Buy Shree Cement Ltd For Target Rs. 29,857 by Centrum Broking Ltd

Strong results driven by impressive cost control

SRCM reported good results for Q3FY25 with reported EBITDA coming in 5.4% ahead of our estimate, predominantly due to better cost control. While volume declined 1.3% YoY and realization was down 1.5% QoQ (4% below our estimate), EBITDA/mt was still ahead of our estimate owing to 9% YoY and QoQ decline in operating costs. Power & Fuel costs and Other Expenses were down by 25% YoY and 21% YoY, respectively, driving down costs. The company is on track to add massive 15.4mn mt capacity by Q1FY26, which is 28% of its existing capacity. While we expect near term utilization to remain soft, cost optimization measures undertaken by the company will keep overall operating costs in check. Our volume growth assumption of 10-11% during FY26-FY27 is modest, in our opinion. We maintain our positive stance on the company and believe that SRCM will be a beneficiary of recent hikes in Non-trade segment in North and East. We maintain our estimates and BUY rating.

Q3FY25 result highlights

Revenue at Rs42.4bn was down 14% YoY and 1% below our estimate. Volume came in at 8.77mn mt, which was down 1.3% YoY whereas realization was down by 1.5% QoQ. EBITDA at Rs9.5bn was 5% above our estimate while EBITDA/mt came in at Rs1,079 against our estimate of Rs1,052. Operating costs declined 9% both on YoY and QoQ basis due to softer fuel prices and operational efficiency. Both Power & Fuel as well as Other Expenses recorded a sharp double-digit YoY reduction. PAT at Rs2.3bn was down 69% YoY and up 146% QoQ

Surprisingly sharp cut on operating costs

SRCM reported operating cost of Rs3,750/mt, which was down by 9.1% on both YoY and QoQ basis. This was the lowest operating cost/mt reported by SRCM in the last 14 quarters. A sharp reduction in Power & Fuel costs and Other Expenses resulted in lower costs. The company has secured a fuel supply contract at Rs1.5/kcal, effective from Q1FY26, which is expected to boost profitability further by reducing input costs. Other initiatives like increased green power usage, higher AFR usage and increased rail coefficient are likely to result in further cost optimization

Substantial capacity to be commissioned by Q1FY26

SRCM’s ongoing capex includes Jaitaran, Rajasthan (6.0MTPA), Kodla, Karnataka (3.00 MTPA), Baloda Bazar, Chhattisgarh (3.40 MTPA) and Etah, Uttar Pradesh (3.00 MTPA). Cumulatively, these capacities stand at 15.4mn mt, which is 28% of the company’s existing capacity. The company expects to commission all these projects by Q1FY26. We expect the ramp-up of these capacities to be gradual and believe that better volume prospects in FY26 augur well for SRCM to increase utilization of these assets

Valuation and outlook

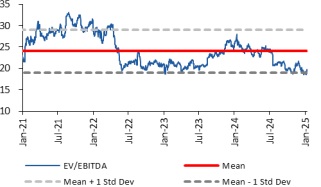

Higher exposure to North and East regions coupled with cost-cutting measures is likely to result in healthy growth in EBITDA/mt for SRCM. Despite heavy capex of Rs40bn+ for the next four years, we expect the balance sheet to remain healthy. We continue to value SRCM at 16x FY27E EV/EBITDA to arrive at our target price of Rs29,857. We maintain our BUY rating

Valuation

We are building in 7%/14% CAGR in revenue/EBITDA for SRCM over FY24-FY27E. We value SRCM at 16x FY27E EV/EBITDA to arrive at a target price of Rs29,857. We have BUY rating on the stock.

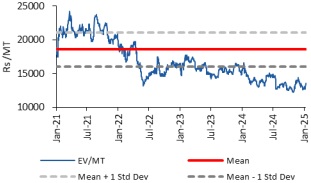

EV/MT mean and standard deviation

EV/EBITDA mean and standard deviation

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331