Buy Healthcare Global Enterprises Ltd For Target Rs.850 by Prabhudas Liladhar Capital Ltd

Multiple levers to drive growth

Quick Pointers:

* Medium-term EBITDA margin guidance of 21–22% (22–23% in 4–5 years)

* Expansion plan of 1,000 beds in 4-5 years

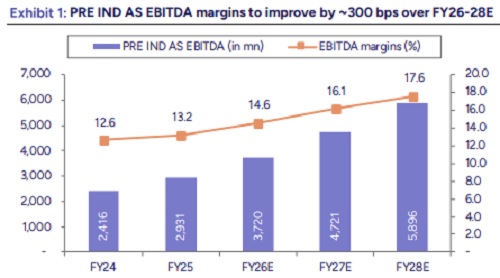

We attended HealthCare Global Enterprises’ (HCG) virtual analyst meet. HCG 1HFY26 consolidated EBITDA grew by ~20% YoY and 14% CAGR over FY23-25. Mgmt guided higher EBITDA growth than historical growth in coming years. HCG’s asset-light approach with a focus on partnerships has made its business model more capital efficient and scalable, in our view. We believe the recent strategic investment by KKR will bring in more operational and financial efficiency. Currently, HCG enjoys 13-14% PRE IND-AS margin, which is lower than its peers. We expect KKR to drive growth through bed expansion largely brownfield, better payor mix, focused marketing initiatives and scale up of margins. We expect ~22% EBITDA CAGR over FY25-28E. At CMP, the stock trades at 20x EV/EBITDA adjusted for rentals and minority. Recommend ‘BUY’ rating with a TP of Rs850/share valuing at 25x on Sept FY27E EV/EBITDA.

* Multi-lever growth engines strengthen visibility: HCG outlined a multi-lever growth strategy that materially enhances medium-term growth visibility. Company intends to optimize existing network backed by improved case mix, focus marketing efforts to become provider of choice across payor types and scale up international business. HCG will develop day care and diagnostic centers which will also free up space in existing network. Company will also leverage its technology leadership with advanced platforms such as CyberKnife and Tomo therapy. With most newer centres turning profitable post-FY22, we believe HCG is structurally well-placed to deliver sustained growth with consistent margin expansion.

* Bed expansion plan of 1,000+ over next 4-5 years: HCG plans to add 1,000+ beds and 10+ LINACs over the next five years, strengthening its oncology leadership across proven and underpenetrated markets. The expansion plan largely is brownfield-led, with ~700 beds planned across Ahmedabad, Vizag, Baroda, Cuttack and greenfield additions of ~200-400 beds in high-potential cities such as Pune, Varanasi supplemented by accretive M&A opportunities. HCG’s capex requirements can be comfortably met through combination of internal accruals and debt. Guided for Rs6bn of capex over next 2-3 years.

* Margins set to accelerate meaningfully: HCG’s pre-Ind AS EBITDA margin of ~13–14% offers significant scope for improvement as the company enters a margin-accretive phase led by base business, brownfield expansions, operating leverage from new LINAC installations, and optimizing case/payor mix. Further GMs to see improvement with better cost procurement mechanisms. We believe KKR’s involvement will accelerate execution and value unlocking, structurally repositioning HCG for long-term growth. Mgmt guided post IND AS margins at 21-22% from current level of 18-19% over next 2-3 years.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271