Buy Dabur India Ltd For Target Rs. 625 by Motilal Oswal Financial Services Ltd

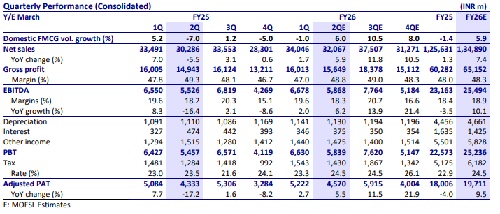

* We expect ~6% revenue growth, majorly backed by 6% volume growth in India business. The growth comes on a beaten down base.

* GP margin is expected to decline 50bp YoY to 48.8% due to price hike lagging behind RM inflation. EBITDA margin is expected to remain flat YoY at 18.3%.

* Home and Personal Care (HPC) division is expected to perform well, driven by the oral, home and skin care categories. Within healthcare, Dabur Honey, Hajmola, Dabur Honitus, and Dabur Health Juices are expected to post robust double-digit growth.

* International business is likely to post strong cc growth, led by MENA, Turkey, Bangladesh and US Namaste business.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412