Buy Dr. Lal PathLabs Ltd For Target Rs. 3,475 By Emkay Global Financial Services Ltd

Despite a muted season and unfavorable base, DLPL continues to deliver a steady performance, with revenue and EBITDA improving 11% each YoY. Uniform double-digit growth across clusters suggests brand strength, and reinforces our view that a benign pricing environment offers an advantage for organized incumbents. Upgradation of test infrastructure, reinvigorating channel mix, and balanced expansion should help sustain volume growth in coming years, per the management. We expect revenue/EBITDA CAGR of 12% each over FY25-28E, given the shift toward organized players and improving contribution of Swasthfit, offsetting investments in specialized testing capabilities and digital initiatives. While it is still in the pilot stage, we remain watchful of DLPL’s foray into advanced radiology, given the asset-heavy nature of the business. Strong net-cash balance sheet, industry-leading margin, and stable return ratios provide comfort on valuations. Our estimates are largely unchanged, while we nudge up TP by 5.3% to Rs3,475, as we roll forward to Sep-26E (based on DCF method), implying FY27E PER of 48x (in line with LTA).

Another textbook quarter; margin performance continues to be robust

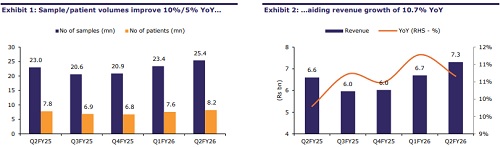

For Q2FY26, DLPL reported revenue growth of 10.7% YoY on the back of sample volumes increasing 10.4% YoY and flattish realizations. Gross margin narrowed slightly by 13bps YoY which can be attributed to a narrowing contribution from the Swasthfit portfolio (Q2FY26: 26%). EBITDA margin was stable at 30.7%, with increase in expenses at par with revenue growth. D&A expenses grew 15% YoY, while other income grew 13% YoY; interest cost reduced further to Rs48mn (down 20% YoY), while tax expenses too narrowed by 2%. As a result, PAT grew 16% YoY to Rs1.5bn. The company has announced an interim dividend of Rs7/share for the quarter and the Board has approved a 1:1 bonus issue.

Outlook and risks

The management plans to continue investing in IT and digital integration, and provide innovation-led offerings to differentiate among organized players, including becoming India's first lab to deploy deep learning AI for cancer micro-metastasis detection. Sustained network investments (15-20 new labs and 600-800 collection centers) in FY26, along with investments in specialized genomics testing, are aimed at fortifying its footprint despite rising competition from hospital-backed and organized players. Volume growth is expected to be stable, as the management expects the Swasthfit program to maintain momentum. As highlighted in our recent ARA note, digital initiatives and infrastructure upgrades leading to cost and operational efficiencies allow DLPL to deliver industry-leading margins. With Q2 results in line with our estimates, we have largely retained our estimates (Exhibit 9). A strong balance sheet (net cash of Rs13bn), stable return ratios (FY28E RoE/RoCE at 24%/26%, respectively), and robust cash generation (OCF as a % of EBITDA at 78% in H1FY26) lend comfort on valuations. Key risks: Increased competition in the organized market, and predatory pricing from any market participant.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354