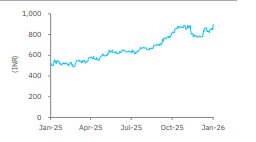

Buy Indian Bank Ltd for Target Rs.800 by Elara Capitals

Good quarter, but valuations rich

Indian Bank (INBK) reported yet another steady quarter with steady progress across key variables. That said, Q3FY26 PAT of INR 30 .6bn was lower than our estimates , given higher credit costs as the bank continued to shore up buffer (in anticipation to smoothen ECL impact). The key highlights were, NII growth of 5.3% QoQ, supported by a 6 bps QoQ improvement in domestic NIMs , b) steady asset quality trends with slippages contained at ~ INR 10bn and GNPA/NNPA at 2.23%/0.15%, although SMA -2 levels inched up due to a couple of PSU accounts. Going ahead, key monitorable include the sustainability of ~1.3% ROA (given core PPOP growth of ~1.3% QoQ), limited headroom for further NIM expansion, and uncertainty around ECL implementation if adopted largely in its current draft form. INBK has gained ~10% in the past three months and in the absence of visible near -term catalysts and with the risk -reward turning unfavorable at current valuations (1.3x FY27E P/BV), we revise INBK from Reduce to Sell, while revising our TP to INR 800 from INR 730 (as we roll over to December ’27E)

NIMs playout better, durability warrants a watch: NIMs expanded by 5 bps QoQ to 3.28%, thus, resulting in a 5.3% QoQ growth in NII. The improvement was largely supported by lower funding costs, despite a moderation in asset yields. Loan growth remained healthy at 15.4%YoY / 3.4% QoQ (secular growth across targeted segments ). In line with industry trends, management highlighted that deposit mobili zation continues to remain challenging, which might require reliance on alternative funding sources. Against this backdrop, the repricing of the repo -linked loan book, coupled with limited room for further deposit rate cuts, could constrain incremental NIM expansion in the near term. Additionally, the domestic CD ratio has edged up to ~79%, which reduces headroom for growth, requiring the bank to manage the trade -off between growth, funding -mix, and margins.

Asset quality holding up well: Slippages were contained at < INR 10bn (0.69%, down 10 bps QoQ), supporting an improvement in headline asset quality. However, SMA -2 levels increased due to the slippage of some PSU corporate accounts (~ INR 30bn), resulting in an uptick in SMA (1 & 2) to 0.81% from 0.41%. Unlike peers that have quantified their ECL impact, the bank has not disclosed a specific number, though management indicated that the impact would be absorbed within the regulatory transition timeline —making outcomes a key monitorable. That said, PCR (excl TWOs) of over +93%, along with sustained recovery momentum, Provides comfort, even as credit cost trends remain under watch amid ECL implementaion.

Revise to Sell with TP raised to INR 800: INBK is clearly among the most consistent player s within PSU banks. Not only on reported basis, but also on core operating level , it has improved consistently. The challenge is INBK has performed well (~10% in the past quarter) and now trades at 1.5x FY27E P/BV for core ROA/ROE of 1.1%/14 -15%, respectively. Despite having performed well, tailwinds to earnings are limited and near -term price catalyst lacking . So, we revise to Sell from Reduce with a higher TP of INR 800 from INR 730 (as we roll over to December 2027E) .

Please refer disclaimer at Report

SEBI Registration number is INH000000933.