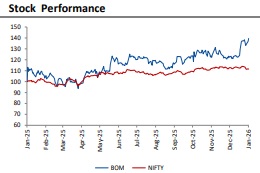

Buy Bank of Maharashtra Ltd for the Target Rs. 80 by Systematix Institutional Equities

Robust advances growth with improvement in margins

Bank Of Maharashtra reported 3QFY26 PAT of Rs 17.8bn (~9% above estimate) which improved by 9% QoQ and 26.5% YoY. Sequentially driven by (i) healthy net interest income (NII) (ii) higher fee income (iii) lower provisions. The bank recorded an impairment loss amounting to ~Rs. 2.9bn towards revaluation of its associate excluding which the profit on investment would have been Rs. 1.12bn instead of the reported loss of -Rs. 1.79bn. Further, the bank does not expect the new labour code to have any significant impact (limited to ~Rs. 3.3 Mn). The bank has reported a healthy sequential growth in net advances of 7.7% in 3Q and 19.8% YoY (higher than the full year guidance if 17%). Further, as expected, the margins stabilised in 3Q as the benefit of deposit repricing and lower CRR flowed through. Going forward, the management expects ~18-20% deposits to reprice in 4Q while the full impact of 25 bps rate cut will be visible correspondingly. The management has maintained the NIM guidance at 3.75%. The credit costs was at 1.1% down by -12bps QoQ and the gross slippage ratio was at 1.1% down by -1bp QoQ. On LCR front, the management expects a net positive impact of ~3% on the bank’s LCR from 1-April-2026 once the new LCR guidelines come into effect. Based on our revised estimates we have revised our target price to Rs 80 (from Rs. 73 earlier) and maintain our BUY rating on Bank of Maharashtra. We have moved our valuation to FY28E and are valuing the standalone bank at 1.4x its FY28E book value per share of Rs. 57.

Net Interest Margins (NIMs) stabilised as expected: The bank has reported a net interest margin of 3.86% for Q3FY26, down -12bps YoY but up 3bps QoQ. The maturity profile for the bank at the beginning of the rate cut cycle was 8-10 months which resulted in benefit of deposit repricing being visible in 3Q. The cost of deposits decreased to 4.47%, down by -20bps QoQ and by -28 bps YoY while the yield on advances further declined to 8.92%, down -27 bps QoQ and by -35 bps YoY. The bank has revised its MCLR rate upwards by ~30-35 bps at the beginning of the rate cut cycle and is now offering repricing benefit to its higher rated MCLR linked borrowers. This has contributed to the decline in YOA alongside the impact of 125bps rate cut on its repo linked book (~40-42%). Going forward, the management expects the benefit of ~18-20% of deposits pending repricing to be visible in 4Q while the full impact of the 25-bps rate cut on YOA will also be visible correspondingly. Taking all these factors into consideration, the management has maintained the NIM guidance at 3.75%. The management also expects the CD ratio to stabilise in the range of 83-84% thus moderating slightly from current ~85% levels.

Healthy Advances and Deposits growth: Gross advances grew by 7.6% QoQ and 19.6% YoY. Retail advances grew at 36% YoY supported by growth in vehicle advances (up 53.8% YoY) and Housing loans (up by 27.5%). Agri loan growth slowed down in 2Q due to a shift in focus for lending area from production-based credit to investment-based credit following which it has shown signs of revival in 3Q (+9% YoY and +10.6% QoQ). The bank also undertook MSME portfolio rebalancing and intends to shift its preference from standalone bill discounting (TREDS platform) towards consortium lending where it has better visibility of the borrower’s business. The MSME growth accelerated to 7.5% YoY and 10% QoQ after a comparatively muted 2Q. The Gold loan portfolio is growing at a healthy pace with the total Gold lending book at ~Rs. 220Bn out of which ~Rs. 170Bn is sourced organically through its own branches and the balance through co-lending partnerships with NBFCs. For home loans the bank is targeting only prime and super-prime borrowers. 23% of sanctions in the last 12 months were for borrowers with a CIBIL score of 800+, while ~57% were in the 750-800 bucket (totaling 80% for scores above 750). On the Deposits front, the total deposits grew 3.8% QoQ and 15.3% YoY supported by CASA growth of 15.9% YoY along with TD which grew by 14.7% YoY despite de-growth in bulk deposits (-7.7% YoY). The high-cost DRI component in bulk was reduced from 13% to 5.08%. The bank’s credit to deposit ratio increased to 85%. On the deposit mobilization front, the bank is focusing on low-cost CASA mobilization from two key sources (i) The traditional retail channel via its existing branch network combined with new branches opened under ‘project 321’ (ii)mobilizing institutional CASA by focusing on institutions, via a separate vertical focusing on providing customized, technology-based transactional and investment solutions.

Asset quality broadly stable: The gross slippages in the quarter were at Rs. 7.49bn where the gross annualized slippage ratio was at 1.1%, up 1bp QoQ but up 3 bps YoY. The GNPA was at 1.60%, down -12 bps QoQ and -20 bps YoY. The NNPA was at 0.15%, down -3 bps sequentially and -5 bps YoY. The SMA 1 & 2 book (accounts above Rs. 5 Cr) showed an improvement, declining by 18 bps to 1.69% while the overall stress in the loan book stood at 3.35%. The bank has a healthy Provision Coverage ratio (PCR) at 98.4% including TWO. In terms of protecting its asset quality for home loans amidst the healthy advances growth, the bank has implemented a strict floor for credit scores, permitting no new underwriting for customers with a CIBIL score below 681. Further, for MSME lending, the bank will not undertake any sanctioning of loans for CMR 6-10. On the dispensation on MSME loans though the management has given a number of Rs. 50bn, in our assessment we assume the export oriented MSME book will be around 8-10% of the MSME book and loans that will qualify for the dispensation within the book will be even lower of which the MSME asking for the dispensation will further be lower. Going forward, the management has guided that the slippages and credit costs to remain below 1%.

PPOP grew due to healthy NII and other income growth despite higher other opex: Other income increased by 10.4% QoQ and 18.4% YoY, driven sequentially by higher fee income and recoveries from written off accounts. The recoveries from written off accounts were at Rs 5.4bn up 92.2% QoQ and 75.3% YoY. The total operating expenses were up by 6.7% QoQ and by 13.4% YoY led by higher other operating expenses (up by 18% QoQ and by 42.1% YoY) while the employee expenses declined by -2.9% QoQ and by -6.1% YoY to Rs. 7.9bn. The higher other operating expenses were a result of the bank incurring PSLC commission expenses worth Rs. 630mn during the quarter combined with the cost of opening new branches under ‘Project 321’ and undertaking IT spends. The impact of new labour code is not expected to be material (limited to ~3.3Mn). Pre-provision operating profit was Rs 27.4bn up by 6.3% QoQ and 18.8% YoY.

Valuation and recommendation: We have revised our estimates to factor in strong advances growth and other business aspects. We have earlier assumed a capital dilution of 5% in FY26E but the bank has taken the OFS route for reducing the government stake and hence have reversed this assumption. Based on our revised estimates we have revised our target price to Rs 80 (from Rs. 73 earlier) and maintain our BUY rating on Bank of Maharashtra. We have moved our valuation to FY28E and are valuing the standalone bank at 1.4x its FY28E book value per share of Rs. 57.

Above views are of the author and not of the website kindly read disclaimer