Buy Nippon Life India AMC Ltd For Target Rs. 750 by Motilal Oswal Financial Services Ltd

Tax reversal and other income drive PAT beat

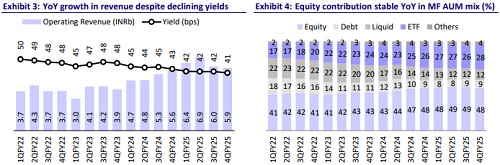

* Nippon Life India AMC (NAM)’s operating revenue grew 21% YoY to INR5.7b (in line) in 4QFY25. Yields declined to 40.7bp from 41.3bp in 4QFY24. NAM’s FY25 revenue came in at INR22.3b, recording a growth of 36% YoY.

* Total opex grew 13% YoY to INR2b (in line) in 4QFY25. As a result, EBITDA rose 26% YoY to INR3.7b (in line) for the quarter. This led to an improvement in EBITDA margin to 64.5% from 62.1% in 4QFY24.

* PAT stood at INR3b in 4QFY25 (10% beat; -13% YoY), largely due to tax reversal and higher-than-expected other income. For FY25, the company’s PAT grew 16% YoY to INR12.9b.

* Equity yield stood at 57bp, and management continues to expect a 2-3bp dip YoY going forward. In FY26, the company expects a cost increase of 15% ex-ESOP, with employee cost growth at 14-15% as well. The tax rate should remain in the range of 24-25%.

* We broadly retain our earnings estimates, keeping our AUM assumptions intact and accounting for expense growth according to the management guidance. We reiterate our BUY rating on the stock with a TP of INR750, based on 34x FY27E core EPS.

Market share continues to expand

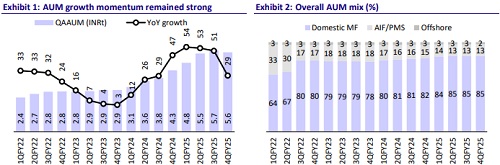

* Overall MF QAAUM grew 29% YoY to INR5.6t. Equity/ETFs/Index/Debt funds saw a YoY growth of 31%/38%/57%/27%.

* NAM’s market share for QAAUM rose 30bp YoY to ~8.3%, with equity market share rising 10bp YoY to ~6.9%. ETF market share continues to surge and was up 236bp YoY at 19.1% with NAM maintaining a dominant position in this space.

* The share of Equity/ ETFs in MF AUM improved 60bp/170bp YoY to 49.8%/ 27.6%. However, the share of Debt/Liquid declined to 15.0%/7.6% and a softer interest rate regime will drive growth for this segment.

* SIP flows of INR97.2b were reported in 4QFY25 compared to INR70.1b in 4QFY24, reflecting a monthly SIP inflow of INR32.4b (+39% YoY). The SIP book grew to INR1.3t (+32% YoY).

* Employee costs grew 25% YoY to INR1.1b with continued investment on headcount addition, while other expenses grew 5% YoY to INR750m.

* Other income came in at INR230m (61% beat; -75% YoY), impacted by the adverse capital market.

* The distribution mix remained largely stable, with IFAs dominating the mix (56% share), followed by banks at 25% and national distributors at 19%.

* NAM’s retail/ HNI/ corporate AUM mix stood at 29%/ 30%/ 41% for 4QFY25 with retail/HNI market share at 9.2%/7.4%.

* On the AIF front, fundraising is underway for two public equity AIFs, one private credit AIF, and a VC AIF. NAM reported the highest AIF inflows in FY25 (2.2x of FY24).

Key takeaways from the management commentary

* The SIP book has started to moderate for the industry due to market volatility. NAM is focused on diversifying products to attract investors towards SIP and maintain momentum.

* Over the last two months, liquidity in the MF industry has gone up in expectation of a moderate rate scenario. Further, FDs nearing maturity will be rolled over at a lower yield, due to which MF schemes will become beneficial for investors. If the softer regime continues, there will be inflow into short-term and medium-duration funds.

* A new scheme launched in Japan gives access to Japanese investors in India, and NAM will be a great beneficiary of this scheme. The management expectsJapanese retail money to come into India in a few years through this scheme.

Valuation and view: Reiterate BUY

* NAM has shown continued market share expansion, especially in passives on the back of improvement in fund performance, maintaining investor stickiness and product innovation. While the yields on the equity segment are expected to decline at a relatively moderate pace, the decline in overall yields will be protected by strong net flows.

* We broadly retain our earnings estimates, keeping our AUM assumptions intact and accounting for expense growth according to the management guidance. We reiterate our BUY rating on the stock with a TP of INR750, based on 34x FY27E core EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412