Buy Blue Jet Healthcare Ltd for the Target Rs. 500 by Motilal Oswal Financial Services Ltd

3Q impacted by pharma destocking; contrast remains stable Earnings below estimates

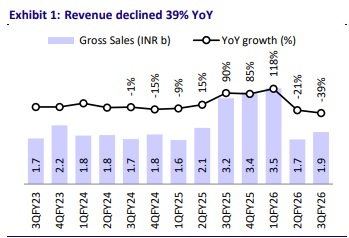

* Blue Jet Healthcare (BLUEJET) reported revenue of INR1.9b in 3QFY26, down 39% YoY, primarily due to pharma intermediate destocking and the timing of sales recognition (goods in transit of 3Q will be recognized in 4Q) in contrast media.

* Going ahead, we expect recovery in the pharma intermediate segment over the next couple of quarters as destocking ends. Additionally, steady growth in contrast media is supported by new intermediate ramp-ups and backward integration.

* Moreover, growth is expected to recover in FY27, backed by confirmed orders, recovery in pharma intermediates and customer-aligned capex expansion.

* Factoring in the weak 3QFY26 performance, we cut our FY26/FY27/FY28 earnings estimates by 32%/33%/34% and value the stock at 27x FY28E EPS to arrive at a TP of INR500. Reiterate BUY.

Declines in high-intensity sweeteners and pharma intermediates drag down operating performance

* BLUEJET reported revenue of INR1.9b (est. INR3.3b), down 39% YoY and up 16% QoQ. High-intensity sweeteners/pharma intermediates revenue declined 31%/73% YoY to INR257m/INR401m, while revenue from contrast media intermediates was flat YoY at INR1.2b.

* Gross margin stood at 51.7% (vs. 54.5% in 3QFY25 and 65% in 2QFY26), primarily due to product mix and a one-time inventory write-off.

* As a percentage of sales, employee costs stood at ~10% YoY (vs. ~5% in 3QFY25), while other expenses stood at ~17% (vs. ~11% in 3QFY25). ? EBITDA declined 62% YoY and 15% QoQ to INR469m (est. INR1.2b). EBITDA margin contracted 14.4pp YoY and 880bp QoQ to 24.4% (est. 35.6%).

* Adj. PAT stood at INR402m (down 59% YoY/23% QoQ), below our estimate of INR932m.

* In 9MFY26, revenue grew 4% YoY to INR7.1b, while EBITDA/adj. PAT declined by 6%/5% to INR2.2b/INR1.8b.

Highlights from the management commentary

* Capacity expansion: Vizag is being developed with INR10b capex planned over 3-4 years, aligned to specific customer demand and new products. Unit 3 at Ambernath, MH (~INR1.46b capex), is nearing validation in 1QFY27, strengthening backward integration in contrast media. A new INR400m Hyderabad R&D center focused on GLP-1 and advanced chemistries is expected to commence operations in 3QFY27.

* Pharma intermediates: Weakness in pharma intermediates was driven by channel destocking and supply chain realignment in the Bempedoic acid chain. Management expects normalization within 1-2 quarters. The earlier revenue spike was due to launch-led inventory build-up across the 9-10-month supply chain, which is now correcting. Importantly, underlying end-demand remains strong with growth in Japan and other markets, and management expects to remain the primary supplier given regulatory switching barriers.

* Contrast media: Contrast media is expected to grow on the back of; (i) an advanced intermediate under validation with five-year capacity visibility, (ii) the NCE intermediate line commissioned in Dec’25, which is expected to ramp up from 1QFY27 with better realizations due to forward integration, and (iii) Unit 3 backward integration to enhance cost competitiveness and supply chain control. The gadolinium-based new chemical entity (NCE) business remained sequentially stable with steady purchase orders.

Valuation and view

* We expect a recovery in pharma intermediates in the next couple of quarters, led by growth in cardiovascular drugs across geographies and end of destocking. Bempedoic acid (a key intermediate for cardiovascular products) should see healthy growth, backed by long-term contracts and the increasing market size of its key drugs.

* Further, operational performance is expected to be driven by strong order visibility in the MRI segment of contrast media and the approval of a new product in the high-intensity sweeteners segment.

* We expect a CAGR of 7%/2%/2% in revenue/EBITDA/PAT over FY25-28. Factoring in the weak 3QFY26 performance, we cut our FY26/FY27/FY28 earnings estimates by 32%/33%/34% and value the stock at 27x FY28E EPS to arrive at our TP of INR500. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412