Buy Titan Company Limited for the Target Rs. 4,989 by Religare Broking Ltd

Strong Quarter Execution Amid Volatility and Competitive Intensity: Titan’s management termed Q3 FY26 a “great quarter,” highlighting a significant uptick in demand despite market volatility and rising competitive intensity. The company also booked the labour code impact upfront, resulting in an exceptional item of Rs. 152 crore at the consolidated level (Rs. 138 crore standalone), reflecting prudent accounting discipline. Management stressed the increasing importance of consolidated reporting as subsidiaries now represent sizable investments and growth drivers. Importantly, bullion and digi-gold sales remain excluded from performance metrics, ensuring operational growth reflects only core business strength..

Jewellery Demand Resilient Despite Flattish Buyer Growth: While overall buyer growth remained flattish during the quarter, Titan saw sequential improvement in new buyer contribution, rising to 45% from 42% in Q2. Average ticket size hit a record Rs. 1.9 lakh, largely driven by soaring gold prices and wedding-led high-value purchases. Plain gold ticket size grew sharply by 44%, while studded jewellery ticket size rose 15%. Management also noted continued strength in studded buyer growth, which stayed a few percentage points above overall jewellery buyer trends, highlighting premium demand resilience.

Margins Challenged by Rising Gold Prices but Profit Focus Intact: Titan acknowledged that maintaining margin percentages is difficult in a rising gold price environment. Gross margins dipped ~100 bps (normalized), driven by a higher salience of gold coins and the mathematical impact of higher gold value on studded jewellery margins. However, management reiterated that the strategic focus remains on absolute EBIT and PBT growth rather than margin percentages. Despite margin headwinds, Titan continues to protect profitability through operating leverage, product mix discipline, and scale benefits, ensuring earnings expansion remains healthy even amid commodity volatility.

Accessibility Strategy Through Lightweight and Lower Karat Jewellery: To counter affordability pressures from high gold prices, Titan is pivoting toward lightweight jewellery and introducing lower karatage offerings (18k, 14k, and even 9k) across brands like Tanishq, Mia, and CaratLane. This strategy aims to maintain accessibility without compromising design appeal. Exchange-led purchases have become a major growth lever, with over 50% of business now involving upgrades or outside gold exchange. Programs like “Golden Advantage” contribute 20-25% of sales, reinforcing Titan’s ability to sustain demand in a high-price environment.

Subsidiaries and International Expansion Strengthen Growth Platform: Titan completed the acquisition of a 67% stake in Damas, with consolidation beginning January 1, meaning Q4 will reflect Damas, CaratLane International, and TEAL together. CaratLane has achieved double-digit EBIT margins, supported by operating leverage and a high studded ratio of 85-90%. International business adjusted margins remain at 5-6%, though Q3 saw a one-off profit boost from a Dubai primary sale to Damas. Eyewear delivered 11% revenue growth backed by premiumization, while TEAL’s order book remains healthy despite milestone-linked margin volatility.

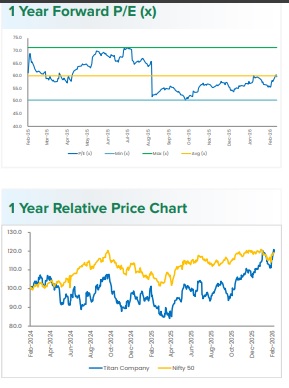

Outlook and Valuation: Management indicated January has been a good month, reflecting demand momentum strong and the premium franchise intact, though gold prices remain bi-directionally volatile, limiting specific Q4 guidance. Consumer behaviour continues to show a FOMO-driven buying pattern during festive and wedding seasons. Younger demographics remain engaged through brands like Mia and CaratLane, reinforcing long-term demand durability. With Damas consolidation beginning in Q4, Titan’s international footprint expands meaningfully. Despite near-term gold-linked margin pressures, Titan’s brand moat, premiumisation strategy, and subsidiary scaling justify its valuation premium, keeping the medium-term outlook structurally strong. On the financial front, we estimate Revenue, EBITDA, and PAT to grow at a CAGR of 29.7%, 42.7%, and 48.9%, respectively, over FY25-27E. Accordingly, we maintain our BUY rating with a target price of Rs. 4,989.

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ00017433