Buy KPIT Technologies Ltd For Target Rs. 1,400 By JM Financial Services

Growth in sight

KPIT’s 2Q results were broadly in-line. Revenues grew 0.3% cc QoQ (JMFe: 0.1%) net of 2.3% cc QoQ decline in organic revenues (JMFe: -2.6%). EBITDA margins held up, as expected. Bookings were healthy with USD 232mn TCV, at 1.3x book-to-bill. Besides, KPIT won a USD 100mn+ SDV transformation deal from a European OEM group, majority of which will be booked in subsequent quarters. That said, deal wins have not been a challenge for KPIT. Revenue conversion has been. Type of KPIT’s work – shorter tenured, development-linked – meant its book-to-bill conversion was almost 100% (limited leakage) earlier. This relationship however broke over the past four quarters, with leakage (gap between TCV-implied and actual revenues) expanding to double digits, per our estimates. Management echoed this. They mentioned that their book of business eroded by USD 65mn within past one year on account of a) USD 45mn due to deferral/reprioritisation of Electrical/Middleware spends of OEMs; and b) USD 20mn due to proactive cannibalisation by KPIT. That also means that ceteris paribus, attenuating leakages alone can trigger growth rebound. This is possibly informing management’s confidence of a stronger 2H, without any support from macro. Stronger exit makes our double digit FY27E revenue growth estimates reasonable as well. Though our changes to our FY26-28E EPS is limited (1-2%), confidence on earnings is now up. Retain BUY with a revised TP of INR 1,400.

* 2QFY26- largely in-line: KPIT reported 0.3% cc QoQ growth vs JMFe: 0.1%. Revenue in USD terms grew 1.8% QoQ in-line with JMFe. Caresoft consolidation added 2.5% to growth, implying an organic revenue decline of 2.3% QoQ cc. Growth was led by Europe (+13% QoQ USD), Commercial Vehicle (+20%QoQ) and cloud based connected services (+10%). Fixed price revenues increased 6% QoQ. EBITDA margins (adj, for FX loss) increased slightly (QoQ) to 21.1%, in-line with JMFe/Cons. :21%. Margins were aided by operational efficiency and INR depreciation. PAT declined 5% QoQ to INR 1,691mn missing JMFe : INR 1,873mn. PAT was impacted by FX loss (INR 144mn), Loss from Qorix (INR 227mn vs a run rate of c.50mn) and additional amortization (INR 43mn) and finance cost (INR 47mn) due to Caresoft consolidation. PAT from core business was reported to be c.INR 1.9bn, in-line with JMFe. 2Q saw net headcount addition of 334 (c.800 added from Caresoft and c.500 reduced from core business).

* Outlook – Recovery in sight: KPIT expects a return to flattish organic (cc) growth in 3Q, with an acceleration in 4Q driven by large deal ramps. Management expects a meaningful recovery in FY27, supported by stronger demand and halving of tariff uncertainty. KPIT is also exploring adjacencies to drive growth. Europe (Pas Cars), CV (in US), India and China within Asia, and domains such as Cybersecurity, Autonomous, and Aftersales Diagnostics are expected to lead growth. KPIT won USD 232mn in deals (LTM up 15% YoY), including a large deal with an European OEM group of over USD 100mn -a 3-year deal spanning multiple domains. The contrast of flat revenues but strong deal wins was attributed to USD 65mn (LTM) revenue erosion, comprising USD 45mn from client spend reprioritization and USD 20mn from cannibalization. Reprioritisation could taper down, per management. Management expects margins to be stable around 21% despite wage hikes, aided by fixed-price productivity, AI, solutioning/productization, and pyramid optimization. PAT may, however, see some impact due to higher amortization (Caresoft) and fluctuating losses from the Qorix JV.

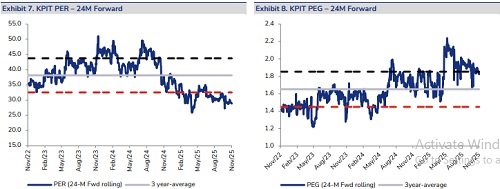

* EPS raised by 1-2%; Retain BUY: We have slightly lowered FY26E growth expectations while largely maintaining FY27-28E. We have also marginally lowered our EBITDA margins. Adj. PAT sees 1-2% increase driven by lower taxes. We revise our TP to INR 1400. Maintain BUY.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361