Buy EPL Ltd for the Target Rs. 270 by Motilal Oswal Financial Services Ltd

All regions deliver healthy growth In-line operating performance

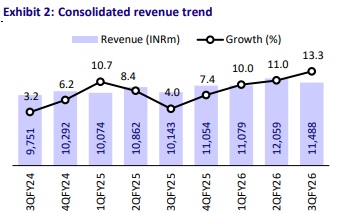

* EPL reported revenue of INR11.5b (up 13% YoY) in 3QFY26, in line with estimates, driven by revenue growth across geographies. The Americas posted the highest growth of 19% YoY on the back of robust revenue growth in Brazil. EAP/AMESA/EU delivered 18%/10%/8% YoY growth, with strong growth of ~26% YoY in Beauty & Cosmetic (BNC), while oral care reported muted growth of 2% YoY.

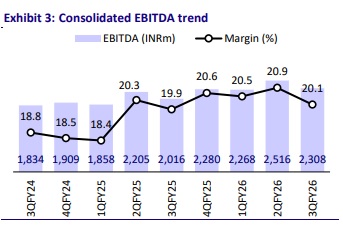

* EPL continued its trajectory of margin expansion (up 20bp YoY), supported by AMESA/EAP/Americas (up 130bp/170bp/80bp). Europe recorded a margin contraction of 640bp due to operational challenges, which, the company indicated, is improving, resulting in a gradual margin recovery. Further, EPL maintains its long-term double-digit growth guidance and expects EBITDA to grow slightly higher than revenue, driven by an increase in the mix of BNC and sustainable products; and higher growth from emerging geographies (Brazil and Thailand).

* We maintain our estimates for FY26/FY27/28 and value the stock at 14x FY28E EPS to arrive at our TP of INR270. Reiterate BUY.

Marginal EBITDA expansion offset by weak EU performance

* Consolidated revenue grew 13% YoY to INR11.5b (est. in line). Gross margin stood at 60.6% (up ~40bp YoY). EBITDA margins expanded ~20bp YoY to 20.1% (est. 20.1%). EBITDA stood at INR2.3b (est. in line), up 14% YoY.

* Adj. PAT declined 3% YoY to INR907m (est. INR973m), adjusted for the INR53m impact of labor code change and the INR67m expense related to the closure of a factory unit in one of its subsidiaries.

* Revenue from AMESA/EAP/Americas/Europe grew 10%/18%/19%/8% YoY to INR3.9b/INR3b/INR3.2b/INR2.4b.

* EBITDA margins for AMESA/EAP/Americas expanded 130bp/170bp/80bp to 19%/23%/20%, whereas Europe EBITDA margin contracted 640bp to 12%.

* EBITDA for AMESA/EAP/Americas grew 18%/27%/24% YoY to INR737m/ INR675m/INR659m, whereas Europe EBITDA declined 30% to INR292m during the quarter.

* For 9MFY26, revenue/EBITDA/adj PAT grew 11%/17%/21% YoY to INR34.6b/INR7b/INR3b. Our implied 4Q revenue/EBITDA/PAT growth is 12%/16%/3%.

Highlights from the management commentary

* Europe: Margin was impacted by short-term operational issues such as higher write-offs, higher outsourcing and production issues, Christmas holidays, and an adverse mix. The company has consolidated some operations to reduce costs, which can drive margin expansion in the coming quarters

* EAP: 3Q results were majorly driven by China performance. EPL initiated commercial production in Thailand plant in Nov’25. There was a factory closure in China mainly due to a customer moving its facility closure to another faculty of EPLL. There are no capacity cuts and machines are operating in another facility.

* Personal care and beyond: Under the personal care and beyond category, B&C delivered robust growth of 26% with all regions delivering at least 20% growth. The company has built frontend and backend capabilities to grow this segment, i.e., building the center of excellence in Mumbai that focuses on innovations. EPLL is also investing in extruded capacities. B&C’s market size and growth are twice that of the Oral segment.

Valuation and view

* EPL continues to deliver a healthy operating performance across geographies (except Europe), supported by healthy demand, product innovations, an improving sustainable mix (38% of total volume), and continued capacity expansion. We expect this positive trend to continue.

* With a focus on improving market share across geographies in the BNC segment and an expected recovery in Europe, we expect a CAGR of 11%/13%/21% in revenue/EBITDA/adjusted PAT over FY25-28. We value the stock at 14x FY28E EPS to arrive at our TP of INR270. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412