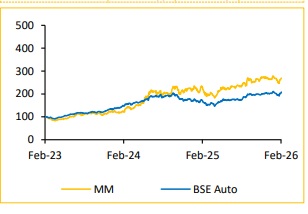

Buy Mahindra & Mahindra Ltd for the Target Rs. 4,450 by Choice Institutional Equity

Sustained Momentum across ICE and EV Segments: MM continues to solidify its leadership in the automotive sector, delivering a 26% increase in SUV volumes and maintaining its number one position in revenue terms. The company demonstrated strong pricing power and brand appeal, evidenced by the XUV 7XO, where over 70% of demand favours top-tier variants. This product mix supported healthy profit margin, which expanded by 90 basis points to 10.4% on a standalone basis, excluding Labour Codes’ impact and eSUV. Furthermore, the company is successfully executing its electric vehicle transition. EV sales surpassed 41,000 units, averaging 4,000 per month, with the new 9S model gaining traction among customers seeking conventional SUV designs. To sustain this growth, the management has outlined aggressive capacity expansion plans, aiming to add 6,000 to 7,000 units per month by mid-2026, followed by significant capacity addition from a new plant in Chakan in 2027 and a greenfield facility in Nagpur by 2028.

Strong Farm Performance Supported by Structural Rural Tailwinds: The Farm segment delivered strong performance, with volumes up 23% and tractor EBIT margins at 21.2%, close to peak levels. The company continues to lead the industry with over 44% market share, reflecting strong brand strength, pricing power and scale advantages. Rural fundamentals remain supportive, driven by healthy reservoir level, continued government spending and stable farmer incomes, providing good demand visibility. Strategic capacity expansion in Nagpur signals management’s confidence in long-term industry growth outlook of around 9% CAGR.

View and Valuation: We marginally revise our FY26/27/FY28E EPS estimate and maintain our target price at INR 4,450, valuing the company at 25x (unchanged) on FY28E EPS, along with subsidiary valuation. We reiterate our ‘BUY’ rating on the stock, supported by M&M’s strategic focus on premium product portfolio expansion and anticipated recovery in rural demand.

Q3FY26 result was largely in line with estimate

* Revenue was up 26.1% YoY and up 15.2% QoQ to INR 3,85,168 Mn (vs CIE est. at INR 3,95,152 Mn), led by 23.9% YoY growth in volume and 1.7% YoY growth in both, automotive and tractor segment ASP.

* EBITDA was up 26.8% YoY and up 16.6% QoQ to INR 56,676 Mn (vs CIE est. at INR 57,692 Mn). EBITDA margin was up 8 bps YoY and up 17 bps QoQ to 14.7% (vs CIE est. at 14.6%).

* APAT was up 35.9% YoY and down 10.9% QoQ to INR 40,295 Mn (vs CIE est. at INR 40,008 Mn).

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131