Add Yatra Online Ltd for the Target Rs.180 by JM Financial Services Ltd

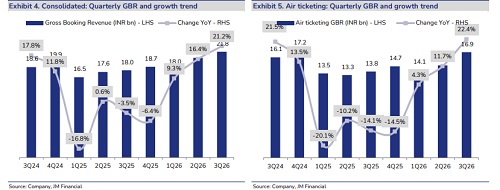

Yatra’s 3QFY26 performance at a consolidated gross bookings (GB) level was strong at 21.2% YoY (+6.1% QoQ), beating JMFe by ~3%. Trends were robust across both Air (+22.4%) and H&P (+19.5%) segments. Interestingly, the GB trends were strong despite headwinds such as major domestic flight disruptions in December and soft MICE activity. That said, revenue less service cost growth moderated to 22.7% YoY from ~44%/34% in 1Q/2Q FY26. This was on account of a sharp increase in customer inducements to 3.0% of GB (JMFe was 2.4%) from 2.3%/2.4% in 1Q/2Q. Consequently, EBITDA margin of 8.8% (+300bps YoY) lagged JMFe of 10.1%, driving a 15% miss on EBITDA. This trade-off between incremental growth and profitability compels us to recalibrate earnings expectations by 15-19% over FY26–28E. Accordingly, we are also cutting the target PER to 30x (from 32x), yielding a revised TP of INR 180 (earlier INR 230); downgrade Yatra to ADD (from BUY) as we see limited upside potential.

? Customer inducements drive GB beat, but weigh on margin: Consolidated gross bookings (GBR) in 3Q stood at INR 21.8bn (21.2% YoY/6.1% QoQ), a beat on JMFe by 3.2%. Bookings in the Air segment grew 22.4% YoY (+14.3% QoQ) due to 22.4% YoY growth in realisation while passengers booked remained flat on account of flight disruptions in December. Management reckons the estimated Air GTV impact was ~INR 480mn. If not for this disruption, the YoY growth in Air would have been 25.9%. H&P bookings, on the other hand, grew 19.5% YoY (-16.3% QoQ) led by expansion in standalone room nights booked of 21.5% YoY (c. 1% QoQ). Flight disruptions led to ~INR 300mn of MICE revenue getting pushed out to subsequent quarters. That said, revenue less service cost growth moderated to 22.7% YoY from ~44%/34% in 1Q/2QFY26. This was on account of a spike in customer inducements to 3.0% of GB (JMFe: 2.4%) from 2.3%/2.4% in 1Q/2Q. Consequently, EBITDA margin of 8.8% (+300bps YoY/ +196bps QoQ) missed JMFe of 10.1%. Similarly, while EBITDA shot up 66% YoY to INR 225mn, it fell short of JMFe by c. 15%. Adjusted PAT of INR 121mn too missed JMFe of INR 168mn due to lower-than-expected other income and higher finance/FX cost

? FY26 guidance remains quite conservative, but we continue to build in stronger momentum: Management maintained revenue less service costs guidance at 22–23% and adjusted EBITDA growth guidance at 35–40%, for FY26E. We, on the other hand, are building in stronger momentum, factoring in consolidated revenue less service cost and adjusted EBITDA growth of 28.5% and 51%, respectively, on the basis of 9MFY26 trends and expectations of a strong 4Q. Management highlighted a temporary working capital blockage in 3Q primarily on account of last-minute flight cancellations, for which advance payments had already been made, but that is expected to normalise by end-March.

? New corporate client additions hold strong: Yatra added 40 new corporate accounts in 3Q with an annual billing potential of INR 2.2bn. Since listing, the company has added 330+ corporate clients with combined billing potential of ~INR 20bn. Its customer base now spans 1,300-plus large corporates and ~58k SME clients.

? Downgrade to ‘ADD’ with a revised Dec’26E TP of INR 180: We are trimming revenue less service costs estimates by 2–3% over FY26–28 post-3Q results. Similarly, we are edging down EBITDA margin forecasts by 20–50bps over FY26–28 driving 7–10% cuts on EBITDA. On top of it, higher D&A and finance cost assumptions lead to 15–19% cuts in FY26–28E EPS. All in all, we are downgrading the stock to ADD with a revised Dec’26E TP of INR 180 given limited potential upside hereon.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361