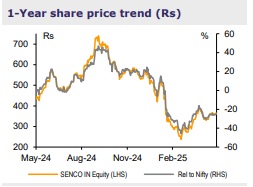

Buy Senco Gold Ltd For Target Rs. 500 By Emkay Global Financial Services Ltd

We maintain BUY on Senco with an unchanged TP of Rs500 (25x Jun-27E EPS), as a 4-5% cut in estimates on higher interest expense is completely offset by rollover to Jun-26E TP. With elevated gold prices, there is a cash crunch on the balance sheet currently; however, D/E levels are comfortable and below historical levels at 0.9x (vs 1.1x YoY); this provides ample room for raising growth capital via debt, in our view. Encouragingly, Senco has also indicated improving franchisee interest, and targets a higher proportion of stores via the franchisee route (vs previous outlook of a ~50% franchisee-led expansion). Q4 performance was ahead of expectations, with a margin-led EBITDA and PAT beat of 30-40%. Retaining its growth outlook, Senco expects 18-20% growth to continue in FY26, along with a 30-40bps increase to the mid-point of the margin outlook vs adj EBITDA/PAT margin of 6.7%/3.2% in FY25. While we build in the top-end of the growth outlook, we stay conservative, with flat adj margin assumptions due to the recent volatility. With focus on attracting GenZ/millennial shoppers, Senco has signed a master-franchisee agreement with light-weight and omni-channel jewelry brand Melorra. Senco has not quantified the planned investments in the new venture, as of now.

Q4 sees robust trends across operational metrics; FY26 margin outlook encouraging:

Senco delivered a 21% YoY growth in consolidated revenue in Q4, supported by 20% growth in gold jewelry sales and a strong 38% growth in diamond jewelry sales. While gold volume declined 6%/3% due to elevated prices in Q4/FY25, diamond volume grew 21%/2%, helping partially offset the pressure. The company added 16 new stores in FY25 (6 franchisee, 9 company-owned, 1 focused on lab-grown diamonds), taking the total count to 175, and has retained its guidance of opening 18–20 stores in FY26, with a higher tilt toward the franchisee model (vs previous outlook of 50-50 expansion). SSG stood at a strong 15% in FY25, helped by ATV increase of 15% (~Rs73,000 in FY25) due to gold-price inflation. Notably, revenue of the non-east region saw faster than expected growth, at 23% to ~Rs12.3bn in FY25 (vs 21% overall growth), thus reinforcing the company's pan-India expansion strategy. On profitability, adjusted EBITDA margin (excustoms duty impact) stood at 6.7% in FY25 vs 7.2% in FY24, suggesting relatively lower volatility on annual basis (vs quarterly trends). Despite multiple margin headwinds in FY25 in terms of heightened competitive intensity on significant rise in gold price, flat studded mix at ~11%, 100bps increase in franchisee mix to 32%, and higher gold exchange (39% mix), Senco was able to protect its EBITDA margin with lower marketing spends, operating leverage, and improved product mix. Senco provided its outlook, of delivering 6.8-7.2% EBITDA margin and 3.5-3.7% PAT margin in FY26 (vs adj EBITDA/PAT margin of 6.7%/3.2% in FY25).

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354