Auto Sector Update : Suspension, Lightning & multiproduct outperform by Elara Capital

We have analysed Q2 performance of 57 listed auto ancillaries where revenue grew 9.1% YoY, lagging listed original equipment manufacturers (OEM) revenue growth of 16% YoY. Twowheeler (2W) and three-wheeler (3W) production grew 11% and 18%, respectively, led by positive sentiments on GST 2.0 reforms, while PV reported 4% growth in Q2. CV posted production growth of 11% in Q2.

Demand trends for 2W production remain stable; we expect 9% growth in FY26E while PV growth is likely to grow at 6% growth. MHCV is likely to grow 4% and tractors at 12%. Global demand commentary on PV has been muted, due to tariff headwinds and subdued demand while the North America Class 8 truck retail growth outlook is set to contract by 14% YoY in CY25E, due to weak freight market and high interest rates.

Q2 revenue growth at 9% YoY for ancillaries; suspension braking, lighting and multiproduct outperform: In Q2, the suspension braking segment posted the highest revenue growth of 13% YoY, followed by lighting and multiproduct components at 12% YoY. The Top 5 firms based on YoY revenue growth are Craftsman Auto, up 65%, Pricol, up 51%, Lumax Auto, up 37%, India Nippon electricals, up 30%, and Sandhar Technology, up 29%. The Top 5 firms based on YoY EBITDA growth include Suprajit Engineering, up 58%, Craftsman Automation, up 57%, Pricol, up 53%, Lumax Auto, up 51%, and Lumax Industries, up 45%.

YoY EBITDA margin contraction for most firms; forgings and batteries the worst hit: Thirty-two out of 57 firms posted an EBITDA margin contraction YoY. While battery companies took a hit, due to input cost pressures in the form of higher lead prices, and forging companies were hit on muted exports for CV. The Top 5 firms in terms of EBITDA margin compression YoY include Ramkrishna Forgings, Precision Camshaft, MM Forgings, Balkrishna Industries, and PPAP Automotive. Among the least hit include bearings and tyre manufacturers for which higher revenue growth along with softer RM cost bolstered margin YoY.

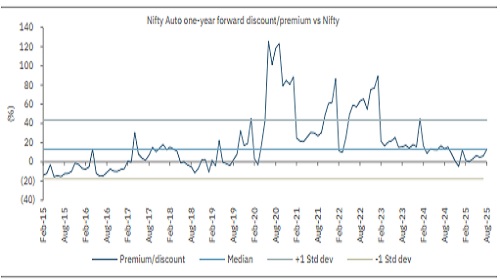

Uno Minda, Gabriel India, Minda Corp, Sona BLW are our top picks: Given the GST cut related benefit and robust festive season, we remain positive on 2W and PV related ancillaries. Nifty auto valuation premium to Nifty 50 is at close to median levels, with improving outlook for volume growth, thereby providing scope of further outperformance. We believe there are four key reasons for any auto ancillary to outperform OEMs; a) product expansion, b) segment expansion, c) geographic expansion, d) inorganic expansion. In this framework our top picks in the ancillaries remain Uno Minda, Gabriel India, Minda Corp and Sona BLW.

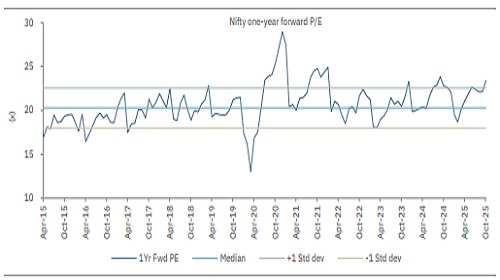

Exhibit 1: Nifty is currently trading close to its historical median P/E

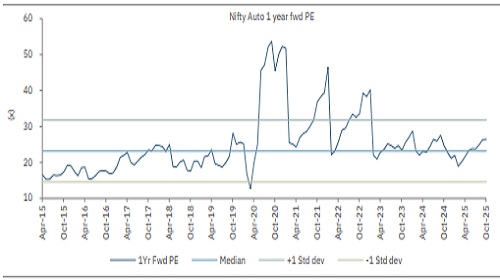

Exhibit 2: Nifty Auto is trading above its historical median P/E

Exhibit 3: Nifty Auto premium to the Nifty 50 is close to median levels currently

Please refer disclaimer at Report

SEBI Registration number is INH000000933