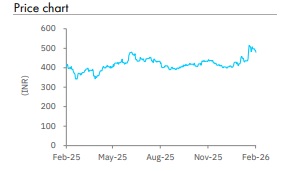

Buy Oil India Ltd for Target Rs 575 by Elara Capitals

The stock price of Oil India (OINL IN) has risen 10% in the past three months, outperforming the benchmark Nifty Index, up 1%, due to the recent ~10% rise in Brent crude oil price. S tandalone PAT fell 34% YoY due to a 15% YoY drop in crude oil realization and higher provisions, but consolidated PAT was broadly flat YoY due to strong contribution from Numaligarh Refinery (NRL). OINL is transitioning from a pure upstream play to a more integrated upst ream and refining firm , with rising downstream refining capacity at NRL to act as upstream earning s stabilizer. The key re -rating trigger is the NRL refinery ramp up in FY27 and FY28 , that would also offer ~ 20% gas production growth visibility , while near -term performance re mains oil -price sensitive. We retain BUY led by improving earnings mix with NRL expansion and gas production growth . Withdrawal of Mozambiique LNG (from force majeure ) and Andaman exploration remain longer -term optionalities.

We cut FY27E and FY 28E EBITDA estimates by 8% and 7%, on lower crude oil prices at USD 65/bbl (from USD 70/bbl), partially offset by assuming weaker INR at 91.6/USD (from 87.8/USD) . We roll -over TP to FY28 E estimates and thus raise it to INR 575 (from INR 536). Reiterate BUY.

Q3 standalone PAT down 34% YoY, led by lower crude oil realization; consolidated PAT flat YoY%: Q3 standalone EBITDA was down 3 8% YoY, largely reflecting lower crude realizations and higher costs/provisions. Similarly, PAT de -grew 34% YoY. PAT was higher tha n our estimates of INR 3.9bn due to lower exploratory write -offs/provision at INR 5.0bn versus our expectation of INR 9.8bn . However, consolidated PAT remained broadly flat YoY at ~INR 14.4bn ( versus INR 14.6bn), as strong GRM at NRL (USD 16.3/bbl, +675% YoY ) cushioned against upstream weakness . Oil output rose 1% QoQ and gas production was flat QoQ.

Gas production guidance contingent on pipeline connectivity: Oil production has been guided at 3.8mn tonne s for FY27 and 4.0mn tonne s for FY28. Gas production target is 13mmscmd by FY28 from current ~ 9mmscmd but it is contingent on pipeline infrastructure being set up – Indradhanush Gas Grid (IGGL) and NRL -IGGL hook -up pipelines in next 1.5 years . We conservatively assume ~12mmscmd gas production by FY28 E .

NRL refinery and DNPL pipeline – Progress on track: NRL’s full ramp -up target has been set at 9mn tonne s by Q1FY28 . DNPL gas pipeline has been completed and would start from Q1FY27, which would support NRL gas demand of 3.0mmscmd from current 1.0mmscmd

Retain Buy with a higher TP of INR 575: We cut FY27E and FY28E EBITDA estimates by 8% and 7%, on lower crude oil prices at USD 65/bbl (from USD 70/bbl). We roll -over our TP to FY28 E estimates and raised TP to INR 575 (from INR 536). We retain BUY on improving earnings mix with NRL expansion and gas production g rowth. Withdrawal of Mozambique LNG (from force majeure ) and Andaman exploration are longer -term optionalities. We value OINL on SOTP, valuing standalone operations at 7.5x ( from 8.0x ) FY2 8E EV/EBITDA. We assume FY2 8E APM gas at USD 7. 0/mmbtu (unchanged). We value OINL’s 69.6% stake in NRL at INR 1 85/share at 6.0x FY2 8E EBITDA (from INR 177/share) on USD 10/bbl GRM .

Please refer disclaimer at Report

SEBI Registration number is INH000000933.