Buy Gland Pharma Ltd for the Target Rs.2,340 by Motilal Oswal Financial Services Ltd

Strong margin gain boosts PAT by 50% YoY

Reviving core markets and driving Cenexi efficiency

* Gland Pharma (GLAND) posted revenue in line with our estimate in 1QFY26. However, EBITDA/PAT exceeded our estimates (13%/16% beat). Strong traction in Europe, Canada, Australia, NZ and the rest of the world, along with better operational efficiency at Cenexi, led to improved performance for the quarter.

* After four quarters of earnings decline, GLAND delivered strong 50% YoY growth in earnings for the quarter.

* Strong 20% YoY growth in Cenexi revenue led to improved operating leverage, driving EBITDA break-even in 1QFY26. The profitability is expected to further improve 2HFY26 onward.

* GLAND’s core market sales remained moderate due to lower off-take of Enoxaparin for the quarter. Having said this, new launches across core markets will improve the outlook of more markets going forward.

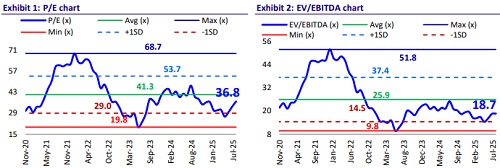

* We raise our earnings estimates by 9%/3% for FY26/FY27, factoring in a) scale-up of GLP-1 products in other core markets, b) faster turnaround of Cenexi and c) potential launches in the US/EU. We value GLAND at 33x 12M forward earnings to arrive at a TP of INR2,340.

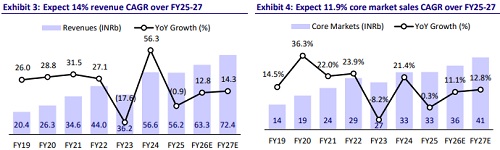

* After three years of earnings decline, we expect a CAGR of 14%/20%/27% in revenue/EBITDA/PAT over FY25-27. GLAND is fortifying its positioning in the complex injectable space through in-house product development as well as partnerships. It is in the process of adding capacity to cater to upcoming GLP-1 opportunities as well. Considering 1Q earnings growth and valuation, we maintain BUY on the stock.

Modest revenue growth; strong profitability uplift in 1QFY26

* 1QFY26 revenues grew 7.4% YoY to INR15b (our estimate: INR15.2b). The base business (ex-Cenexi) grew 3% YoY to INR10.4b.

* Core markets sales rose 2% YoY to IN8.5b (56.8% of sales). RoW sales increased by 4% YoY to INR2.4b (10.2% of sales). India sales grew 13%YoY to INR594m (4% of sales).

* Gross margin (GM) expanded 560bp YoY to 65.4% due to a cut in the cost of finished goods purchase and a favorable change in the product mix in the business.

* EBITDA margin expanded by 560bp YoY to 24.4% (our estimate: 21%), led by better gross margins. Higher employee costs (+170bp YoY as % of sales) were offset by lower other expenses (down 170bp YoY as % of sales).

* Excl. Cenexi, EBITDA margin was 34.5% (up 550bp YoY). The milestone income/profit share for the quarter was 9%/12% of the base business sales for 1QFY26.

* EBITDA grew 39% YoY to INR3.7b (our estimate: INR3.3b) owing to lower revenue.

* Adj. PAT surged 50% YoY to INR2.2b (our estimate: INR1.9b).

Highlights from the management commentary

* Gland guided for mid-teens YoY growth in revenue for FY26 and EBITDA margin of 24-25% for FY26.

* While Cenexi achieved EBITDA breakeven in 1QFY26, it might see subdued performance in 2Q due to summer shutdown. In the subsequent quarters, the profitability is expected to improve on the back of a healthy order book and reduced downtime.

* US sales for the quarter were impacted by reduced sales of Enoxaparin (INR700m in 1QFY26 vs. INR1.4b QoQ/YoY).

* Gland indicated g-Dalbavancin to be a potential opportunity for the US market from Sep’25 onward. The CMS contract for US/EU markets would also support growth in those markets for FY26.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412