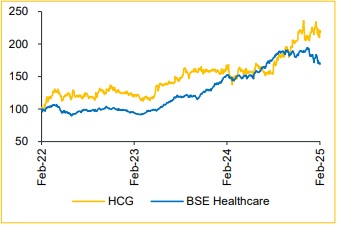

Buy Healthcare Global Enterprises Ltd For the Target Rs. 621 by Choice Broking Ltd

KKR acquires 54% stake in HCG, set to assume operational control KKR, via Hector Asia Holdings II, will acquire a 54% stake in HCG for USD 400 Mn at INR 445 per share and make an open offer for an additional 26% at INR 504 per share, with completion expected by Q3 CY25. HCG’s founder, Dr. BS Ajaikumar, will transition to Non-Executive Chairman as KKR takes operational control. As India’s largest oncology hospital chain, with 25 hospitals and 2,500 beds, HCG plans to expand capacity by adding 900 beds over the next three years.

KKR's investment signals confidence in India's oncology market

Oncology is a significant growth driver in India’s healthcare sector, with the market valued at approximately USD 5 Bn and projected to grow at a CAGR of 12-15%. Oncology performance of other coverage companies:

* Max Healthcare: Oncology revenues grew from INR 10,756 Mn in FY22 to INR 17,123 Mn in FY24, a 59% increase.

* Global Health: Oncology revenues increased from INR 2,387 Mn in FY22 to INR 3,831 Mn in FY24, up 61%.

* Yatharth: Oncology revenues jumped from INR 200 Mn in FY22 to INR 335 Mn in FY24, marking a 67% increase. KKR’s investment in HCG highlights its commitment to the flourishing oncology market in India, reinforcing its track record of investing in the healthcare sector

A history of success:

KKR’s playbook for healthcare investments KKR has established itself as a leading investor with a strong track record of creating value through strategic investments in India’s healthcare sector. Over the years, it has built a strong track record in the healthcare sector by scaling up businesses through global best practices, operational efficiencies, and strategic partnerships.

Notable examples include:

* Max Healthcare: Acquired in 2018 when the EBITDA margin stood at 7%. By the time KKR exited in 2022, Max Healthcare’s EBITDA margin had grown to 24%.

* JB Chemicals & Pharma: Acquired in 2020 with an EBITDA margin of 21%. Although KKR has not exited yet, JB Chemicals’ margin reached 26% in FY24. These successes highlight KKR’s ability to drive operational improvements and enhance value within its healthcare investments

View and Valuation:

We believe HCG will benefit from KKR’s strategic expertise, given its strong track record in scaling businesses. With oncology being a high-growth segment in Indian healthcare, KKR’s focused approach is expected to strengthen HCG’s market position. We anticipate margins to improve under the new leadership, rising from 17% in FY25E to 21% in FY27E. We value the company at 15x FY27 EV/EBITDA, arriving at a target price of INR 621 per share, and maintain a ‘BUY’ rating

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131