Buy L&T Finance Ltd For Target Rs.170 by Motilal Oswal Financial Services Ltd

Navigating challenges and pivoting for long-term resilience

Benefits of Cyclops and Nostradamus projects will be visible from 2HFY26

* L&T Finance (LTF), much like its MFI industry peers, is also navigating a tough period in microfinance but has admittedly exhibited much better asset quality performance (or lower credit costs) in the current MFI credit cycle. While there are still events such as the Karnataka Ordinance (which has disrupted industrywide collections in the state) and the upcoming implementation of MFIN guardrails 2.0, which would make the MFI stress linger around for longer (than currently expected), LTF could eventually emerge relatively less impacted compared to other MFI lenders.

* LTF recently forayed into the gold loans business through a proposed inorganic acquisition of Paul Merchants Finance on a slump sale basis. This acquisition will enhance the company’s secured retail portfolio, extending its footprint across 11 states with 130 branches and a customer franchise exceeding 98K. This acquisition will accelerate its gold loan business’ time-to-scale by 36 months. We expect gold loans to start contributing to LTF’s retail loan growth by end-FY26.

* LTF is at the forefront of tech transformation, developing future-ready solutions to enhance efficiency. AI/ML-driven initiatives such as: 1) Project Cyclops for credit underwriting will improve throughput and the customer mix and lower delinquencies, and 2) Project Nostradamus for predictive risk management will be capable of aging analysis and putting out risk models to identify customers with a high propensity to default. In our opinion, the implementation of both Cyclops and Nostradamus can structurally reduce credit costs for LTF, but the benefits will be visible from 2HFY26 onwards.

* LTF had earlier slowed down its personal loans (PL) business to calibrate its underwriting in the segment and improve customer quality. The company has now started scaling up its PL business with its omnichannel digital architecture, reimagined customer journeys, use of AI-ML technologies derived models, and end-to-end digital journeys through its partnerships with Amazon, CRED, and PhonePe. LTF will focus on identifying resilient customers, which will provide sustainable loan growth while keeping credit costs within acceptable limits. We expect the company to enter into a few more large partnerships over the next 3-12 months and accelerate its loan growth in the PL segment.

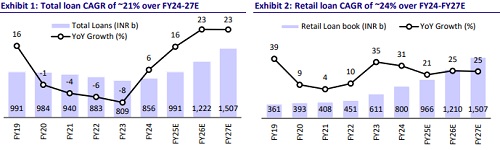

* Going forward, we expect LTF’s growth in MFI loans to be more opportunistic in nature, given that it targets to bring down the MFI loans in the loan mix to 20-22% over the long term. The company's development of Cyclops sets it apart, enabling precise identification of resilient customers and the construction of a robust portfolio. We estimate a loan CAGR of ~21% and PAT CAGR of ~22% over FY24-FY27, with a consolidated RoA/RoE of 2.7%/~14% by FY27. Beyond the current stress in MFI, the company will continue to deliver an improvement in profitability and RoA expansion. Reiterate BUY with a TP of INR170 (based on 1.4x Sept’26E BVPS).

Rural business and MFI: Why has LTF outperformed peers?

* LTF proactively detected early delinquency trends and implemented stringent sourcing controls, including restricting disbursements to customers with LTF+3 lender associations. The company tightened its MFI underwriting norms from Jan’24, prioritizing risk management over repeat customer loans. LTF has remained disciplined in its MFI operations – focusing on collections and pausing disbursements whenever/wherever collection efficiency dips below 98%.

* Stringent implementation of MFIN guardrails significantly reduced LTF’s exposure to customers with LTF+>=4 lender associations, which declined to ~3.9% in Dec’24 from ~7.0% in Jun’24. In contrast, NBFC-MFI peers reported a much higher range of ~9-16% for five or more MFI lender associations as of Dec’24. This underscored LTF’s proactive risk management measures and commitment to curbing customer overleveraging through strict adherence to MFIN guidelines.

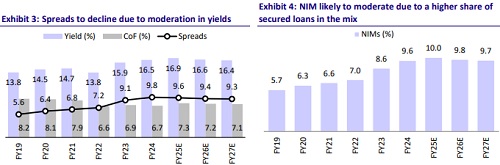

NIM moderation can be offset by a decline in cost ratios & lower credit costs

* LTF will expand the share of secured products in its loan mix and target a 65:35 secured and unsecured loan mix. The company is strengthening its focus on prime segments in 2W financing, whose share rose from ~35% in Dec’23 to ~49% in Dec’24, while the share of MFI loans in the loan mix has declined over the last two quarters by ~150bp to ~28%. Gradually, we also see secured products like gold loans and micro-LAP, gaining more traction.

* LTF’s recent foray into the gold loan business will be NIM/EPS accretive, as gold financiers typically operate with margins ranging around 11%-13%. We model NIMs of ~9.8%/9.7% in FY26/FY27 (vs. ~10% in FY25E).

* Product mix pivoting toward secured loans will indeed result in NIM moderation for the company. However, LTF is well-equipped to offset the impact on NIM through improved productivity resulting in lower cost ratios, reduced collection costs, and structurally lower credit costs.

Leading the way in technology and analytics by leveraging AI

* With a robust focus on artificial intelligence (AI), machine learning (ML), and data-driven decision-making, LTF is redefining its financial services landscape. Key initiatives such as the AI-powered credit-underwriting engine, Project Cyclops, and the predictive risk management system, Project Nostradamus, will revolutionize the company’s credit evaluation and portfolio monitoring.

* LTF has observed notable benefits from Project Cyclops, its next-generation credit underwriting engine, particularly in two-wheeler (where 100% dealer coverage has been completed). By integrating Credit Bureau data, Account Aggregator (AA) insights, and Trust Signals, Cyclops has improved credit decisioning, leading to more accurate risk assessment and lower early delinquencies. Early results show that Net 0+ delinquency in the two-wheeler segment has dropped by 120bp over four months, indicating enhanced portfolio quality.

* Looking forward, LTF is expanding Cyclops to Farm Equipment Finance, where it has already begun phase-wise deployment since Dec’24. Future enhancements will focus on leveraging satellite and meteorological data for risk assessment in agri-financing, improving customer profiling, and extending Cyclops to other retail lending segments like personal and SME loans. The benefits of Project Cyclops are expected to materialize from 2HFY26 onwards.

Valuation and view

* LTF has invested in process automation and customer journeys. This, along with large partnerships with digital behemoths, should lead to stronger and more sustainable retail loan growth. While there are industry-wide signs of stress in non-MFI retail segments like 2W, tractors, and PL, we expect the stress to subside within the next few quarters. Stress in the microfinance sector is a nearterm headwind, which the company will navigate and come out stronger.

* LTF's relatively better navigation of the MFI crisis and diversification into nonleveraged MFI markets demonstrate its resilience and adaptability. Supported by digital partnerships with major players such as Amazon and PhonePe, L&T Finance is poised for a potential rerating and sustainable earnings growth once the near-term headwinds in the MFI business subside.

* LTF can deliver a PAT CAGR of ~22% over FY24-FY27E, which will result in a RoA/RoE of 2.7%/14.1% in FY27E. We reiterate our BUY rating on the stock with a TP of INR170 (based on 1.4x Sep’26 P/BV).

* Key risks: 1) stress in microfinance lingering beyond the next 2-3 quarters, 2) asset quality deterioration in relatively vulnerable retail segments such as PL and 2W, and 3) near-term compression in NIM and fee income.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)