Auto Insights September 2025 by Choice Institutional Equities

Auto OEM Dispatch – In September 2025, 2W sales surged, with Eicher up 42.9% and TVS up 12.1% YoY, driven by premium demand. The PV segment saw a modest growth in sales in the domestic market, with M&M up 10.1% YoY. MSIL was up 2.7 YoY, primarily supported by strong exports. The CV segment saw strong gains

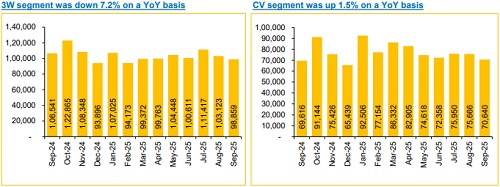

Auto Retail Sales –The automotive industry last month saw a 5.0% YoY growth in retail sales. While 2W, PV, CV and tractor segments exhibited increase, 3W sales declined 7.2% YoY.

CNG and EV Penetration – The PV segment witnessed increased CNG penetration, while 3Ws saw a decline due to a shift towards EVs. CVs also recorded higher CNG adoption. EV penetration deepened across the segments but overall remained low as adoption continues to be constrained by infrastructure and range concerns.

Inventory Analysis – Dealer inventory levels were mixed across key vehicle segments. PV inventory was at lower levels, specifically Maruti Suzuki and M&M. CV inventory, led by Ashok Leyland, showed a decline, easing dealer pressure after a subdued year.

Auto OEM Dispatches:

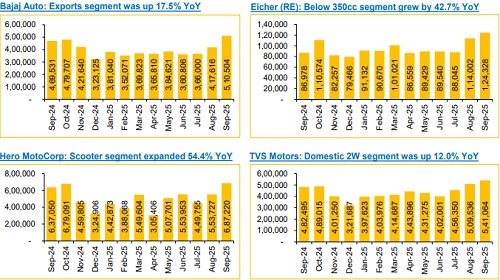

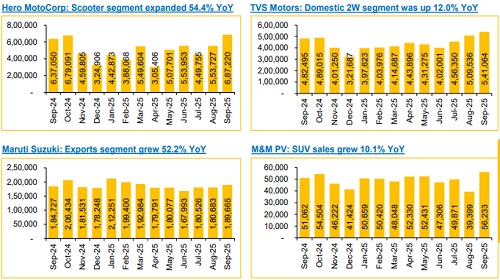

* In September 2025, OEMs in the 2W segment recorded strong growth, supported by robust export performance and domestic recovery driven by the festive demand and GST rate cuts. The domestic market saw improvement, with dealers stocking up for the festive season, aided by the GST changes. EIM and TVSL led the segment with YoY dispatch growth of 42.9% and 12.1%, respectively, facilitated by premium motorcycle demand and successful new launches. HMCL posted a 7.9% YoY increase, supported by rural recovery. BJAUT saw a 8.7% increase owing to recovery in the domestic demand and growth of 17.5% in its export segment.

* The OEMs in the PV segment saw a modest growth in sales, with dealers holding a light inventory before GST rate changes came into effect and then stocking up towards the end of the month. M&M reported a 10.1% YoY increase in dispatches. MSIL saw a 2.7% YoY growth in dispatches, primarily supported by strong exports, while its domestic segment witnessed a decline. Tata Motors reported a significant growth in dispatches, growing 47.4% YoY.

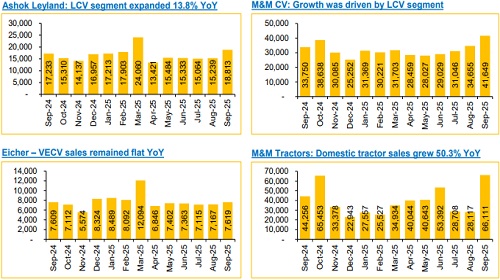

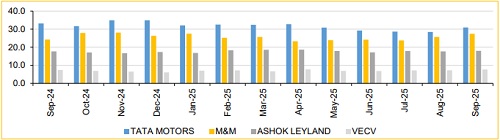

* The CV segment saw a strong growth, with M&M’s CV division up 23.4% YoY, Ashok Leyland rising 9.2% YoY and Tata Motors increasing 19.4% YoY. Eicher Motors’ sales (VECV) remained flat YoY. The tractor segment witnessed a spectacular growth driven by GST rate cuts, with M&M marching up 49.4% YoY and Escorts growing 47.6% over the same period.

OEMs Total Dispatch Volume (Units) Trend

Auto Retail Sales:

Automobile Market Trend: Overall performance was positive

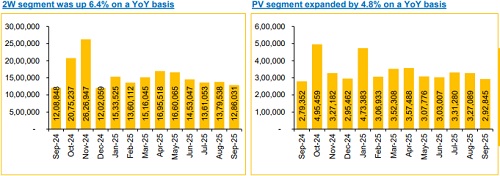

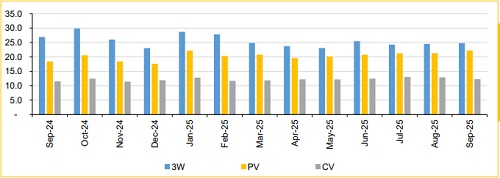

The automotive industry recorded a 5.0% YoY growth in retail sales for September 2025, with all the segments, except 3Ws, expanding on a YoY basis. 2W sales grew by 6.4% YoY, highlighting improvement in demand owing to the onset of the festive season and GST rate change. PV sales improved by 4.8% YoY, led by a healthy demand for both, SUV as well as passenger car, segments. The CV segment saw an increase of 1.5% YoY, whereas 3W sales de-grew by 7.2% YoY. The tractor segment grew by 2.4% YoY. Overall, on a sequential basis, the industry de-grew, largely due to delay of purchases by customers to the last nine days of the month, driven by the GST rate reduction, effective September 22.

Retail Sales (Units) Trend

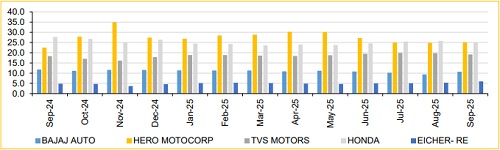

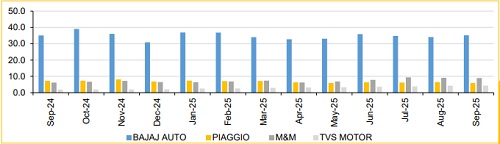

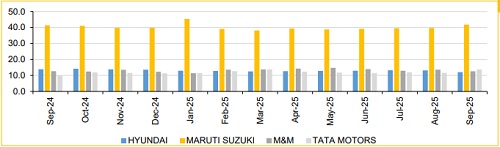

Retail Market share (%) Trend

2W: Hero MotoCorp regains leadership position (September 2025)

3W: Bajaj Auto leads 3W segment, aided by passenger 3Ws

PV: Maruti Suzuki retains its leadership position, improving its market share sequentially in Sept ’25

CV: Tata Motors retains its leadership; market share grew sequentially in Sept ’25

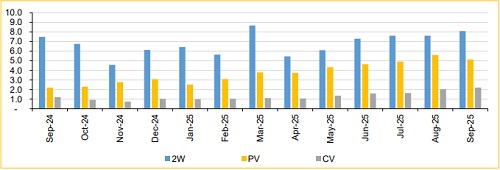

CNG and EV Adoption: CNG penetration in 3Ws decreased by 210bps YoY to 24.8% due to shift towards EVs. PVs saw an increase of 378bps YoY to 22.2%, indicating a increasing shift towards cleaner fuels in the PV segment. The CV segment also witnessed deepening of penetration with a 72bps growth YoY to 12.3%. On the EV front, 2W penetration grew by 60bps to 8.1%, while PVs saw an increase of 293bps to 5.1%, but overall adoption remained low. Overall, the automotive industry is showing a transition towards cleaner energy, particularly in the PV segment, but the adoption of EVs remains slow due to concerns about limited charging infrastructure, range anxiety, battery life and performance.

CNG penetration in 3W segment declined YoY due to increased EV adoption. PV segment penetration improves owing to a shift in consumer preference

EV penetration improving across segments

Inventory Analysis: Assessing Dealer Inventory levels across Key Segments

For Passenger Vehicles, Maruti Suzuki's dealer inventory peaked at 28 days in September 2024 and, at present, is at a level of 7 days, which is lower than its one-year average (17 days). However, M&M’s average inventory level was higher than Maruti’s. Its current dealer inventory stands at 26 days, lower than its one-year average (28 days). PV OEMs also faced logistical constraints due to the unavailability of trailers, driven by surge in demand towards the last leg of the month.

In the 2W segment, inventory peaked in the Sep–Oct 2024 period as dealers stocked up for the festive season. Inventory levels of TVS Motors and Eicher Motors were higher than their one-year averages, indicating stocking up by the dealers for the season. Bajaj Auto and Hero MotoCorp dealers are operating at low inventory levels, aligning with a shift in consumer preference.

In the CV segment, Ashok Leyland dealer inventory was steady at 34 days for September 2025. The trend suggests that the company reduced its inventory over the past year, alleviating pressure on dealers after a subdued performance in the CV segment.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

More News

IT Sector Update : Bharat sovereign AI stack crystallizing by InCred Equities