Buy Senores Pharmaceuticals Ltd For Target Rs. 930 By Sushil Finance

ANDA products to propel sales in Regulated Markets

Senores Pharmaceuticals Limited (Senores) distributes complex generics in the US, Canada, and UK using a combination of proprietary ANDAs (new drug filings) and long-term licensing/distribution arrangements with major pharmaceutical companies. As evidence of its rapidly expanding pipeline, the management reported launching 2 of its own ANDAs in Q1FY26, bringing their total commercialized portfolio to 24 ANDA products as of Q1FY26. Senores’ management envisions the regulated markets segment as its primary growth driver. In Q1 FY26 alone, regulated market revenue surged 69% year-on-year to Rs.90cr, led by incremental ANDA launches.

Scaling up the CDMO Segment in Regulated Markets

Senores has established a contract development and manufacturing (CDMO) business around its Atlanta facility, which now accounts for around 30% of regulated markets sales and is primed for significant expansion. For both branded and generic drug manufacturers aiming towards regulated markets, this category offers end-to-end services (from pre-clinical development to commercial production). The CDMO operations run at relatively high gross margins since Senores leverages existing infrastructure and regulatory assets to service multiple clients simultaneously. The company’s asset utilization at the Atlanta plant has been rising steadily, supported by the ramp-up of customer contracts and repeat business from existing partners.

Portfolio expansion in Emerging Markets

The Emerging Markets (EM) division of Senores, which operates in Asia, Latin America, the Middle East, and Africa, has become a second source of growth, accounting for almost 30% of total sales in FY25. Senores management stated in Q1 FY26 that fresh go-to-market tactics and a changing product mix were resulting in improved profitability in Emerging Markets. Senores profits from this secular tailwind by participating in areas where healthcare spending is on the rise, the prevalence of chronic diseases is rising, and insurance coverage is growing.

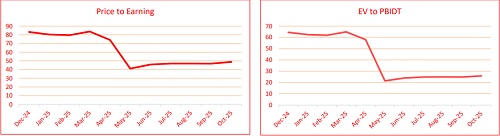

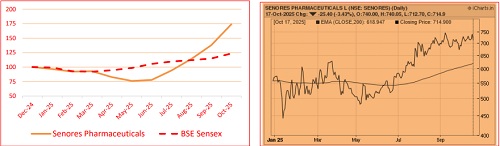

OUTLOOK & VALUATION

Factoring the various positive triggers for the stock, we expect revenue at Rs.696.9cr, EBITDA at Rs.177.7cr at an EBITDA margin of 25.5% and Adjusted PAT of Rs.133.8cr. Given the strong growth outlook, we estimate FY27E EPS at Rs.29.1, and assign a PE multiple of 32x to arrive at a target price of Rs.930, which is an upside of ~28.3% from its last traded price of Rs.725. We initiate coverage on Senores Pharmaceuticals Ltd. with a BUY rating, over an investment horizon of 18-24 months.

Please refer disclaimer at https://www.sushilfinance.com/Disclamier/disclaimer

Member : BSE/ NSE/ MSEI. SEBI Registration No.-INZ000165135