sales of 2.6x FY28E, at par with its current one-year forward multiple. The stock could get re-rated to its mean multiple of 3.9x EV/sales, with market share gain and return to profitability. We initiate with BUY – Any decline in the stock price could be used as an opportunity to buy for long-term gains. Key catalysts are higher-than-expected growth, improvement in profitability and working capital cycle. Key risks are any failure to regain market share, intensifying competition and sharp volatility in raw material prices

Please refer disclaimer at Report

SEBI Registration number is INH000000933