Buy Tata Steel Ltd For Target Rs. 153 By Elara Capital

Europe turnaround – A step forward

While Tata Steel’s (TATA IN) India operations continue to outperform peers with strong margin, its European operations have remained a drag on consolidated financials. However, today’s announcement focusing on improving the cost structure at Tata Steel Netherland (TSN) marks a positive step towards reducing this drag and should support an improvement in valuation. Also, it will enable TSN to survive in challenging conditions. Domestically, TATA’s performance is expected to benefit in the near term from the ramp-up at its Odisha-based Kalinganagar plant. Also, the proposed 12% safeguard duty on flat steel products should further prop domestic steel prices, reinforcing TATA’s earnings momentum. We maintain our positive stance on TATA with TP unchanged at INR 153. With an upside potential of ~21%, we revise TATA to Buy from Accumulate.

TSN’s transformation program…

With an aim to improve competitiveness of its operations, TSN has announced a transformation program. This program is likely to enable TSN to achieve: 1) maximization in production efficiency, 2) reduction in fixed cost, and 3) improvement in product mix and margin. The management expects to achieve ~15% reduction in controllable cost from FY25 levels through this program. Also, TATA has reiterated its long-term plan to transition to green steel at TSN and accordingly, one of the two blast furnaces will be replaced by a new direct reduced iron furnace and an electric arc furnace by the end of this decade.

…likely to yield savings of ~EUR 550-560mn by FY27:

TATA expects its transformation program to lead to savings of ~EUR 500mn in FY26, and an additional EUR 50-60mn savings in FY27. A significant portion of these savings is expected to come from a planned reduction of 1,600 employees out of TSN’s total workforce 12,000 (savings in the range of EUR 160-180mn). Besides, workforce optimization, other cost saving triggers include improvement in key performance indicators (KPIs), lower repair & maintenance cost and reduction in other controllable costs.

US tariffs – Limited direct impact:

Sales volume from TATA’s Europe operations constitutes ~30% of consolidated volume. As per management, in the case of the UK and Netherland, the exposure to the US market is minimal at ~3% and ~10%, respectively. Thus, at the group level, the direct impact of the US tariff is likely to be limited. However, the management has not yet quantified the indirect impact of the said tariffs for Europe operations.

Revise to Buy; TP unchanged at INR 153:

We will revisit our estimates and TP post Q4FY25 results. So, our SoTP-based TP is unchanged at INR 153, valuing standalone operations at 6.0x (unchanged) March 2027E EV/EBITDA, EU operations at 4.0x (unchanged) March 2027E EV/EBITDA and Others at 4.0x (unchanged) March 2027E EV/EBITDA. But given an upside potential of ~21%, we revise TATA to Buy from Accumulate. Demand slowdown, delayed ramp-up in recently-added capacity, and unprecedented rise in coking coal prices are key risks to our call.

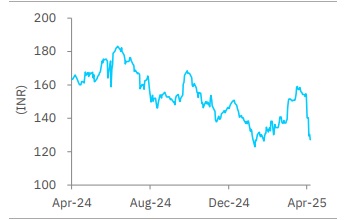

Price chart

Please refer disclaimer at Report

SEBI Registration number is INH000000933